- United Kingdom

- /

- Machinery

- /

- LSE:SPX

Did You Miss Spirax-Sarco Engineering's (LON:SPX) Impressive 166% Share Price Gain?

Spirax-Sarco Engineering plc (LON:SPX) shareholders might be concerned after seeing the share price drop 10% in the last quarter. But in stark contrast, the returns over the last half decade have impressed. We think most investors would be happy with the 166% return, over that period. Generally speaking the long term returns will give you a better idea of business quality than short periods can. Of course, that doesn't necessarily mean it's cheap now.

See our latest analysis for Spirax-Sarco Engineering

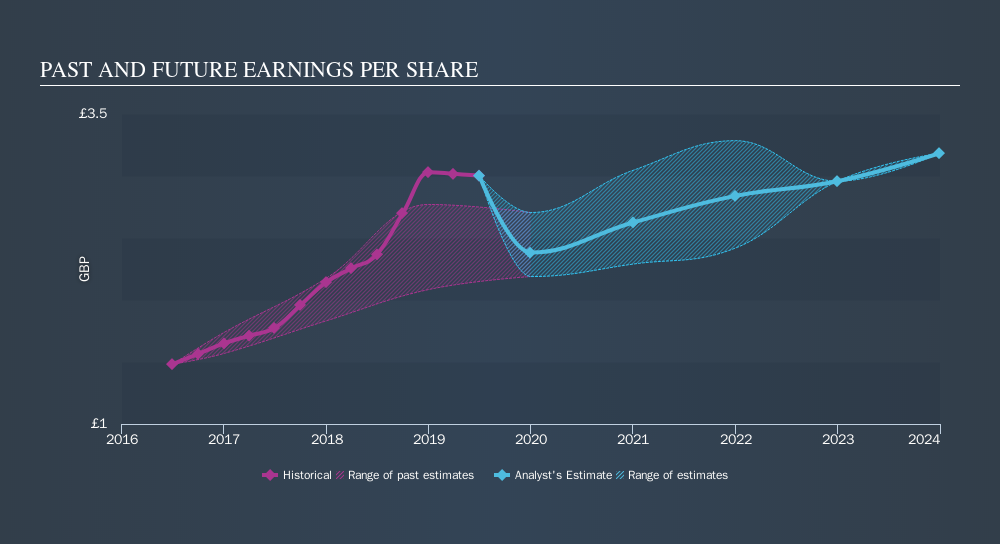

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

Over half a decade, Spirax-Sarco Engineering managed to grow its earnings per share at 17% a year. This EPS growth is slower than the share price growth of 22% per year, over the same period. So it's fair to assume the market has a higher opinion of the business than it did five years ago. That's not necessarily surprising considering the five-year track record of earnings growth.

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. Dive deeper into the earnings by checking this interactive graph of Spirax-Sarco Engineering's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. We note that for Spirax-Sarco Engineering the TSR over the last 5 years was 200%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

It's good to see that Spirax-Sarco Engineering has rewarded shareholders with a total shareholder return of 15% in the last twelve months. And that does include the dividend. Having said that, the five-year TSR of 25% a year, is even better. The pessimistic view would be that be that the stock has its best days behind it, but on the other hand the price might simply be moderating while the business itself continues to execute. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Spirax-Sarco Engineering by clicking this link.

Spirax-Sarco Engineering is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:SPX

Spirax Group

Provides thermal energy and fluid technology solutions in Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives