- United Kingdom

- /

- Machinery

- /

- LSE:WEIR

Weir Group (LSE:WEIR) Secures Major Contracts in Morocco and Pakistan, Driving Future Growth

Reviewed by Simply Wall St

Weir Group (LSE:WEIR) has recently secured significant contracts, including a £25 million deal with OCP Group in Morocco and a £53 million agreement with Barrick Gold Corporation's Reko Diq project, reinforcing its strategic focus on energy-efficient solutions and expanding its footprint in emerging markets. Despite facing challenges such as a decreased net profit margin and a volatile dividend history, Weir's earnings forecast and strategic pricing initiatives highlight potential for growth and financial performance enhancement. In the following discussion, readers can expect insights into Weir's competitive advantages, critical performance issues, and emerging market trends impacting its future trajectory.

Take a closer look at Weir Group's potential here.

Competitive Advantages That Elevate Weir Group

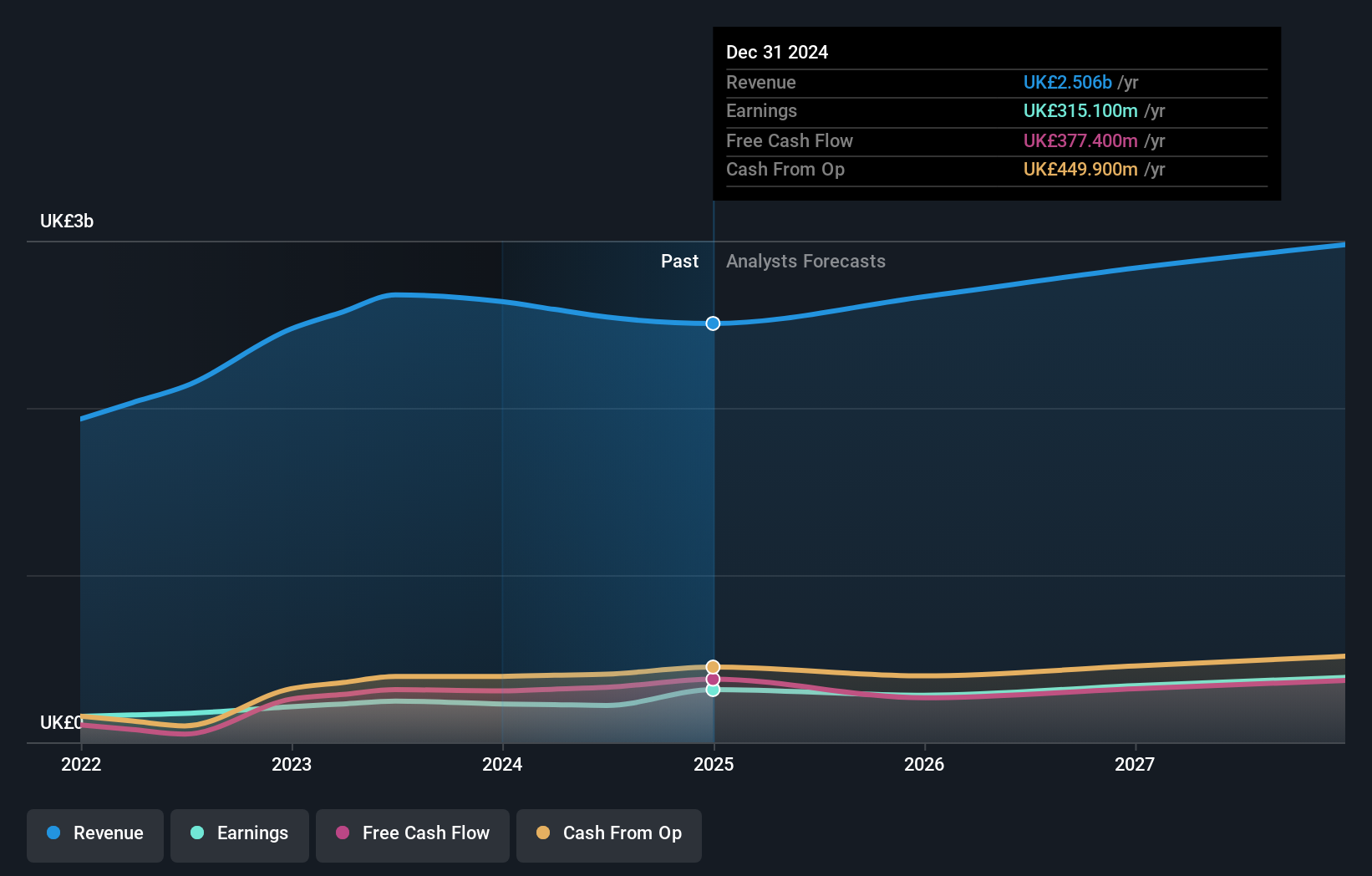

Weir Group's earnings forecast of 19.4% annual growth surpasses the UK market average, highlighting its strategic positioning. The company's focus on diverse product offerings, particularly in aftermarket services, has driven significant revenue increases. CEO Jon Stanton emphasized the importance of product line diversity in capturing market share. Furthermore, Weir's operational efficiency is reflected in its margin expansion, with CFO Brian Puffer noting the positive impact of strategic pricing. The company's strong customer relationships have been instrumental in sustaining growth, particularly in challenging conditions.

To gain deeper insights into Weir Group's historical performance, explore our detailed analysis of past performance.Critical Issues Affecting the Performance of Weir Group and Areas for Growth

Weir faces challenges such as a decreased net profit margin, now at 8.7%, and a Return on Equity of 12.7%, which is below the desired threshold. These factors, coupled with a 10.5% earnings decline over the past year, suggest areas for improvement. The volatility in dividend payments over the past decade also raises concerns about financial stability. However, Weir's current trading position, 27.1% below its estimated fair value, suggests potential for price appreciation, indicating room for financial performance enhancement.

Learn about Weir Group's dividend strategy and how it impacts shareholder returns and financial stability.Emerging Markets Or Trends for Weir Group

Weir's recent £25 million contract with OCP Group in Morocco and a £53 million deal with Barrick Gold Corporation for the Reko Diq project underscore its strategic alliances and product-related announcements. These contracts, focusing on sustainable solutions, not only enhance Weir's market position but also capitalize on the growing demand for energy-efficient technologies. Such strategic moves are poised to bolster Weir's presence in emerging markets, providing a platform for future growth.

See what the latest analyst reports say about Weir Group's future prospects and potential market movements.Market Volatility Affecting Weir Group's Position

Weir's valuation, with a P/E ratio of 24x, is considered high compared to peers, posing a threat to investor confidence. Additionally, economic headwinds and supply chain vulnerabilities present risks to Weir's growth trajectory. The company's awareness of regulatory changes and proactive risk management strategies are crucial in navigating these challenges, ensuring long-term stability and market competitiveness.

To dive deeper into how Weir Group's valuation metrics are shaping its market position, check out our detailed analysis of Weir Group's Valuation.Conclusion

Weir Group's strategic focus on diverse product offerings and operational efficiency has positioned it for a substantial 19.4% annual growth, surpassing the UK market average. However, challenges such as a decreased net profit margin and return on equity, along with past earnings declines, highlight areas for improvement. The company's recent strategic contracts in emerging markets underscore its potential for future growth, particularly with the increasing demand for sustainable solutions. Despite being perceived as expensive with a P/E ratio of 24x compared to peers, Weir is trading 27.1% below its estimated fair value, suggesting a strong opportunity for price appreciation. This potential, combined with proactive risk management and strategic alliances, indicates a promising outlook for Weir's long-term stability and competitive edge.

Next Steps

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if Weir Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About LSE:WEIR

Weir Group

Produces and sells highly engineered original equipment worldwide.

Solid track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives