- United Kingdom

- /

- Trade Distributors

- /

- LSE:VP.

Why It Might Not Make Sense To Buy Vp plc (LON:VP.) For Its Upcoming Dividend

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that Vp plc (LON:VP.) is about to go ex-dividend in just two days. The ex-dividend date is two business days before a company's record date in most cases, which is the date on which the company determines which shareholders are entitled to receive a dividend. The ex-dividend date is of consequence because whenever a stock is bought or sold, the trade can take two business days or more to settle. Therefore, if you purchase Vp's shares on or after the 4th of December, you won't be eligible to receive the dividend, when it is paid on the 15th of January.

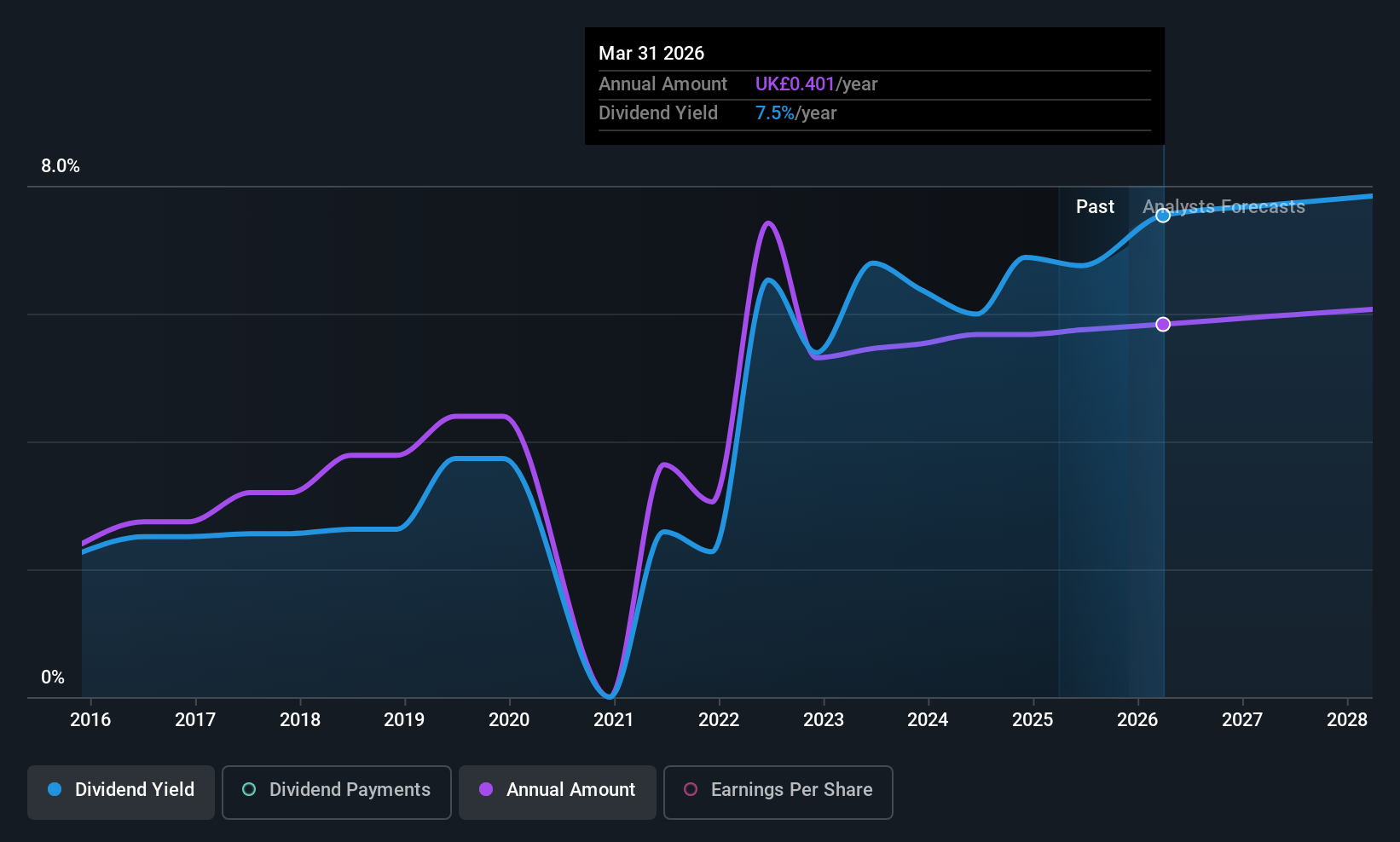

The company's next dividend payment will be UK£0.115 per share, on the back of last year when the company paid a total of UK£0.40 to shareholders. Based on the last year's worth of payments, Vp has a trailing yield of 7.4% on the current stock price of UK£5.32. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. We need to see whether the dividend is covered by earnings and if it's growing.

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. Vp paid out 196% of profit in the past year, which we think is typically not sustainable unless there are mitigating characteristics such as unusually strong cash flow or a large cash balance. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. It paid out an unsustainably high 206% of its free cash flow as dividends over the past 12 months, which is worrying. Our definition of free cash flow excludes cash generated from asset sales, so since Vp is paying out such a high percentage of its cash flow, it might be worth seeing if it sold assets or had similar events that might have led to such a high dividend payment.

Cash is slightly more important than profit from a dividend perspective, but given Vp's payments were not well covered by either earnings or cash flow, we are concerned about the sustainability of this dividend.

Check out our latest analysis for Vp

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

When earnings decline, dividend companies become much harder to analyse and own safely. If earnings fall far enough, the company could be forced to cut its dividend. Readers will understand then, why we're concerned to see Vp's earnings per share have dropped 16% a year over the past five years. Ultimately, when earnings per share decline, the size of the pie from which dividends can be paid, shrinks.

The main way most investors will assess a company's dividend prospects is by checking the historical rate of dividend growth. In the past 10 years, Vp has increased its dividend at approximately 9.1% a year on average. The only way to pay higher dividends when earnings are shrinking is either to pay out a larger percentage of profits, spend cash from the balance sheet, or borrow the money. Vp is already paying out 196% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

The Bottom Line

Should investors buy Vp for the upcoming dividend? Not only are earnings per share declining, but Vp is paying out an uncomfortably high percentage of both its earnings and cashflow to shareholders as dividends. Unless there are grounds to believe a turnaround is imminent, this is one of the least attractive dividend stocks under this analysis. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

Having said that, if you're looking at this stock without much concern for the dividend, you should still be familiar of the risks involved with Vp. For instance, we've identified 3 warning signs for Vp (2 are potentially serious) you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:VP.

Vp

Provides equipment rental and related services in the United Kingdom and internationally.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026