- United Kingdom

- /

- Commercial Services

- /

- AIM:KINO

The Bilby (LON:BILB) Share Price Is Down 84% So Some Shareholders Are Rather Upset

It's not possible to invest over long periods without making some bad investments. But really bad investments should be rare. So consider, for a moment, the misfortune of Bilby Plc (LON:BILB) investors who have held the stock for three years as it declined a whopping 84%. That would certainly shake our confidence in the decision to own the stock. And more recent buyers are having a tough time too, with a drop of 73% in the last year. Furthermore, it's down 58% in about a quarter. That's not much fun for holders.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Bilby

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Although the share price is down over three years, Bilby actually managed to grow EPS by 41% per year in that time. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Alternatively, growth expectations may have been unreasonable in the past. It's worth taking a look at other metrics, because the EPS growth doesn't seem to match with the falling share price.

We note that the dividend seems healthy enough, so that probably doesn't explain the share price drop. We like that Bilby has actually grown its revenue over the last three years. If the company can keep growing revenue, there may be an opportunity for investors. You might have to dig deeper to understand the recent share price weakness.

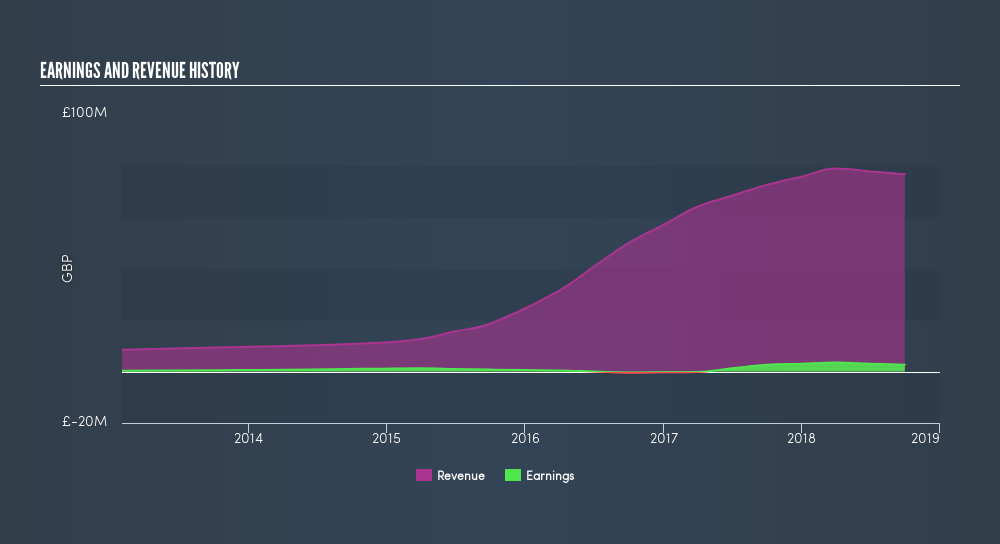

Depicted in the graphic below, you'll see revenue and earnings over time. If you want more detail, you can click on the chart itself.

You can see how its balance sheet has strengthened (or weakened) over time in this freeinteractive graphic.

A Different Perspective

Over the last year, Bilby shareholders took a loss of 72%, including dividends. In contrast the market gained about 6.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. The three-year loss of 44% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Warren Buffett famously said he likes to 'buy when there is blood on the streets', he also focusses on high quality stocks with solid prospects. Most investors take the time to check the data on insider transactions. You can click here to see if insiders have been buying or selling.

For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:KINO

Kinovo

Provides specialist property services to housing associations and local authorities, public buildings, industrial and commercial, and education and private sectors in the United Kingdom.

Undervalued with proven track record.

Market Insights

Community Narratives