- United Kingdom

- /

- Construction

- /

- LSE:SFR

There's Reason For Concern Over Severfield plc's (LON:SFR) Massive 28% Price Jump

Severfield plc (LON:SFR) shareholders are no doubt pleased to see that the share price has bounced 28% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 62% share price drop in the last twelve months.

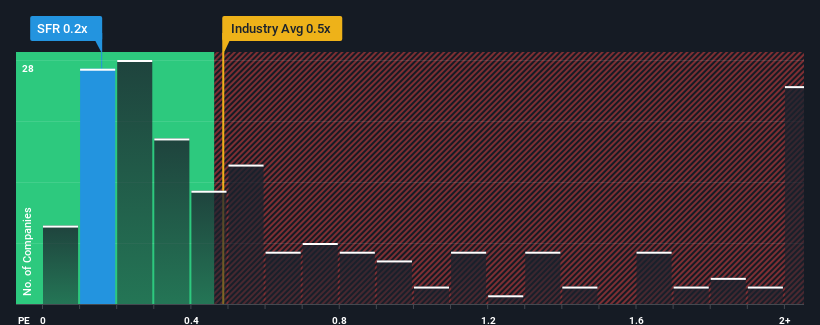

Although its price has surged higher, there still wouldn't be many who think Severfield's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in the United Kingdom's Construction industry is similar at about 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

Our free stock report includes 4 warning signs investors should be aware of before investing in Severfield. Read for free now.Check out our latest analysis for Severfield

How Has Severfield Performed Recently?

Recent revenue growth for Severfield has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Severfield.What Are Revenue Growth Metrics Telling Us About The P/S?

In order to justify its P/S ratio, Severfield would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered a decent 6.0% gain to the company's revenues. The latest three year period has also seen an excellent 34% overall rise in revenue, aided somewhat by its short-term performance. So we can start by confirming that the company has done a great job of growing revenues over that time.

Shifting to the future, estimates from the five analysts covering the company suggest revenue growth is heading into negative territory, declining 6.8% over the next year. With the industry predicted to deliver 10% growth, that's a disappointing outcome.

In light of this, it's somewhat alarming that Severfield's P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

The Bottom Line On Severfield's P/S

Severfield's stock has a lot of momentum behind it lately, which has brought its P/S level with the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

It appears that Severfield currently trades on a higher than expected P/S for a company whose revenues are forecast to decline. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Severfield (2 don't sit too well with us!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:SFR

Severfield

A structural steelwork company, engages in the designing, manufacturing, fabrication, construction, and erection of steelwork activities in the United Kingdom, Republic of Ireland, Europe, and internationally.

Very undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives