- United Kingdom

- /

- Machinery

- /

- LSE:WEIR

Is The Weir Group PLC's (LON:WEIR) CEO Overpaid Relative To Its Peers?

In 2016 Jon Stanton was appointed CEO of The Weir Group PLC (LON:WEIR). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Weir Group

How Does Jon Stanton's Compensation Compare With Similar Sized Companies?

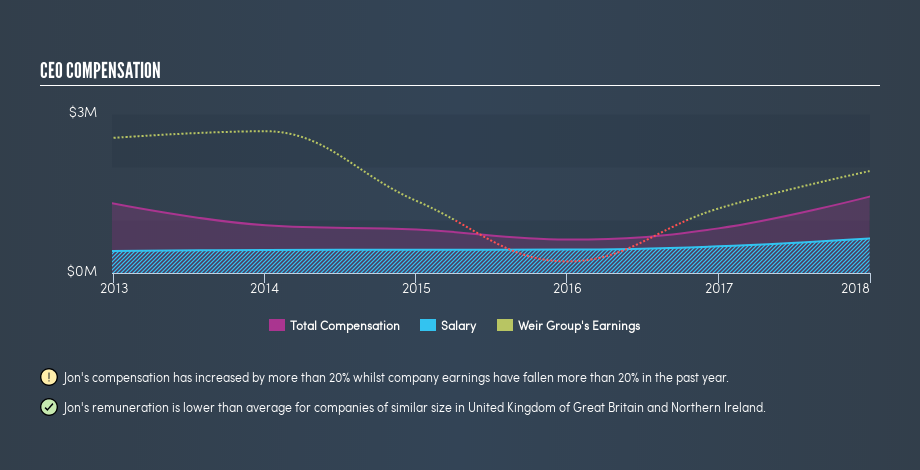

According to our data, The Weir Group PLC has a market capitalization of UK£4.2b, and pays its CEO total annual compensation worth UK£1.4m. (This is based on the year to December 2017). We think total compensation is more important but we note that the CEO salary is lower, at UK£650k. We looked at a group of companies with market capitalizations from UK£3.1b to UK£9.2b, and the median CEO total compensation was UK£2.5m.

A first glance this seems like a real positive for shareholders, since Jon Stanton is paid less than the average total compensation paid by similar sized companies. However, before we heap on the praise, we should delve deeper to understand business performance.

You can see, below, how CEO compensation at Weir Group has changed over time.

Is The Weir Group PLC Growing?

Over the last three years The Weir Group PLC has grown its earnings per share (EPS) by an average of 92% per year (using a line of best fit). It achieved revenue growth of 23% over the last year.

This demonstrates that the company has been improving recently. A good result. It's a real positive to see this sort of growth in a single year. That suggests a healthy and growing business. It could be important to check this free visual depiction of what analysts expect for the future.

Has The Weir Group PLC Been A Good Investment?

Most shareholders would probably be pleased with The Weir Group PLC for providing a total return of 74% over three years. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

It appears that The Weir Group PLC remunerates its CEO below most similar sized companies. Since the business is growing, many would argue this suggests the pay is modest. And given most shareholders are probably very happy with recent returns, you might even think that Jon Stanton deserves a raise!

It is relatively rare to see a modestly paid CEO when performance is so impressive. The cherry on top would be if company insiders are buying shares with their own money. CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Weir Group (free visualization of insider trades).

Important note: Weir Group may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:WEIR

Weir Group

Produces and sells highly engineered original equipment worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives