- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:RR.

Assessing Rolls-Royce (LSE:RR.) Valuation as Investor Interest Grows

Reviewed by Simply Wall St

Rolls-Royce Holdings (LSE:RR.) shares have ticked higher in recent trading, with investors showing renewed interest in the stock. The company’s performance over the past month has remained relatively flat. However, gains over the past three months stand out.

See our latest analysis for Rolls-Royce Holdings.

Momentum around Rolls-Royce Holdings has been building, with its share price up more than 97% year-to-date and a remarkable 1-year total shareholder return of 111%. These strong gains follow persistent optimism about improvements in core operations and changing investor risk perceptions. Even a modest uptick recently hints that confidence remains high as investors look to the future.

If Rolls-Royce's surge has you thinking bigger, this could be the ideal moment to discover See the full list for free.

With impressive returns already on the books, the big question now is whether Rolls-Royce Holdings is undervalued or if the market has already factored in all of its future growth. Could there still be a buying opportunity here?

Most Popular Narrative: 2.8% Undervalued

The narrative's fair value of £11.93 stands just above Rolls-Royce Holdings' last close at £11.60. The debate among analysts centers on whether the stock's robust recovery still leaves hidden upside for investors.

The growing investor enthusiasm for Rolls-Royce's sustainable technology initiatives (SMRs, UltraFan, hydrogen propulsion, advanced battery storage) is increasingly priced into the stock. However, these projects remain in early commercialization stages and carry material execution, regulatory, and capex risks. If adoption lags or investor timelines prove optimistic, anticipated new revenue streams are likely to be delayed, impacting long-term earnings visibility.

What’s driving this high target? The most popular narrative is anchored on ambitious margin expansion, recurring cash flows, and a bold reset of what fair value means for Rolls-Royce. Clues lie in aggressive earnings assumptions and a profit multiple rarely seen outside tech giants. Want the full story behind this valuation leap? Hit the link to uncover the critical projections that just might change your outlook.

Result: Fair Value of £11.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, risks remain, such as supply chain disruptions or slower than expected progress in new sustainable technologies, which could challenge these upbeat forecasts.

Find out about the key risks to this Rolls-Royce Holdings narrative.

Another View: Multiples Paint a Different Picture

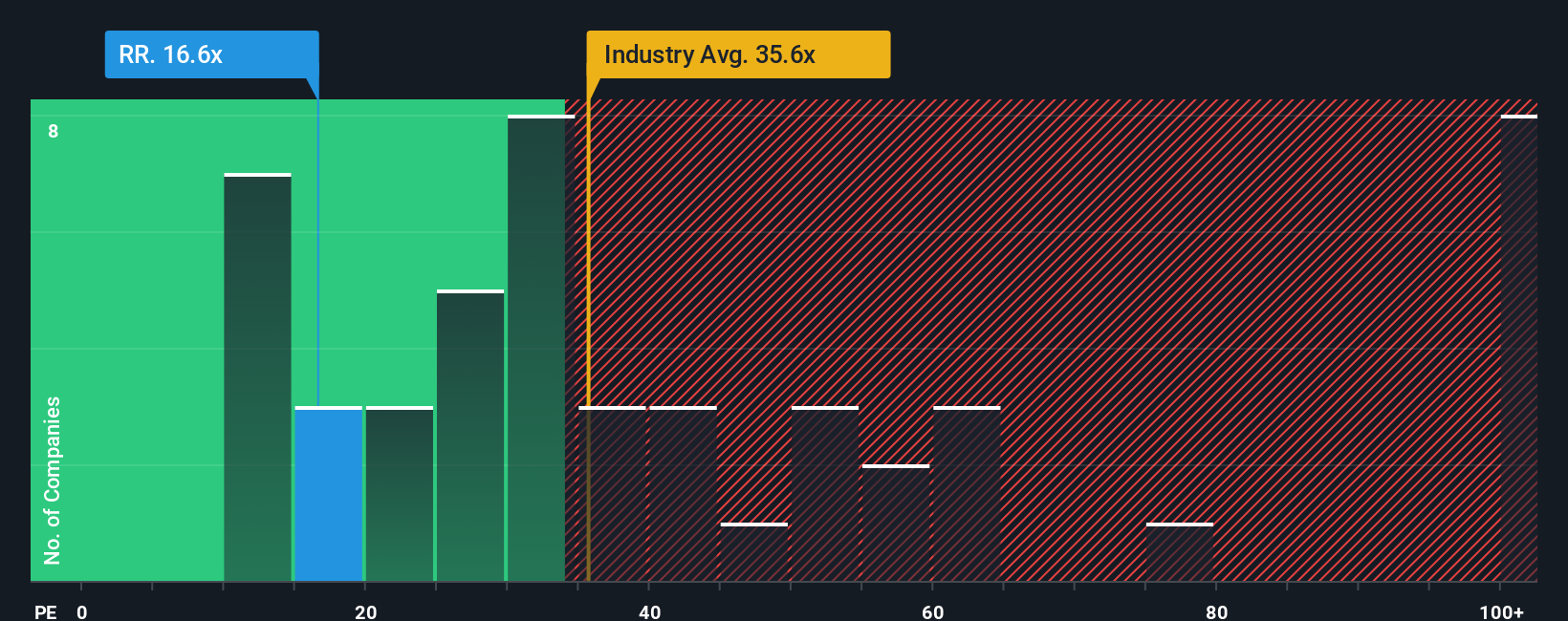

Looking at how Rolls-Royce Holdings is valued compared to its peers, its current price-to-earnings ratio sits at 16.9x. This is noticeably cheaper than the industry average of 34.6x and the peer average of 27.1x. Interestingly, it is also trading below its fair ratio of 20.4x, hinting that the market may be underpricing the company’s future potential. But does this relative value signal a real bargain, or is there another reason for the gap?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rolls-Royce Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rolls-Royce Holdings Narrative

If you would rather draw your own conclusions or want to put the numbers under your own spotlight, you can build your own narrative with just a few clicks. Do it your way

A great starting point for your Rolls-Royce Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Don’t let your next big opportunity slip by. Simply Wall St’s expert screeners put new investment prospects right at your fingertips, tailored to every strategy.

- Uncover unique tech players by tapping into the world of next-generation computing with these 28 quantum computing stocks and see who’s making big moves in quantum advancements.

- Capture competitive yields and build reliable income streams. Start with these 21 dividend stocks with yields > 3% to pinpoint companies delivering attractive and sustainable dividends.

- Ride the wave of artificial intelligence breakthroughs by targeting market leaders among these 26 AI penny stocks that are redefining innovation and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:RR.

Rolls-Royce Holdings

Develops and delivers mission-critical power systems in the United Kingdom and internationally.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives