- United Kingdom

- /

- Building

- /

- AIM:JHD

James Halstead Leads These 3 Undiscovered Gems In The United Kingdom

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 and FTSE 250 indices experience fluctuations amid global economic challenges, particularly influenced by China's sluggish recovery, investors are increasingly looking for opportunities beyond the blue-chip stocks. In this environment, identifying promising small-cap companies like James Halstead can be crucial for those seeking growth potential in a market characterized by volatility and shifting global demands.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 29.42% | 31.34% | ★★★★★★ |

| Livermore Investments Group | NA | 9.92% | 13.65% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.15% | 4.93% | ★★★★★★ |

| London Security | 0.22% | 10.13% | 7.75% | ★★★★★★ |

| M&G Credit Income Investment Trust | NA | 17.28% | 15.80% | ★★★★★★ |

| VH Global Energy Infrastructure | NA | 18.30% | 20.03% | ★★★★★★ |

| FW Thorpe | 5.89% | 11.97% | 12.07% | ★★★★★☆ |

| Goodwin | 37.02% | 9.75% | 15.68% | ★★★★★☆ |

| BBGI Global Infrastructure | 0.02% | 3.08% | 6.85% | ★★★★★☆ |

| AltynGold | 77.07% | 28.64% | 38.10% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

James Halstead (AIM:JHD)

Simply Wall St Value Rating: ★★★★★★

Overview: James Halstead plc is a company that manufactures and supplies flooring products for both commercial and domestic applications across the UK, Europe, Scandinavia, Australasia, Asia, and other international markets with a market cap of £702.29 million.

Operations: James Halstead generates revenue of £274.88 million from the manufacture and distribution of flooring products.

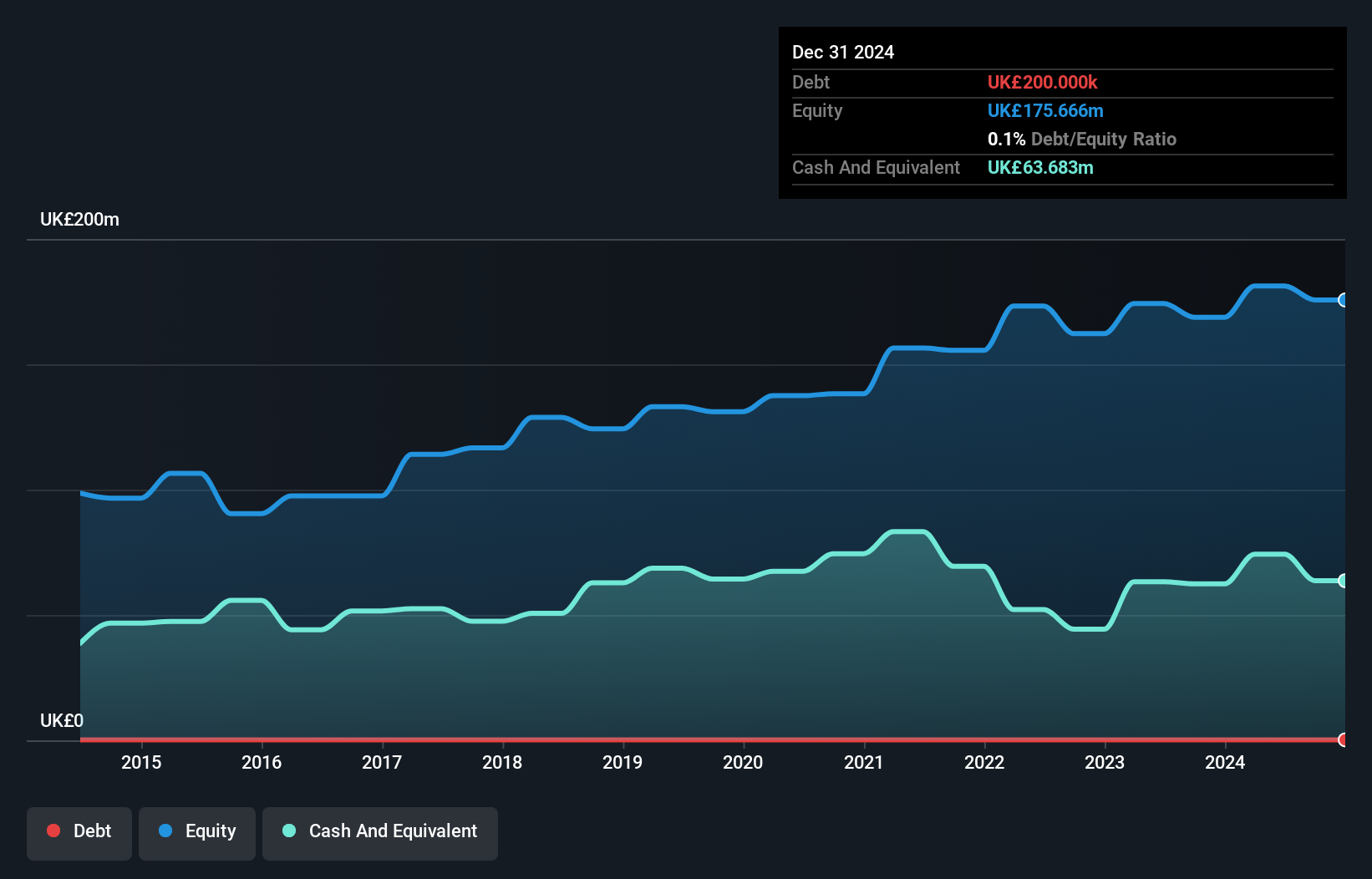

James Halstead, a noteworthy player in the flooring sector, has seen its debt to equity ratio decrease from 0.2% to 0.1% over five years, indicating improved financial health. Despite a negative earnings growth of -2.1% last year against the building industry's 1%, it trades at an attractive 11.2% below estimated fair value and maintains high-quality earnings with more cash than total debt. The company is free cash flow positive with £46 million as of June 2024, suggesting robust liquidity management despite recent leadership changes with Anthony Wild stepping down as Chairman in December 2024.

- Click to explore a detailed breakdown of our findings in James Halstead's health report.

Assess James Halstead's past performance with our detailed historical performance reports.

Goodwin (LSE:GDWN)

Simply Wall St Value Rating: ★★★★★☆

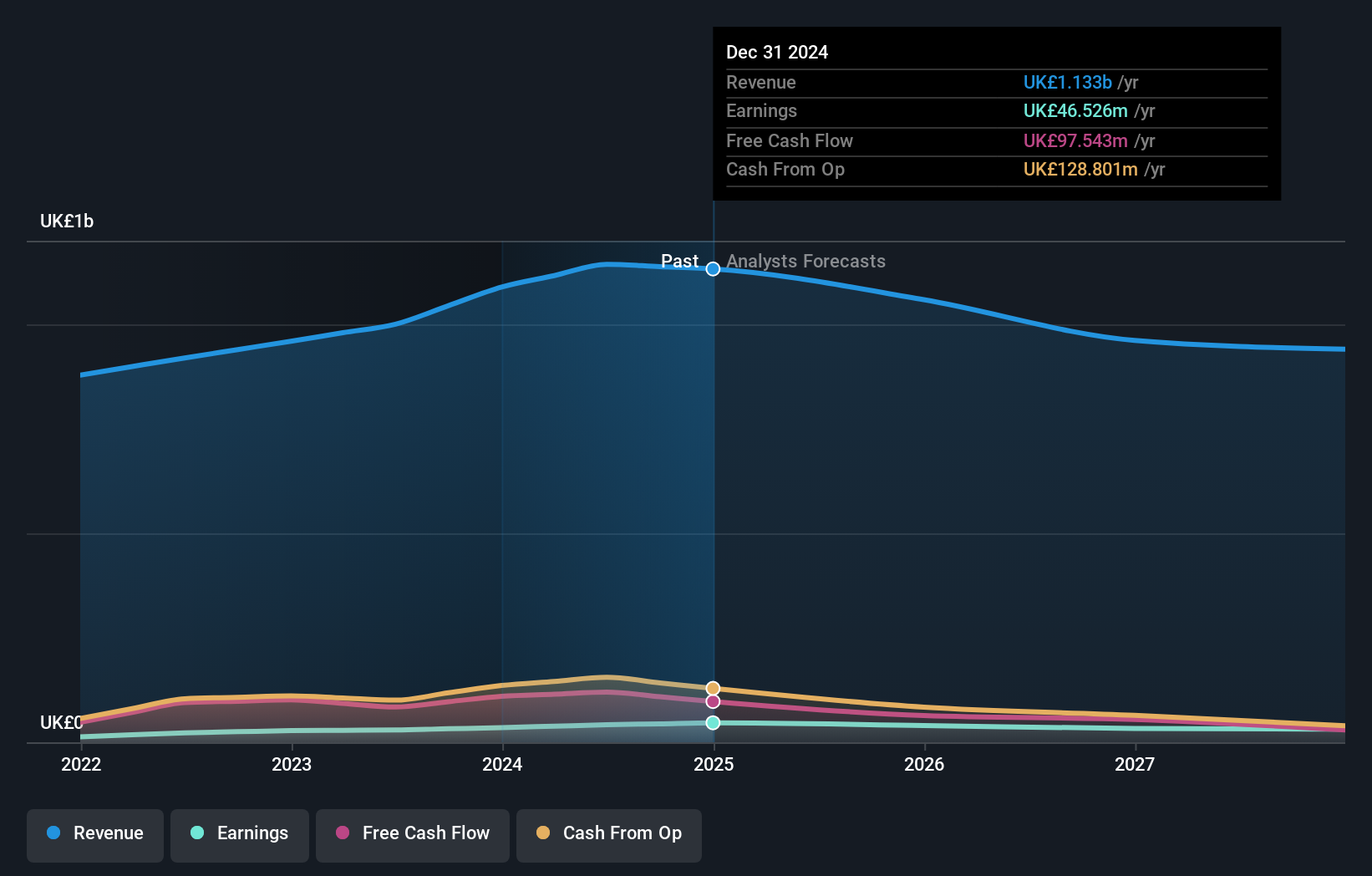

Overview: Goodwin PLC, along with its subsidiaries, offers mechanical and refractory engineering solutions across various regions including the United Kingdom, Europe, the United States, and the Pacific Basin, with a market cap of £546.70 million.

Operations: Goodwin PLC generates revenue through its mechanical and refractory segments, with the mechanical segment contributing £168.02 million and the refractory segment adding £75.58 million. The company's net profit margin trends provide insight into its profitability dynamics over time.

Goodwin, a smaller player in the UK market, has demonstrated robust performance with earnings growth of 22.9% over the past year, outpacing its industry peers. The company reported half-year sales of £106.39 million and net income of £11.33 million, up from last year's figures. Trading at a significant discount to its estimated fair value by 58.8%, Goodwin appears undervalued despite an increase in debt-to-equity ratio from 27% to 37% over five years. With interest payments well-covered by EBIT at an impressive 8.4 times coverage and satisfactory net debt levels at 25%, it showcases high-quality earnings potential moving forward.

- Get an in-depth perspective on Goodwin's performance by reading our health report here.

Explore historical data to track Goodwin's performance over time in our Past section.

Mears Group (LSE:MER)

Simply Wall St Value Rating: ★★★★★☆

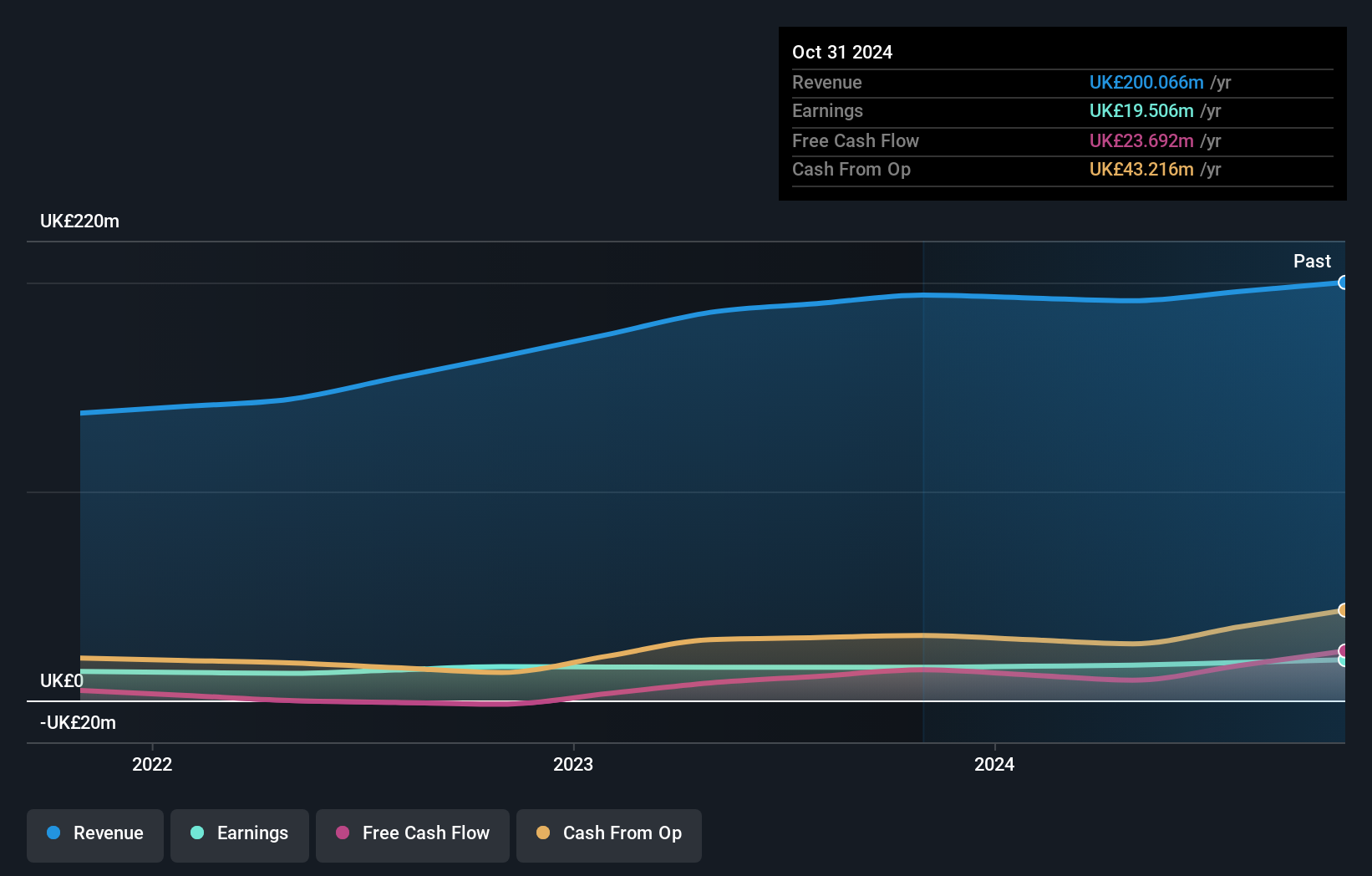

Overview: Mears Group plc, with a market cap of £328.11 million, offers outsourced services to both public and private sectors in the United Kingdom through its subsidiaries.

Operations: Mears Group generates revenue primarily from its Management segment, contributing £591.63 million, and Maintenance segment, adding £551.73 million. The net profit margin is a key financial indicator to consider when evaluating the company's performance over time.

Mears, a nimble player in the UK market, stands out with no debt compared to five years ago when its debt-to-equity ratio was 43.5%. Its price-to-earnings ratio of 7.8x undercuts the UK market average of 16x, indicating potential value for investors. Recent earnings surged by 42.6%, surpassing industry growth of 20.7%, showcasing robust performance despite forecasts suggesting a yearly decline of 13.8% over the next three years. The company remains free cash flow positive and has high-quality earnings, though leadership changes are underway with Angela Lockwood stepping up as Senior Independent Director following Julia Unwin's retirement.

- Take a closer look at Mears Group's potential here in our health report.

Gain insights into Mears Group's historical performance by reviewing our past performance report.

Make It Happen

- Investigate our full lineup of 62 UK Undiscovered Gems With Strong Fundamentals right here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:JHD

James Halstead

Manufactures and supplies flooring products for commercial and domestic uses in the United Kingdom, rest of Europe, Scandinavia, Australasia, Asia, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives