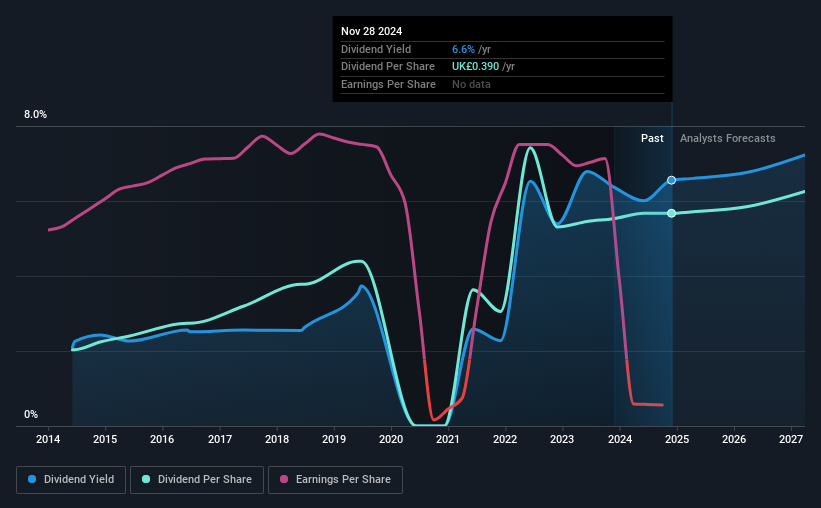

Vp plc (LON:VP.) has announced that it will pay a dividend of £0.115 per share on the 15th of January. Based on this payment, the dividend yield on the company's stock will be 6.6%, which is an attractive boost to shareholder returns.

View our latest analysis for Vp

Vp's Projections Indicate Future Payments May Be Unsustainable

Estimates Indicate Vp's Could Struggle to Maintain Dividend Payments In The Future

Vp's Future Dividends May Potentially Be At Risk

Impressive dividend yields are good, but this doesn't matter much if the payments can't be sustained. The company is paying out a large amount of its cash flows, even though it isn't generating any profit. These payout levels would generally be quite difficult to keep up.

Earnings per share is forecast to rise exponentially over the next year. If recent patterns in the dividend continues, we would start to get a bit worried, with the payout ratio possibly reaching 172%.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. The dividend has gone from an annual total of £0.14 in 2014 to the most recent total annual payment of £0.39. This implies that the company grew its distributions at a yearly rate of about 11% over that duration. Despite the rapid growth in the dividend over the past number of years, we have seen the payments go down the past as well, so that makes us cautious.

Dividend Growth May Be Hard To Come By

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. It's not great to see that Vp's earnings per share has fallen at approximately 6.5% per year over the past five years. If the company is making less over time, it naturally follows that it will also have to pay out less in dividends. It's not all bad news though, as the earnings are predicted to rise over the next 12 months - we would just be a bit cautious until this can turn into a longer term trend.

Vp's Dividend Doesn't Look Great

In summary, while it is good to see that the dividend hasn't been cut, we think that at current levels the payment isn't particularly sustainable. The company's earnings aren't high enough to be making such big distributions, and it isn't backed up by strong growth or consistency either. Overall, the dividend is not reliable enough to make this a good income stock.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. For example, we've identified 2 warning signs for Vp (1 is a bit unpleasant!) that you should be aware of before investing. Is Vp not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:VP.

Vp

Provides equipment rental and related services in the United Kingdom and internationally.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives