- Norway

- /

- Specialty Stores

- /

- OB:KID

Exploring European Undervalued Small Caps With Insider Action In November 2025

Reviewed by Simply Wall St

In November 2025, European markets have been grappling with concerns overvaluation in artificial intelligence-related stocks, leading to a pullback in major indices like the STOXX Europe 600. Amid this backdrop, small-cap stocks present intriguing opportunities as investors seek value and potential growth outside the high-profile sectors that have dominated recent headlines. Identifying small caps with solid fundamentals and insider activity can offer insights into potentially resilient investments during times of broader market uncertainty.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Cairn Homes | 12.2x | 1.6x | 29.37% | ★★★★★★ |

| Eurocell | 17.1x | 0.3x | 38.06% | ★★★★★☆ |

| Bytes Technology Group | 15.9x | 3.9x | 25.88% | ★★★★★☆ |

| Boozt | 18.0x | 0.8x | 47.54% | ★★★★★☆ |

| Speedy Hire | NA | 0.3x | 26.34% | ★★★★★☆ |

| Nyab | 18.0x | 0.8x | 37.07% | ★★★★☆☆ |

| Senior | 24.5x | 0.8x | 26.29% | ★★★★☆☆ |

| Social Housing REIT | NA | 6.8x | 38.42% | ★★★★☆☆ |

| Kid | 18.6x | 1.4x | 1.81% | ★★★☆☆☆ |

| Eastnine | 11.8x | 7.5x | 48.92% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

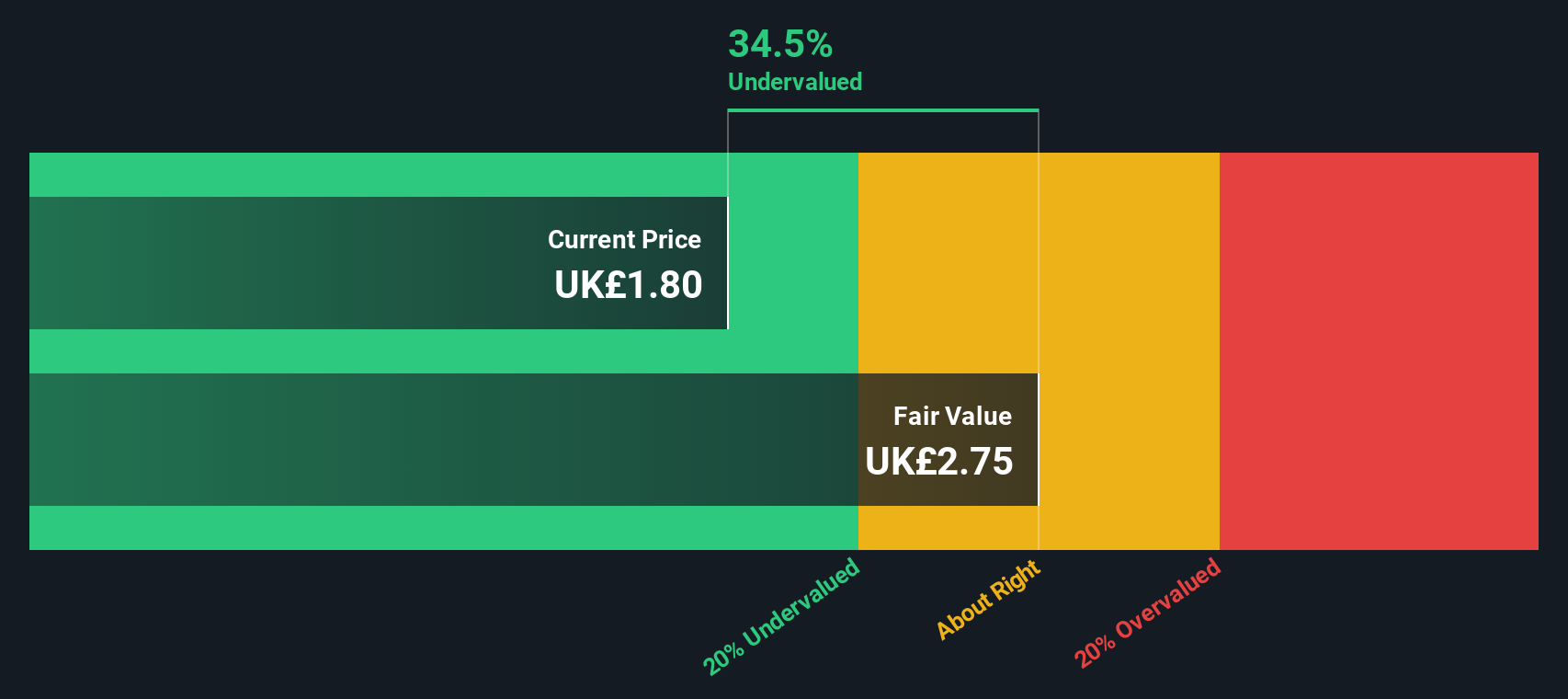

NCC Group (LSE:NCC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: NCC Group specializes in providing cybersecurity and software escrow services, with a market capitalization of approximately £0.45 billion.

Operations: The company's revenue is primarily driven by its Cyber Security segment, contributing significantly to its total income. Over the years, there has been a notable fluctuation in net income margin, with recent periods experiencing negative margins as low as -7.68%. Operating expenses have consistently increased over time, impacting profitability. The gross profit margin has shown variability but reached up to 42.19% in some periods.

PE: -30.5x

NCC Group's recent SEK 200 million project to build a swim center in Rödeby highlights their expertise and strategic partnerships, enhancing energy efficiency in collaboration with Karlskrona Municipality. Despite relying solely on external borrowing for funding, which carries higher risk, NCC's earnings are forecasted to grow by 61% annually. Insider confidence is evident from share purchases within the past year, showcasing belief in future growth potential. This small company presents an interesting opportunity amidst its challenges and prospects.

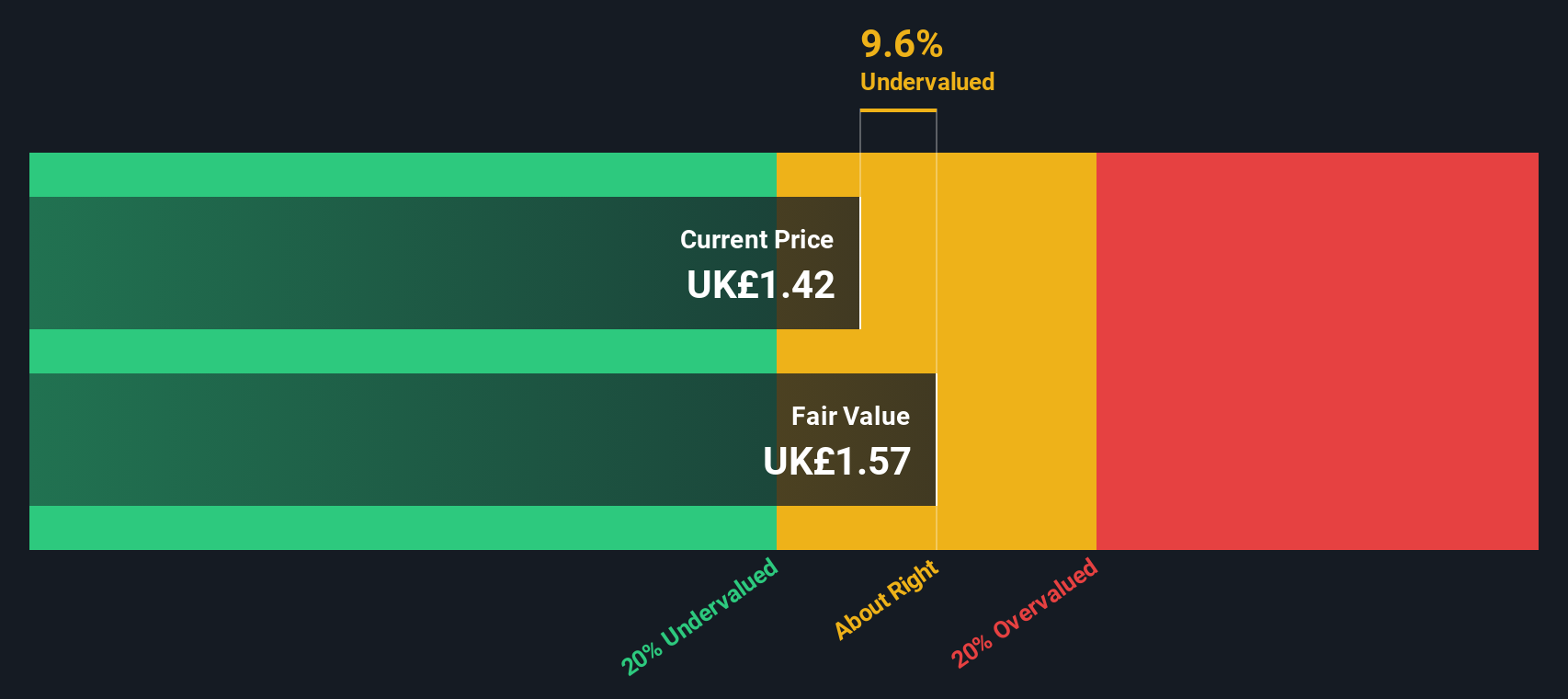

Senior (LSE:SNR)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Senior is an international engineering solutions provider with a market cap of approximately £0.72 billion, operating primarily in the aerospace and flexonics sectors.

Operations: The company generates revenue primarily from two segments: Aerospace (£670.70 million) and Flexonics (£316.90 million). The gross profit margin has shown some variability, reaching 21.32% in the most recent period. Operating expenses are significant, with General & Administrative Expenses consistently being a major component of costs.

PE: 24.5x

Senior, a European engineering solutions provider, is attracting attention in the small cap space due to its potential for growth and insider confidence. Recently, insiders have shown their belief in the company's prospects by purchasing shares throughout 2025. Despite facing challenges from large one-off items affecting earnings quality and reliance on external borrowing for funding, Senior's earnings are projected to grow at an annual rate of 14.56%. With its Q3 2025 results expected soon, investors are keenly watching for signs of continued performance improvement.

- Click here and access our complete valuation analysis report to understand the dynamics of Senior.

Gain insights into Senior's historical performance by reviewing our past performance report.

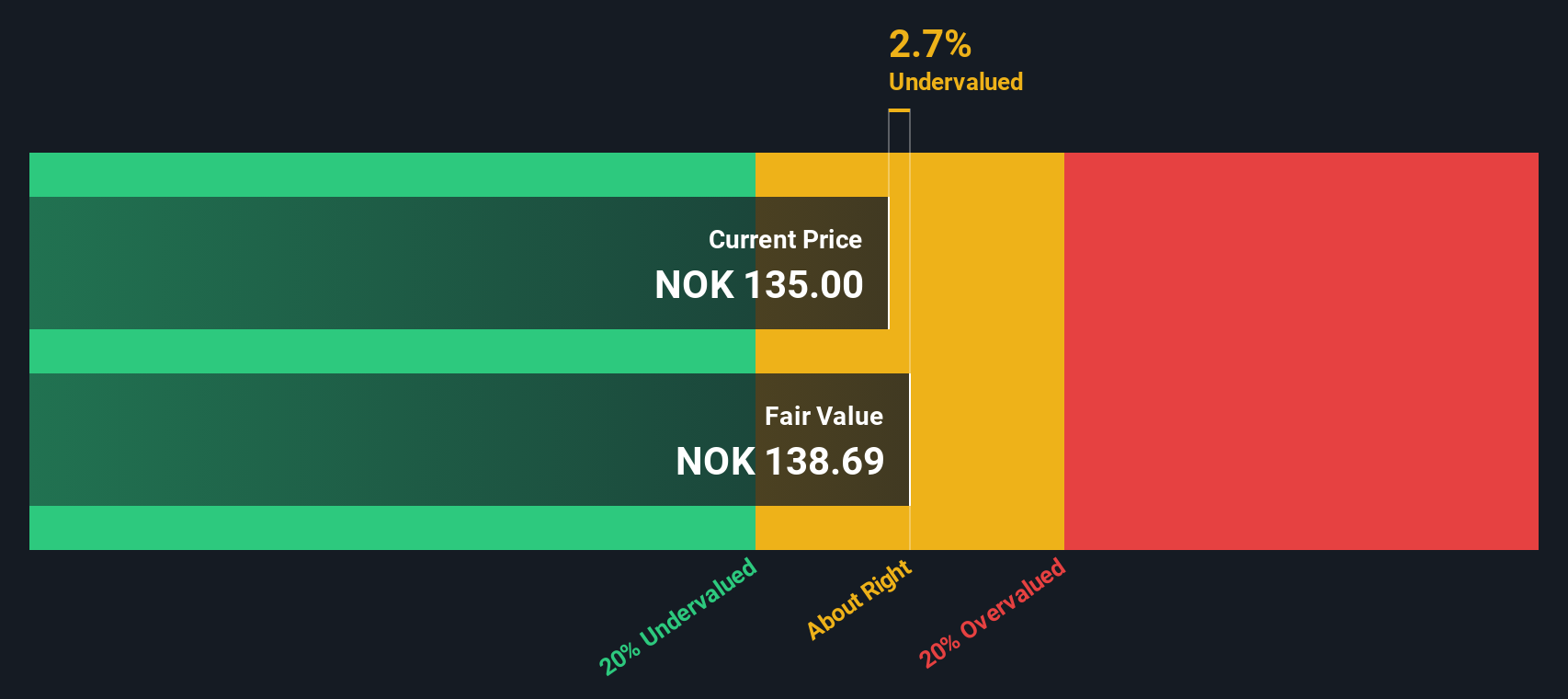

Kid (OB:KID)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kid is a company engaged in the retail sector, specializing in home textiles and interior products, with a market cap of NOK 2.5 billion.

Operations: Kid generates revenue primarily through sales, with cost of goods sold (COGS) and operating expenses being significant components of its financial structure. Over the periods reviewed, the gross profit margin has shown fluctuations, reaching 62.67% in June 2024 and decreasing to 61.44% by September 2025. Operating expenses include notable allocations for general and administrative costs as well as depreciation and amortization.

PE: 18.6x

Kid ASA's financial performance shows mixed signals, with recent earnings revealing a dip in net income to NOK 39.85 million for Q3 2025, down from NOK 70.22 million the previous year. Despite this, revenue saw a slight increase to NOK 902.99 million from NOK 888.24 million year-over-year, suggesting potential resilience in sales growth amid challenges. The company’s inclusion in the S&P Global BMI Index highlights its growing market presence. While facing high debt levels and relying on external borrowing, insider confidence is evident through recent share purchases by insiders within the last quarter, indicating belief in future prospects despite current financial pressures and dividend reductions to NOK 2.50 per share for November 2025 payments.

- Navigate through the intricacies of Kid with our comprehensive valuation report here.

Examine Kid's past performance report to understand how it has performed in the past.

Key Takeaways

- Explore the 60 names from our Undervalued European Small Caps With Insider Buying screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kid might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OB:KID

Kid

Operates as a home textile retailer in Norway, Sweden, Finland, and Estonia.

High growth potential and fair value.

Market Insights

Community Narratives