- United Kingdom

- /

- Food

- /

- LSE:AEP

3 Top UK Dividend Stocks Yielding Up To 6.2%

Reviewed by Simply Wall St

In recent days, the UK's FTSE 100 index has faced downward pressure due to weak trade data from China, highlighting the interconnectedness of global markets and the challenges faced by economies attempting to recover from pandemic disruptions. Amid these market fluctuations, dividend stocks can offer a measure of stability and income potential for investors seeking reliable returns in uncertain times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 6.56% | ★★★★★★ |

| 4imprint Group (LSE:FOUR) | 3.48% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 8.93% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.89% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 4.17% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.27% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 6.05% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 5.04% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.93% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.90% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our Top UK Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

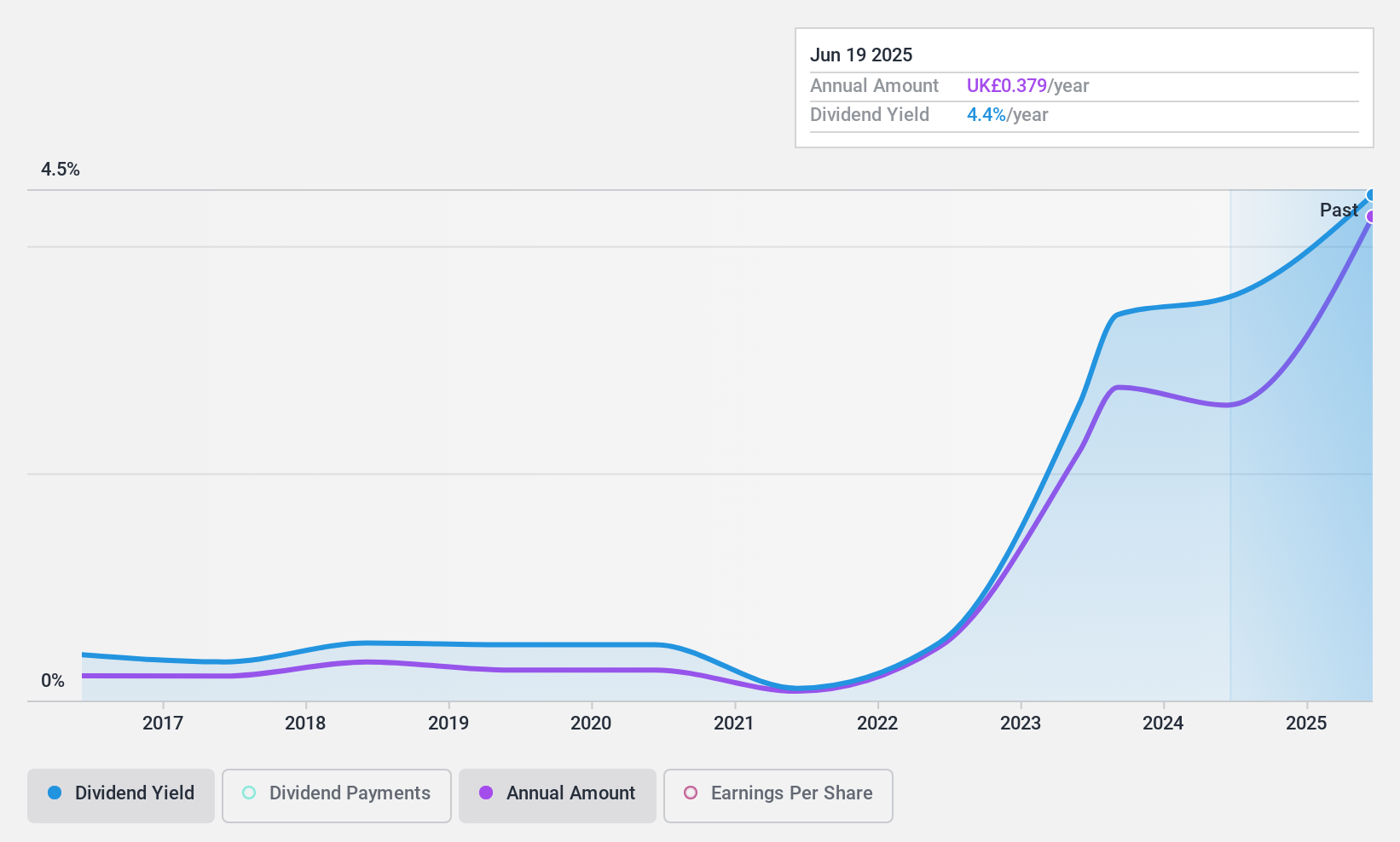

Anglo-Eastern Plantations (LSE:AEP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anglo-Eastern Plantations Plc, with a market cap of £245.62 million, owns, operates, and develops agriculture plantations in Indonesia and Malaysia.

Operations: Anglo-Eastern Plantations generates its revenue primarily from the cultivation of plantations, amounting to $364.23 million.

Dividend Yield: 4%

Anglo-Eastern Plantations has a low dividend yield of 3.95%, underperforming compared to top UK dividend payers. Despite a history of volatility and instability in its dividends, the company's payout ratios indicate strong coverage by both earnings (10.7%) and cash flows (24.4%). Recent executive changes may impact governance, but with shares trading significantly below estimated fair value, there could be potential for capital appreciation alongside dividend income.

- Take a closer look at Anglo-Eastern Plantations' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that Anglo-Eastern Plantations is priced lower than what may be justified by its financials.

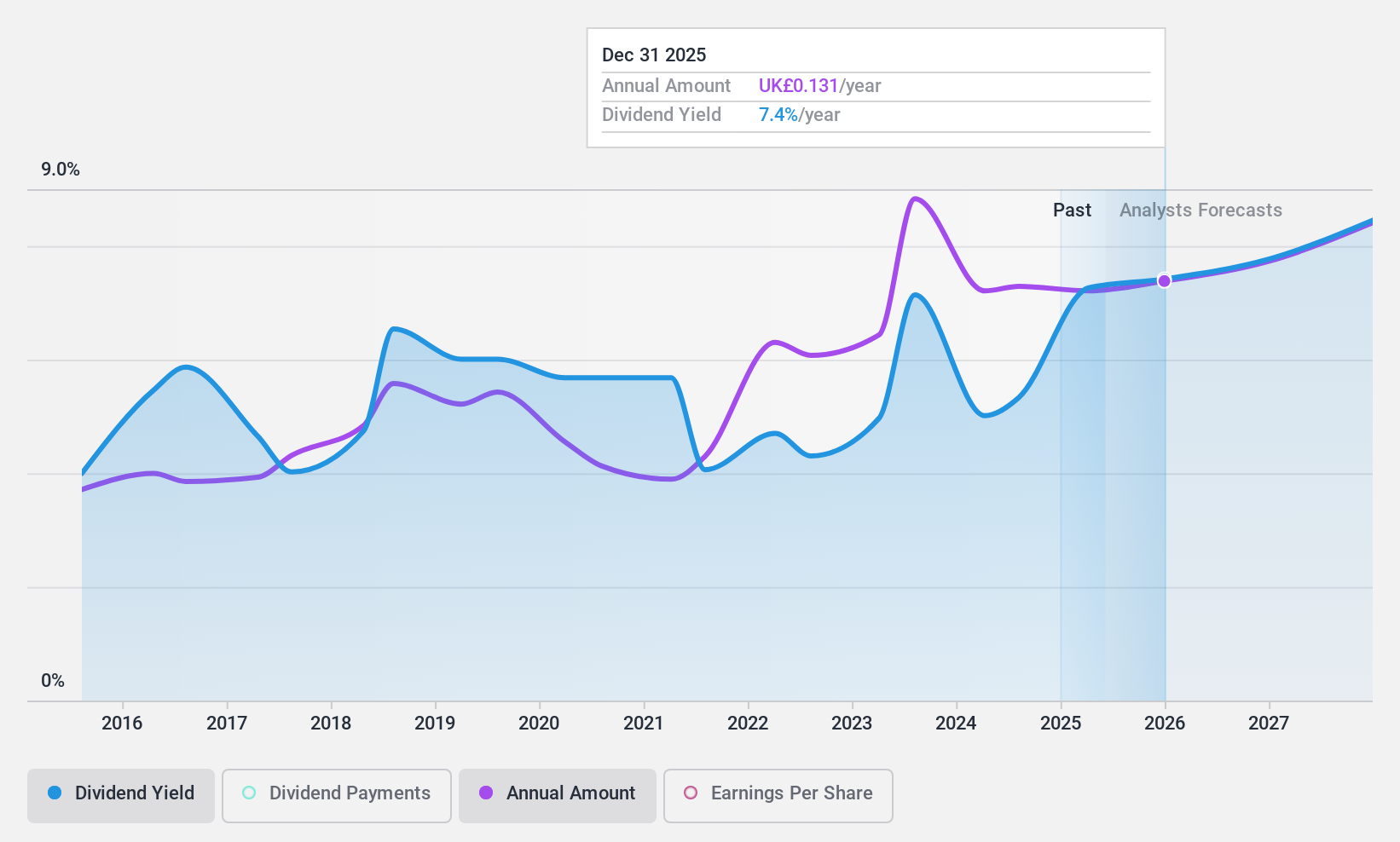

Man Group (LSE:EMG)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Man Group Limited is a publicly owned investment manager with a market cap of approximately £2.36 billion.

Operations: Man Group Limited generates revenue of $1.40 billion from its Investment Management Business segment.

Dividend Yield: 6.3%

Man Group offers a dividend yield of 6.27%, placing it among the top 25% of UK dividend payers. Despite past volatility, its dividends are well covered by earnings (60.3% payout ratio) and cash flows (46.3% cash payout ratio). The stock trades at a significant discount to its estimated fair value, suggesting potential for capital appreciation. However, investors should be cautious due to the company's unstable dividend history over the last decade.

- Dive into the specifics of Man Group here with our thorough dividend report.

- Our expertly prepared valuation report Man Group implies its share price may be lower than expected.

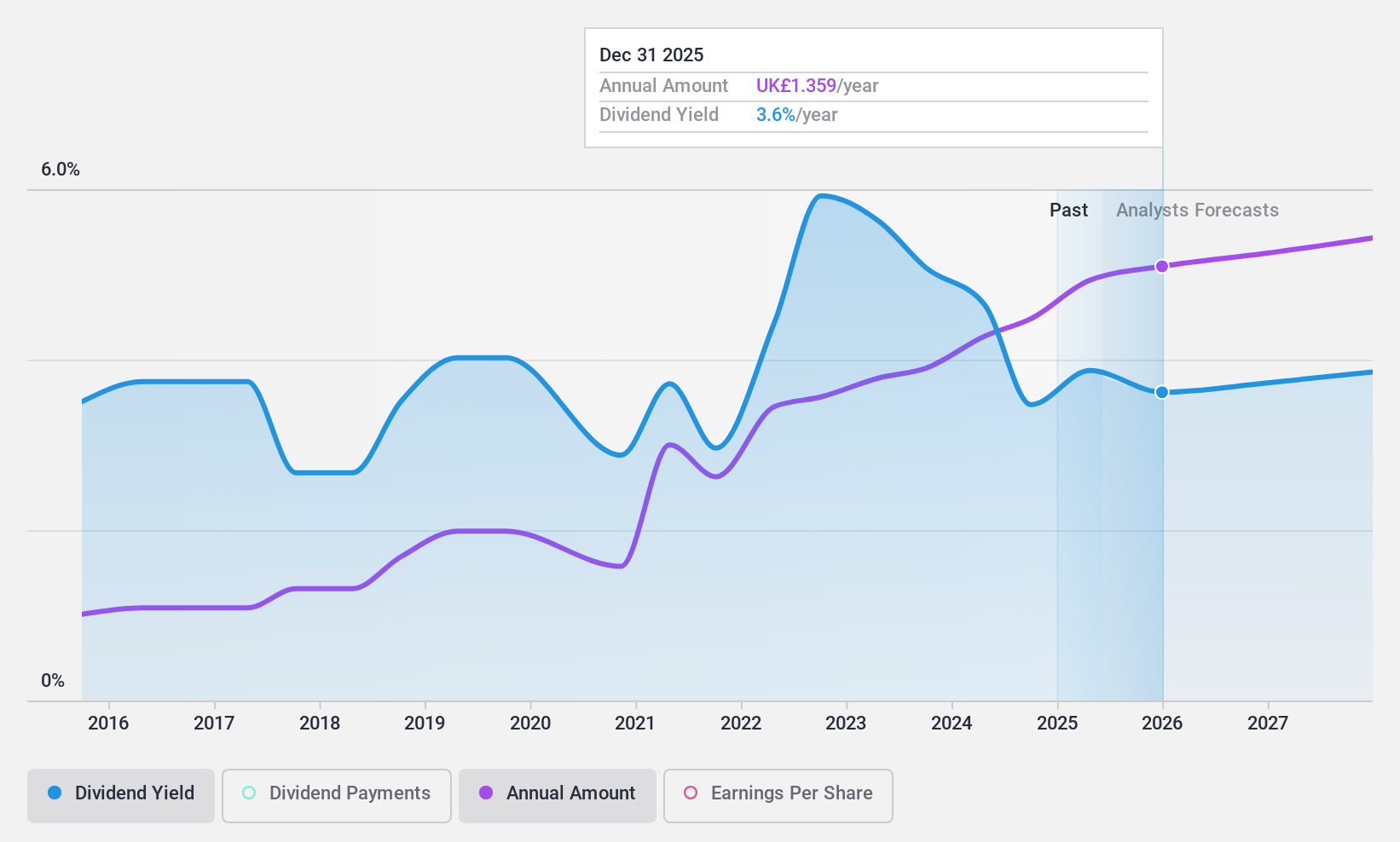

Morgan Sindall Group (LSE:MGNS)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Morgan Sindall Group plc is a UK-based construction and regeneration company with a market cap of £1.70 billion.

Operations: Morgan Sindall Group plc generates revenue from several segments, including Fit Out (£1.24 billion), Construction (£1.02 billion), Infrastructure (£989.20 million), Property Services (£191.80 million), Urban Regeneration (£148.40 million), and Partnership Housing (£845.20 million).

Dividend Yield: 3.3%

Morgan Sindall Group's dividend payments are well covered by earnings (44.7% payout ratio) and cash flows (33.4% cash payout ratio), though its dividend history has been volatile over the past decade. The company trades at 15.6% below estimated fair value, indicating potential for capital appreciation. Recent guidance suggests earnings for 2024 will exceed expectations, but significant insider selling raises caution despite a modest 3.31% dividend yield compared to top UK payers.

- Navigate through the intricacies of Morgan Sindall Group with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Morgan Sindall Group's current price could be inflated.

Seize The Opportunity

- Click here to access our complete index of 63 Top UK Dividend Stocks.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AEP

Anglo-Eastern Plantations

Owns, operates, and develops agriculture plantations in Indonesia and Malaysia.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives