- United Kingdom

- /

- Capital Markets

- /

- AIM:ASTO

Did You Manage To Avoid AssetCo's (LON:ASTO) 19% Share Price Drop?

It's easy to match the overall market return by buying an index fund. When you buy individual stocks, you can make higher profits, but you also face the risk of under-performance. For example, the AssetCo plc (LON:ASTO) share price is down 19% in the last year. That's disappointing when you consider the market returned 2.0%. At least the damage isn't so bad if you look at the last three years, since the stock is down 14% in that time. The silver lining is that the stock is up 1.6% in about a week.

Check out our latest analysis for AssetCo

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

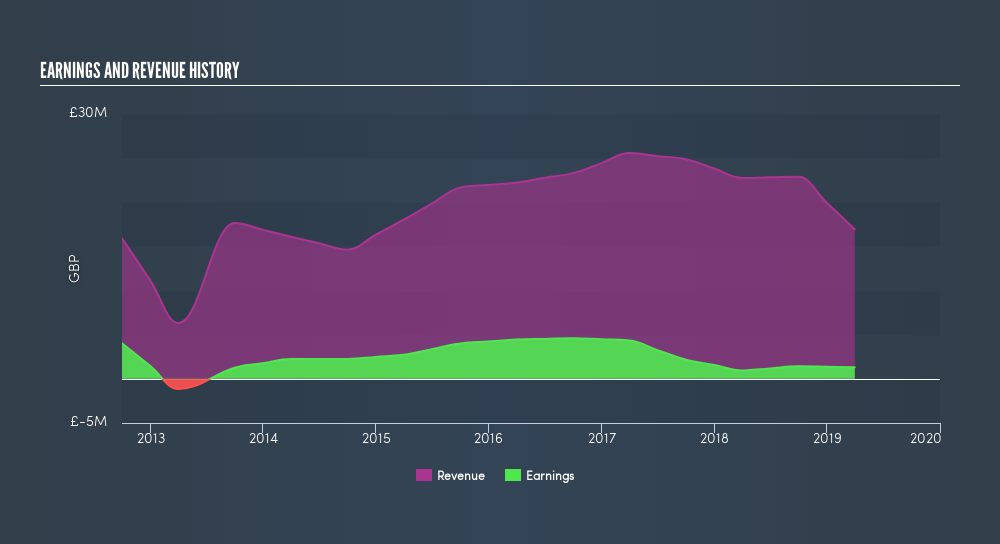

During the unfortunate twelve months during which the AssetCo share price fell, it actually saw its earnings per share (EPS) improve by 38%. Of course, the situation might betray previous over-optimism about growth. It's fair to say that the share price does not seem to be reflecting the EPS growth. But we might find some different metrics explain the share price movements better.

On the other hand, we're certainly perturbed by the 26% decline in AssetCo's revenue. If the market sees the weak revenue as jeopardising EPS, that could explain the lower share price.

Take a more thorough look at AssetCo's financial health with this free report on its balance sheet.

A Different Perspective

Investors in AssetCo had a tough year, with a total loss of 19%, against a market gain of about 2.0%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. On the bright side, long term shareholders have made money, with a gain of 1.6% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Before forming an opinion on AssetCo you might want to consider these 3 valuation metrics.

But note: AssetCo may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:ASTO

AssetCo

Engages in acquiring, managing, and operating asset and wealth management activities and interests.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives