- United Kingdom

- /

- Electrical

- /

- LSE:DIA

Should You Take Comfort From Insider Transactions At Dialight plc (LON:DIA)?

We've lost count of how many times insiders have accumulated shares in a company that goes on to improve markedly. On the other hand, we'd be remiss not to mention that insider sales have been known to precede tough periods for a business. So before you buy or sell Dialight plc (LON:DIA), you may well want to know whether insiders have been buying or selling.

What Is Insider Selling?

It is perfectly legal for company insiders, including board members, to buy and sell stock in a company. However, such insiders must disclose their trading activities, and not trade on inside information.

We don't think shareholders should simply follow insider transactions. But equally, we would consider it foolish to ignore insider transactions altogether. As Peter Lynch said, 'insiders might sell their shares for any number of reasons, but they buy them for only one: they think the price will rise.'

Check out our latest analysis for Dialight

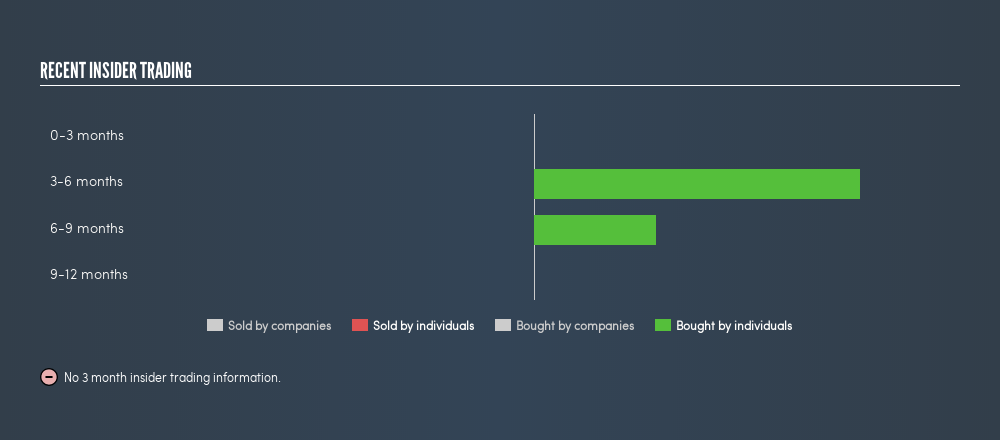

Dialight Insider Transactions Over The Last Year

Group CEO & Executive Director Martin Rapp made the biggest insider purchase in the last 12 months. That single transaction was for UK£61k worth of shares at a price of UK£3.08 each. Even though the purchase was made at a significantly lower price than the recent price (UK£4.67), we still think insider buying is a positive. But because it occurred at a lower valuation, it doesn't tell us much about whether insiders might find today's price attractive.

In the last twelve months insiders paid UK£103k for 27500 shares purchased. Dialight may have bought shares in the last year, but they didn't sell any. They paid about UK£3.75 on average. These transactions show that insiders have confidence to invest their own money in the stock, albeit at slightly below the recent price. The chart below shows insider transactions (by individuals) over the last year. If you click on the chart, you can see all the individual transactions, including the share price, individual, and the date!

Dialight is not the only stock that insiders are buying. For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Insider Ownership of Dialight

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. Our information indicates that Dialight insiders own about UK£617k worth of shares. This level of insider ownership is notably low, and not very encouraging.

So What Do The Dialight Insider Transactions Indicate?

The fact that there have been no Dialight insider transactions recently certainly doesn't bother us. But insiders have shown more of an appetite for the stock, over the last year. While we have no worries about the insider transactions, we'd be more comfortable if they owned more Dialight stock. Therefore, you should should definitely take a look at this FREEreport showing analyst forecasts for Dialight.

Of course Dialight may not be the best stock to buy. So you may wish to see this freecollection of high quality companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:DIA

Dialight

Primarily develops, manufactures, and supplies LED lighting solutions for use in hazardous and industrial applications in North America, Europe, the Middle East, Africa, and internationally.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives