- United Kingdom

- /

- Machinery

- /

- LSE:SPX

Does Spirax-Sarco Engineering (LON:SPX) Deserve A Spot On Your Watchlist?

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

If, on the other hand, you like companies that have revenue, and even earn profits, then you may well be interested in Spirax-Sarco Engineering (LON:SPX). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. Conversely, a loss-making company is yet to prove itself with profit, and eventually the sweet milk of external capital may run sour.

See our latest analysis for Spirax-Sarco Engineering

How Quickly Is Spirax-Sarco Engineering Increasing Earnings Per Share?

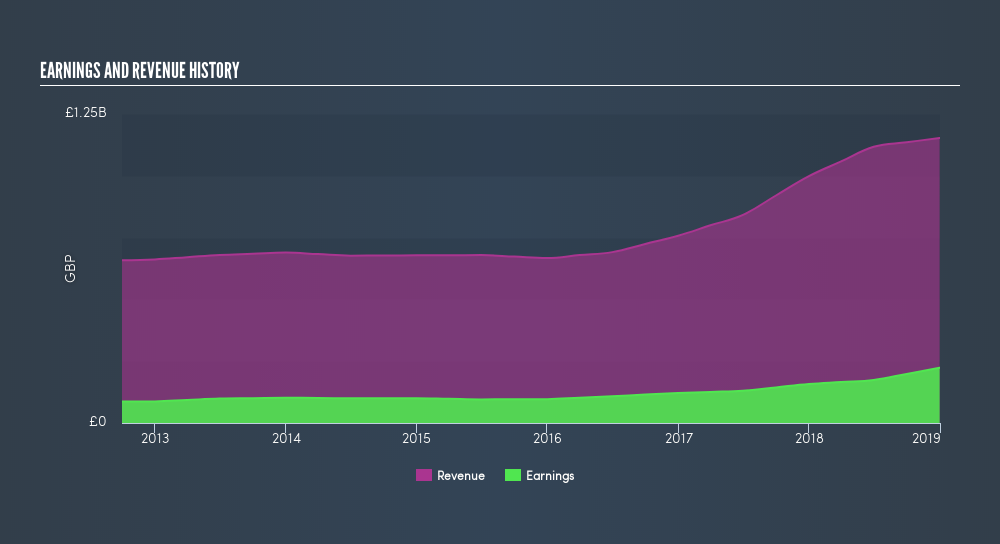

If a company can keep growing earnings per share (EPS) long enough, its share price will eventually follow. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. As a tree reaches steadily for the sky, Spirax-Sarco Engineering's EPS has grown 33% each year, compound, over three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Spirax-Sarco Engineering is growing revenues, and EBIT margins improved by 4 percentage points to 26%, over the last year. Ticking those two boxes is a good sign of growth, in my book.

Fortunately, we've got access to analyst forecasts of Spirax-Sarco Engineering's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Spirax-Sarco Engineering Insiders Aligned With All Shareholders?

Like the kids in the streets standing up for their beliefs, insider share purchases give me reason to believe in a brighter future. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Any way you look at it Spirax-Sarco Engineering shareholders can gain quiet confidence from the fact that insiders shelled out UK£259k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that lady luck will grace this business. Zooming in, we can see that the biggest insider purchase was by Chairman of the Board James Robert Pike for UK£200k worth of shares, at about UK£70.02 per share.

The good news, alongside the insider buying, for Spirax-Sarco Engineering bulls is that insiders (collectively) have a meaningful investment in the stock. Indeed, they hold UK£10m worth of its stock. That's a lot of money, and no small incentive to work hard. Even though that's only about 0.2% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

While insiders are apparently happy to hold and accumulate shares, that is just part of the pretty picture. The cherry on top is that the CEO, Nick Anderson is paid comparatively modestly to CEOs at similar sized companies. I discovered that the median total compensation for the CEOs of companies like Spirax-Sarco Engineering with market caps between UK£3.2b and UK£9.6b is about UK£2.8m.

The Spirax-Sarco Engineering CEO received UK£2.3m in compensation for the year ending December 2018. That comes in below the average for similar sized companies, and seems pretty reasonable to me. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. I'd also argue reasonable pay levels attest to good decision making more generally.

Does Spirax-Sarco Engineering Deserve A Spot On Your Watchlist?

You can't deny that Spirax-Sarco Engineering has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. Of course, just because Spirax-Sarco Engineering is growing does not mean it is undervalued. If you're wondering about the valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

The good news is that Spirax-Sarco Engineering is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:SPX

Spirax Group

Provides thermal energy and fluid technology solutions in Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives