- Sweden

- /

- Life Sciences

- /

- OM:BIOT

European Undervalued Small Caps With Insider Action In April 2025

Reviewed by Simply Wall St

In April 2025, European markets saw a positive shift as the pan-European STOXX Europe 600 Index rose by 2.77%, buoyed by signals from U.S. President Trump to reduce trade tensions with China. Despite some economic uncertainties, such as Germany revising its GDP forecast due to tariff impacts, the resilience of small-cap stocks in this environment can often be attributed to their agility and potential for growth within niche markets. Identifying promising small-cap stocks involves looking at companies that demonstrate strong fundamentals and strategic positioning amid these broader market dynamics.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 10.9x | 0.5x | 41.83% | ★★★★★★ |

| Tristel | 27.6x | 3.9x | 26.76% | ★★★★★☆ |

| TT Electronics | NA | 0.3x | 46.99% | ★★★★★☆ |

| Savills | 23.9x | 0.5x | 43.19% | ★★★★☆☆ |

| Speedy Hire | NA | 0.2x | 3.06% | ★★★★☆☆ |

| Seeing Machines | NA | 1.8x | 49.22% | ★★★★☆☆ |

| Norcros | 24.6x | 0.6x | 27.21% | ★★★☆☆☆ |

| FRP Advisory Group | 12.7x | 2.3x | 7.31% | ★★★☆☆☆ |

| Elmera Group | 11.0x | 0.3x | -140.30% | ★★★☆☆☆ |

| Arendals Fossekompani | NA | 1.6x | 43.70% | ★★★☆☆☆ |

Let's review some notable picks from our screened stocks.

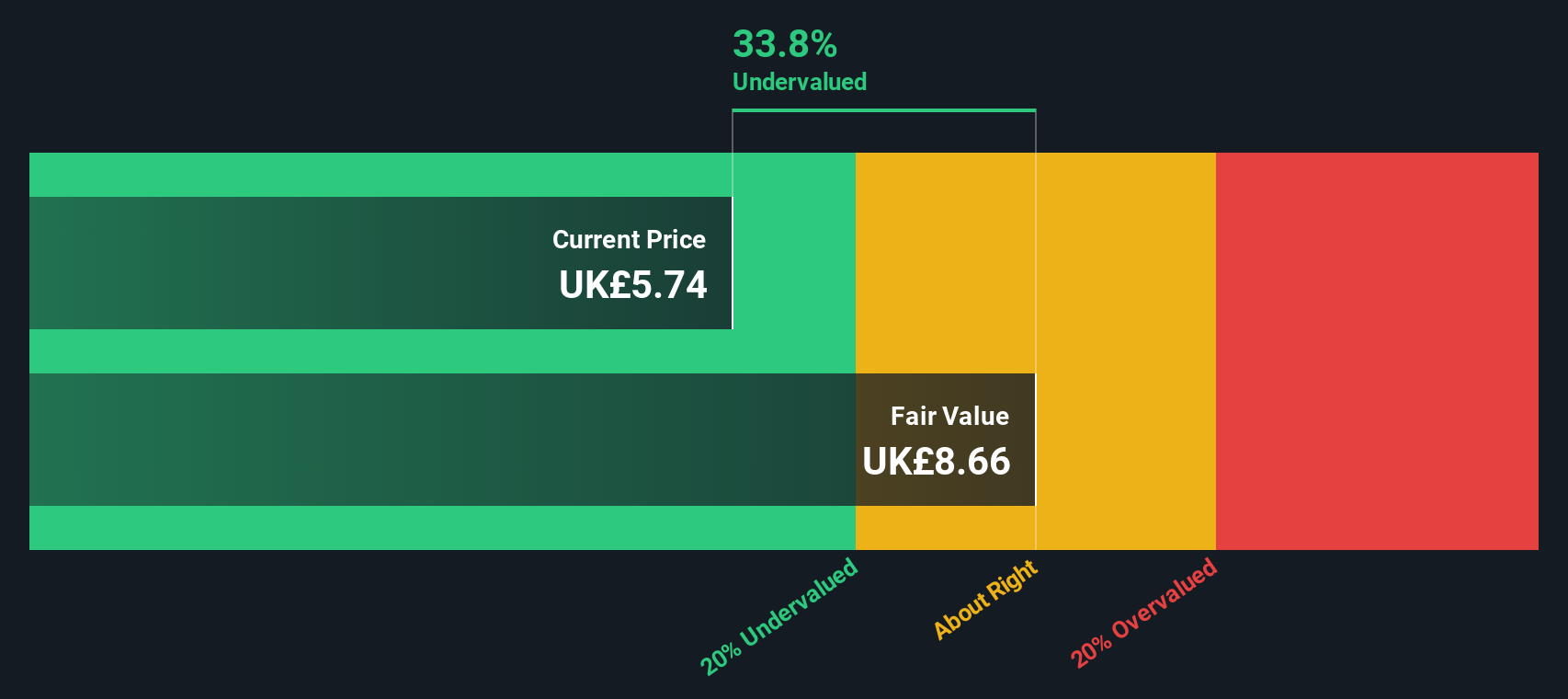

Vp (LSE:VP.)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Vp is a company engaged in equipment rental services across various sectors, with operations primarily in the UK and internationally, and it has a market capitalization of approximately £0.32 billion.

Operations: The company generates revenue primarily from its UK operations (£339.21 million) and international activities (£43.35 million). Over recent periods, the gross profit margin has shown a notable increase, reaching 33.08% by September 2024, reflecting a significant improvement in cost management relative to revenue generation. Operating expenses are consistently present but vary slightly across periods, impacting overall profitability alongside non-operating expenses.

PE: -43.0x

Vp, a smaller European stock, is attracting attention for its potential value. Despite having high debt levels with all liabilities sourced from external borrowing, the company shows promise with an expected earnings growth of 55% annually. Insider confidence is evident as Jeremy F. Pilkington recently purchased 113,532 shares worth £638,583 in January 2025. The appointment of Richard Smith as a non-executive director signals strategic leadership changes that could drive future growth and stability.

- Click here to discover the nuances of Vp with our detailed analytical valuation report.

Examine Vp's past performance report to understand how it has performed in the past.

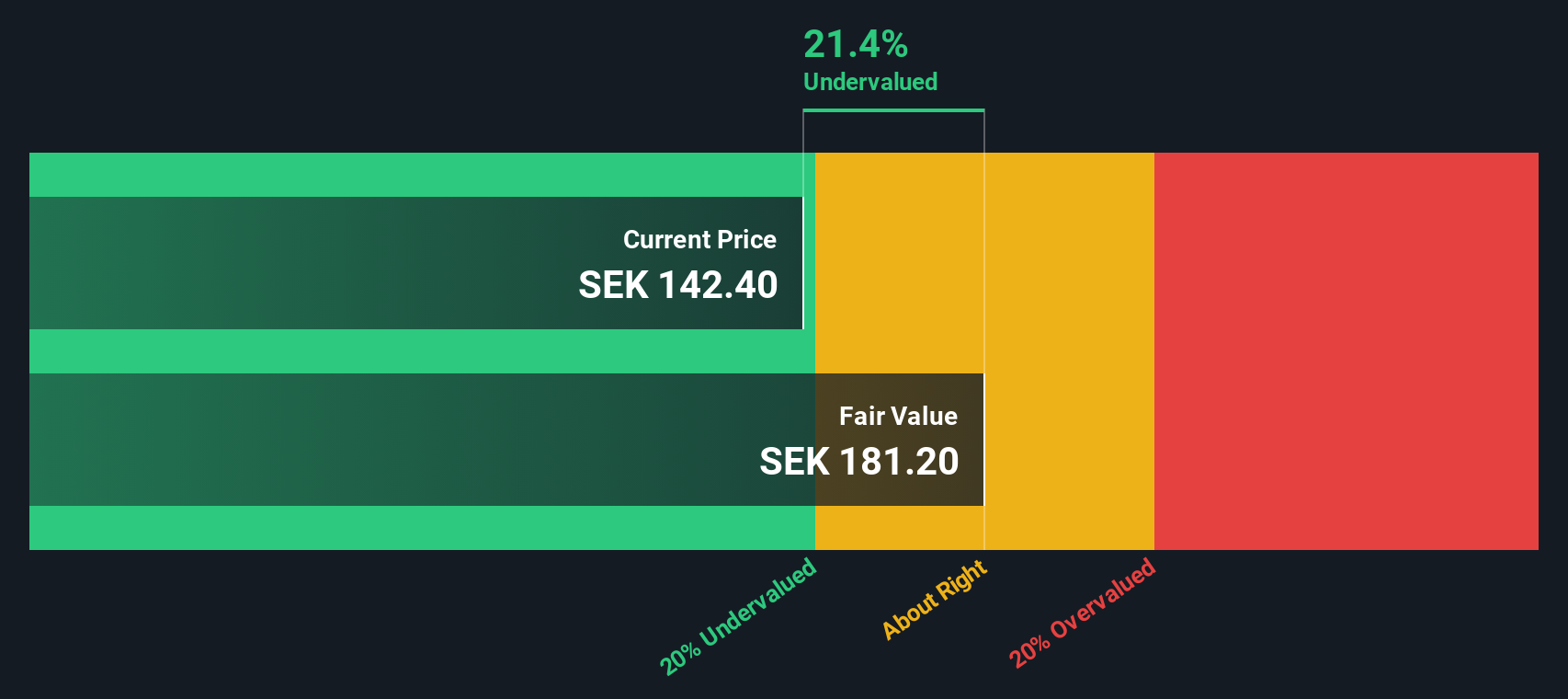

Biotage (OM:BIOT)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Biotage is a company specializing in healthcare software, with a market capitalization of approximately SEK 19.61 billion.

Operations: Biotage generates revenue primarily from its healthcare software segment, with recent figures indicating SEK 1.96 billion. The company's cost structure includes significant expenses in sales and marketing, research and development, and general administrative functions. Over the periods observed, Biotage's gross profit margin has shown a trend of reaching up to 62.73%.

PE: 44.2x

Biotage, a smaller European company, has recently caught attention due to its SEK 1.65 per share dividend approved on April 24, 2025. The firm reported first-quarter sales of SEK 385 million, down from SEK 480 million the previous year. Despite this dip, there's insider confidence with significant buying activity observed in recent months. A proposed acquisition by Kohlberg Kravis Roberts & Co., valuing shares at SEK 145 each, suggests potential growth and industry interest despite current challenges.

- Get an in-depth perspective on Biotage's performance by reading our valuation report here.

Gain insights into Biotage's past trends and performance with our Past report.

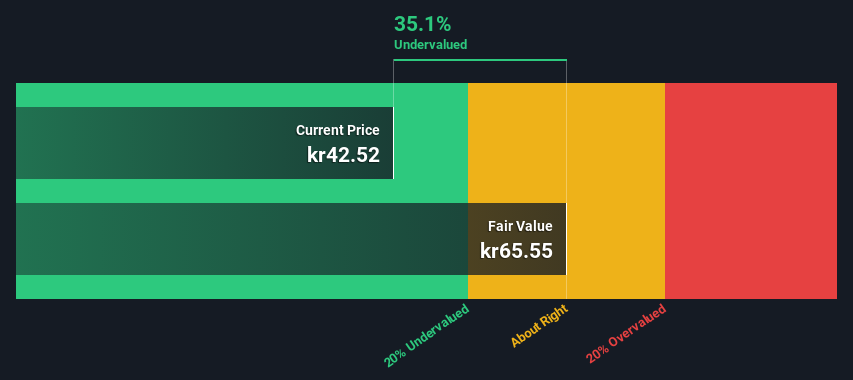

NCAB Group (OM:NCAB)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NCAB Group specializes in providing printed circuit board (PCB) solutions and has a market cap of approximately SEK 8.53 billion.

Operations: The company's revenue is primarily driven by its operations in Europe, with significant contributions from the Nordic and North American regions. Over recent periods, the gross profit margin has shown an upward trend, reaching 37.41% as of 2024-06-30. Operating expenses are a substantial part of the cost structure, with general and administrative expenses being a major component.

PE: 35.1x

NCAB Group, a player in the printed circuit board market, is navigating financial challenges with declining profit margins—6% this year from 9.5% last year—and high debt levels. Despite these hurdles, they project a 28.34% annual earnings growth and are actively seeking mergers and acquisitions to expand their asset-light model globally. Recent insider confidence is evident through share purchases within the past six months, signaling belief in future prospects despite current financial strains.

- Navigate through the intricacies of NCAB Group with our comprehensive valuation report here.

Explore historical data to track NCAB Group's performance over time in our Past section.

Next Steps

- Take a closer look at our Undervalued European Small Caps With Insider Buying list of 68 companies by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Biotage might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BIOT

Biotage

Provides solutions and products in the areas of drug discovery and development, analytical testing, and water and environmental testing.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives