- United Kingdom

- /

- Specialty Stores

- /

- LSE:PETS

Top UK Dividend Stocks For February 2025

Reviewed by Simply Wall St

As the UK market grapples with challenges stemming from weak trade data from China, the FTSE 100 has experienced notable declines, reflecting concerns over global economic conditions and their impact on commodity-linked stocks. Amidst this backdrop, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate uncertain times by focusing on companies with strong fundamentals and consistent payout histories.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 5.74% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.52% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 8.06% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.71% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.02% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.76% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.82% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.01% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.99% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.54% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Begbies Traynor Group (AIM:BEG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Begbies Traynor Group plc offers professional services to businesses, advisors, corporations, and financial institutions in the UK with a market cap of £148.53 million.

Operations: Begbies Traynor Group's revenue is generated from its Property Advisory segment, which contributes £44.96 million, and its Business Recovery and Advisory segment, which brings in £102.18 million.

Dividend Yield: 4.4%

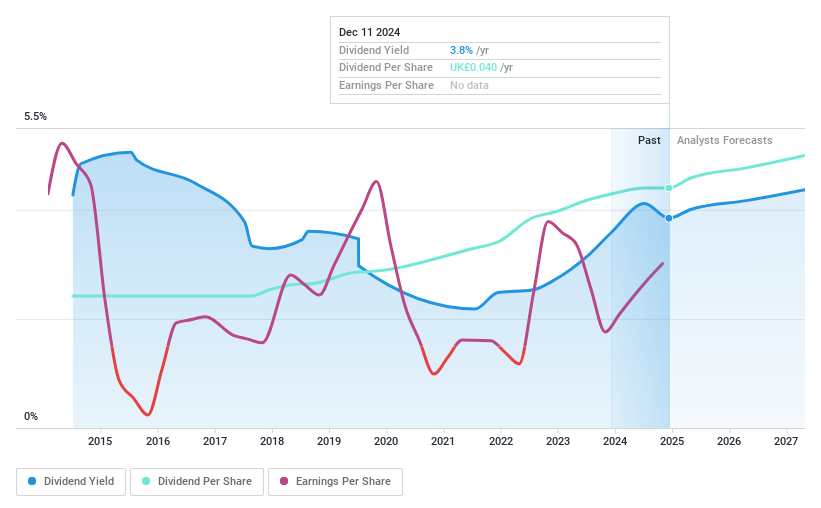

Begbies Traynor Group, while offering a dividend yield of 4.4%, faces challenges in sustainability as its dividends are not well covered by earnings, indicated by a high payout ratio of 265.4%. However, the company's cash flow coverage is reasonable at a 72.6% cash payout ratio. Despite trading below estimated fair value and recent positive earnings growth, the dividend remains lower than top UK payers and is impacted by large one-off items in financial results.

- Unlock comprehensive insights into our analysis of Begbies Traynor Group stock in this dividend report.

- Our expertly prepared valuation report Begbies Traynor Group implies its share price may be lower than expected.

Pets at Home Group (LSE:PETS)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Pets at Home Group Plc operates as a specialist omnichannel retailer of pet food, pet-related products, and accessories in the United Kingdom with a market cap of £1.01 billion.

Operations: Pets at Home Group Plc generates its revenue from two main segments: Retail, which accounts for £1.33 billion, and Vet Group, contributing £161.10 million.

Dividend Yield: 5.7%

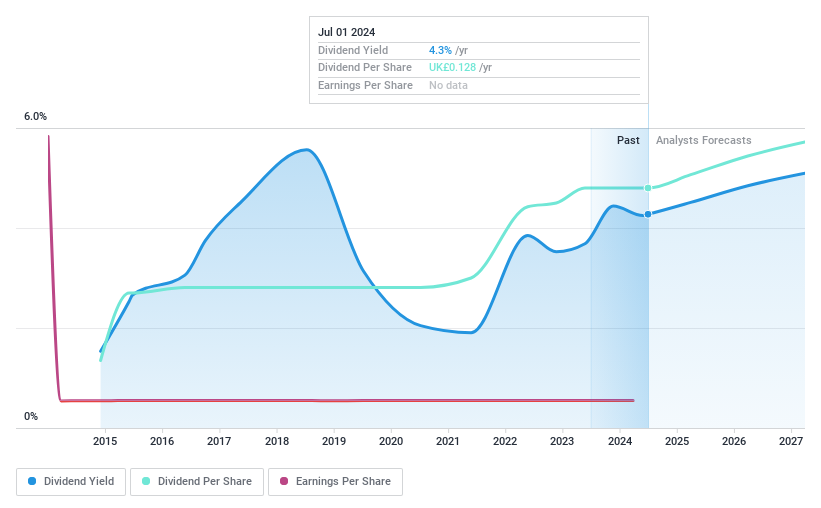

Pets at Home Group offers a high dividend yield of 5.74%, placing it in the top 25% of UK dividend payers, with stable and growing dividends over the past decade. The dividends are well-supported by earnings (67.3% payout ratio) and cash flows (35.8% cash payout ratio). Recent earnings growth enhances its appeal, with net income rising significantly year-on-year. Despite recent board changes, the stock trades below its estimated fair value, suggesting potential upside for investors.

- Click here to discover the nuances of Pets at Home Group with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, Pets at Home Group's share price might be too pessimistic.

RS Group (LSE:RS1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: RS Group plc is involved in the distribution of maintenance, repair, and operations products and service solutions across various countries including the UK, US, France, Germany, Italy, and Mexico; it has a market cap of £2.97 billion.

Operations: RS Group plc's revenue is primarily derived from Own-Brand Products, contributing £404.70 million, and Other Product and Service Solutions, which account for £2.53 billion.

Dividend Yield: 3.5%

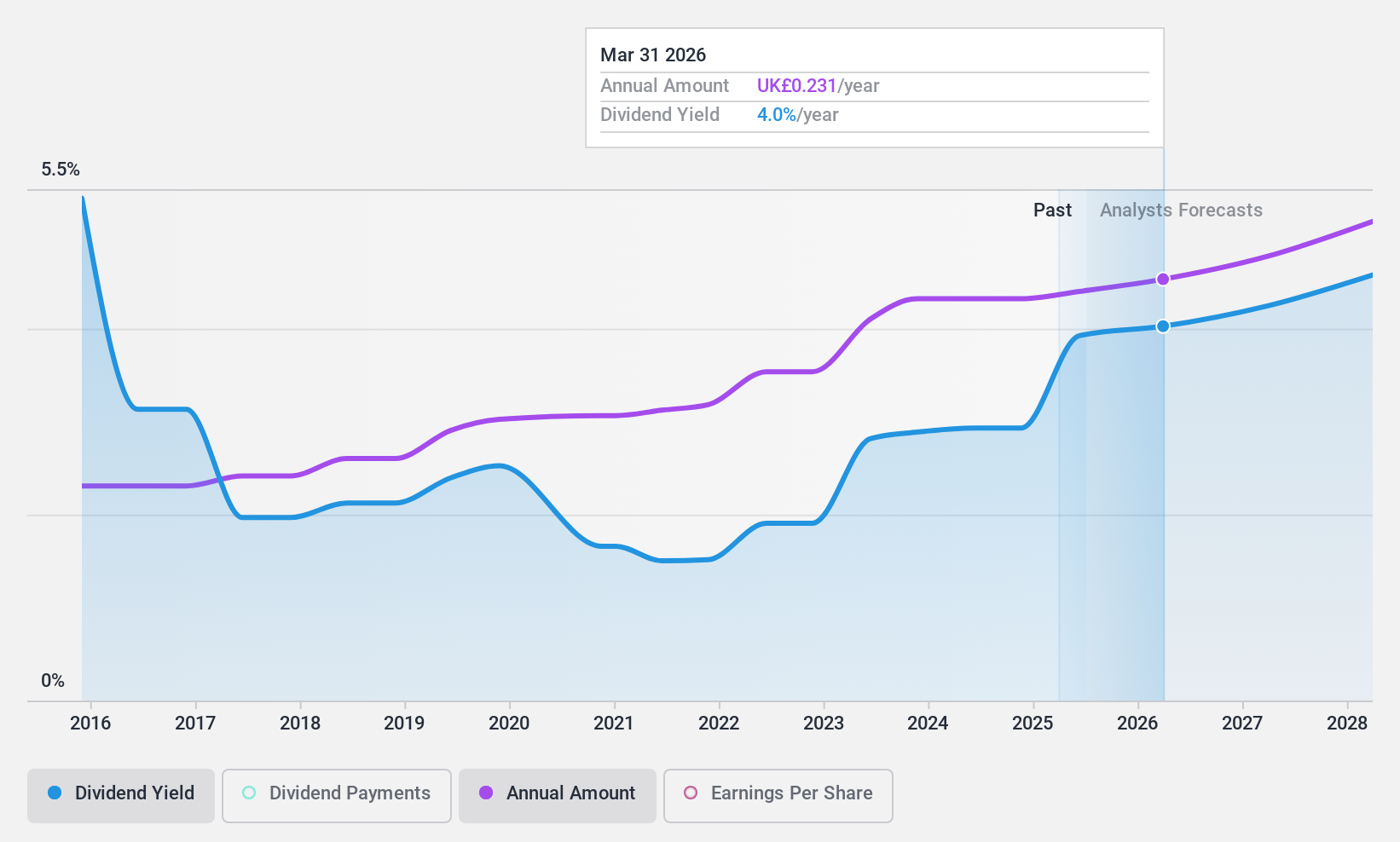

RS Group's dividend yield of 3.54% is lower than the top 25% of UK dividend payers, but its dividends are reliably covered by earnings and cash flows, with payout ratios at 61.8% and 49.2%, respectively. The company has consistently increased dividends over the past decade without volatility. Recent product innovations in digitalization solutions could bolster future performance, though current trading remains slightly below fair value estimates, indicating potential growth opportunities.

- Navigate through the intricacies of RS Group with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of RS Group shares in the market.

Where To Now?

- Reveal the 58 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PETS

Pets at Home Group

Engages in the specialist omnichannel retailing of pet food, pet related products, and pet accessories in the United Kingdom.

Very undervalued 6 star dividend payer.

Market Insights

Community Narratives