- United Kingdom

- /

- Trade Distributors

- /

- LSE:DPLM

Is Now The Time To Put Diploma (LON:DPLM) On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Diploma (LON:DPLM). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Diploma with the means to add long-term value to shareholders.

Check out our latest analysis for Diploma

Diploma's Earnings Per Share Are Growing

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Impressively, Diploma has grown EPS by 20% per year, compound, in the last three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

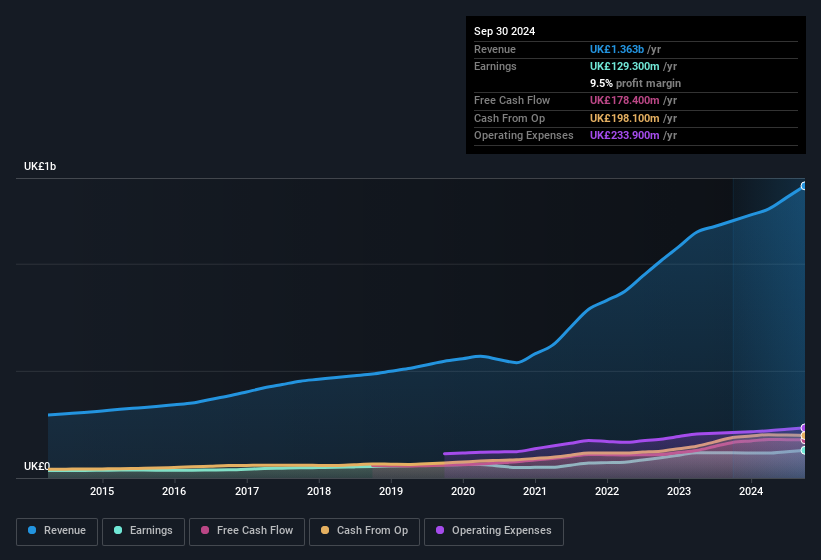

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Diploma achieved similar EBIT margins to last year, revenue grew by a solid 14% to UK£1.4b. That's a real positive.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Diploma's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Diploma Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Shareholders in Diploma will be more than happy to see insiders committing themselves to the company, spending UK£220k on shares in just twelve months. When you contrast that with the complete lack of sales, it's easy for shareholders to be brimming with joyful expectancy. We also note that it was the CFO & Executive Director, Christopher Davies, who made the biggest single acquisition, paying UK£168k for shares at about UK£42.80 each.

Along with the insider buying, another encouraging sign for Diploma is that insiders, as a group, have a considerable shareholding. To be specific, they have UK£11m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 0.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Should You Add Diploma To Your Watchlist?

For growth investors, Diploma's raw rate of earnings growth is a beacon in the night. Furthermore, company insiders have been adding to their significant stake in the company. So it's fair to say that this stock may well deserve a spot on your watchlist. It is worth noting though that we have found 1 warning sign for Diploma that you need to take into consideration.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of Diploma, you'll probably love this curated collection of companies in GB that have an attractive valuation alongside insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:DPLM

Diploma

Supplies specialized technical products and services in the United Kingdom, Europe, North America, and internationally.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives