- United Kingdom

- /

- Oil and Gas

- /

- AIM:HSP

Top UK Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As the UK market grapples with global economic uncertainties, particularly influenced by weak trade data from China, the FTSE 100 has experienced a downturn, highlighting vulnerabilities in sectors tied to international demand. In such volatile conditions, dividend stocks often attract investors seeking stability and income generation through regular payouts.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Pets at Home Group (LSE:PETS) | 5.70% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.15% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 3.38% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 7.54% | ★★★★★☆ |

| Man Group (LSE:EMG) | 6.03% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 4.58% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.87% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.66% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.02% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 6.58% | ★★★★★☆ |

Click here to see the full list of 63 stocks from our Top UK Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Hargreaves Services (AIM:HSP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hargreaves Services Plc offers environmental and industrial services across the United Kingdom, Europe, Hong Kong, and internationally with a market cap of £194.47 million.

Operations: Hargreaves Services Plc generates revenue primarily from its Services segment (£206.86 million) and Hargreaves Land (£7.04 million).

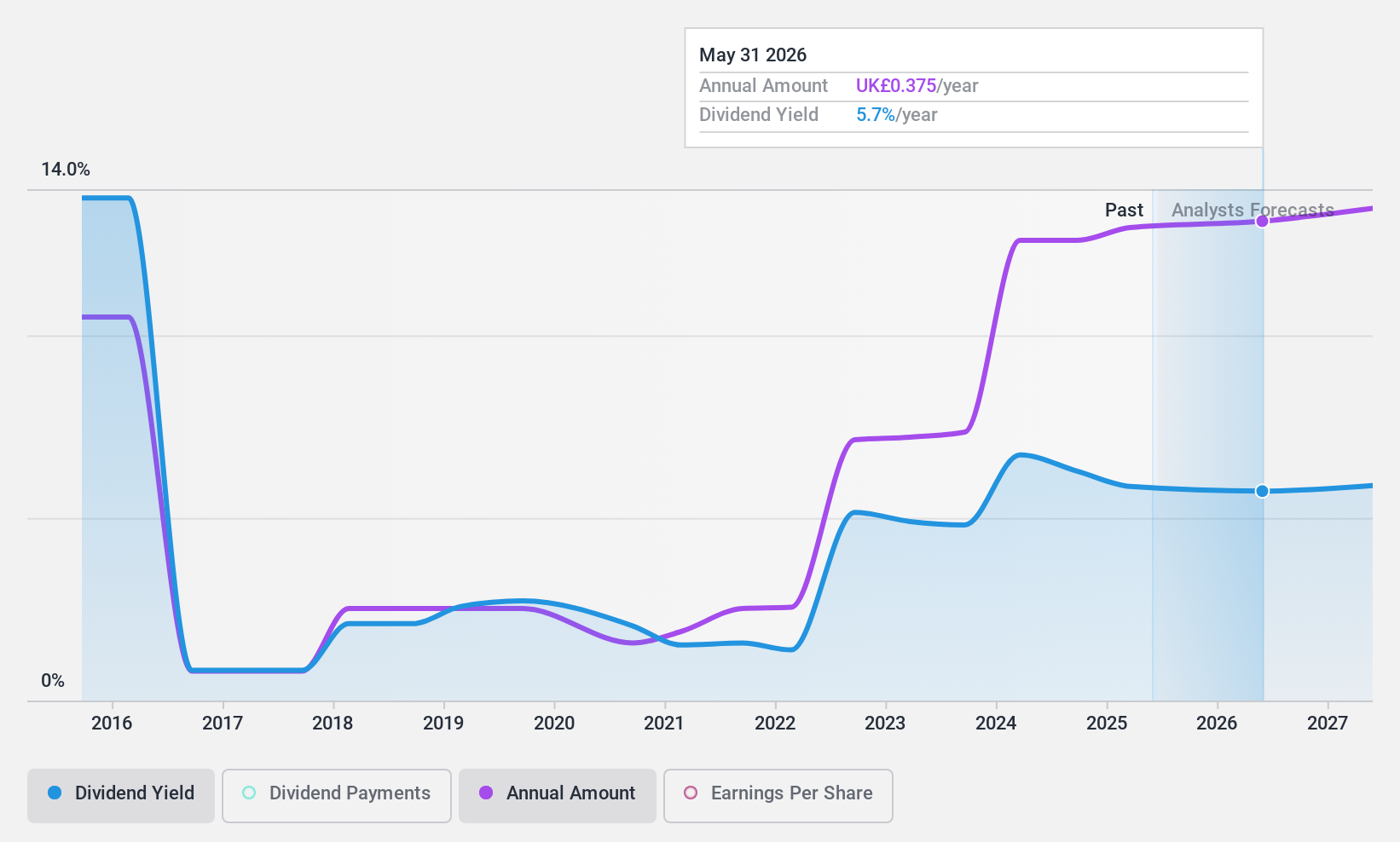

Dividend Yield: 6.1%

Hargreaves Services offers a dividend yield of 6.1%, placing it in the top 25% of UK dividend payers, yet its dividends are not well covered by earnings due to a high payout ratio of 94.8%. While cash flows cover dividends with a reasonable cash payout ratio of 58.3%, the payments have been volatile over the past decade. Recent executive changes aim to support strategic goals but may introduce transitional uncertainties affecting future stability and growth prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of Hargreaves Services.

- The valuation report we've compiled suggests that Hargreaves Services' current price could be inflated.

Somero Enterprises (AIM:SOM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Somero Enterprises, Inc. designs, assembles, remanufactures, sells, and distributes concrete leveling, contouring, and placing equipment in the United States and internationally with a market cap of £175.72 million.

Operations: Somero Enterprises generates its revenue primarily from the construction machinery and equipment segment, totaling $113.69 million.

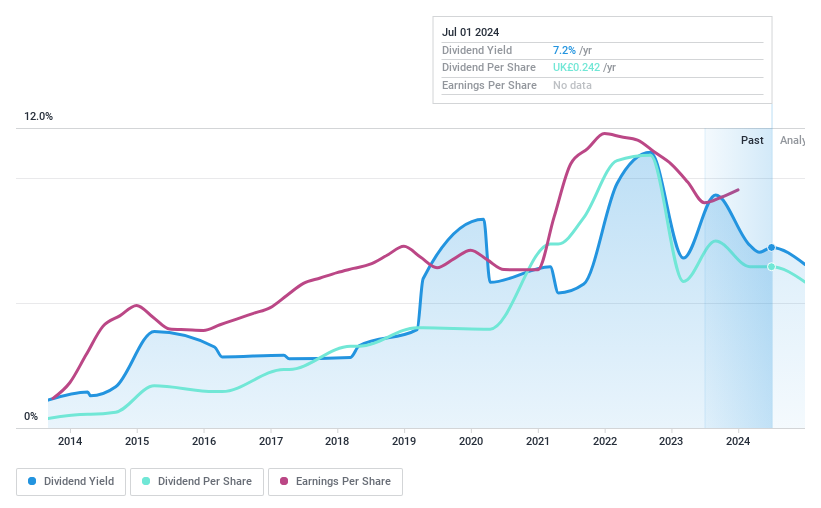

Dividend Yield: 7.6%

Somero Enterprises offers a dividend yield of 7.58%, ranking in the top 25% of UK dividend payers, but its dividends are not well covered by free cash flow due to a high cash payout ratio of 104.3%. Despite this, dividends are adequately covered by earnings with a payout ratio of 49.6%. However, past payments have been volatile and unreliable over the last decade, though there has been growth in dividend payments during this period.

- Get an in-depth perspective on Somero Enterprises' performance by reading our dividend report here.

- According our valuation report, there's an indication that Somero Enterprises' share price might be on the expensive side.

DCC (LSE:DCC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: DCC plc is involved in the sales, marketing, and distribution of carbon energy solutions globally, with a market cap of £5.40 billion.

Operations: DCC plc's revenue is primarily derived from three segments: DCC Energy (£13.91 billion), DCC Healthcare (£853.99 million), and DCC Technology (£4.80 billion).

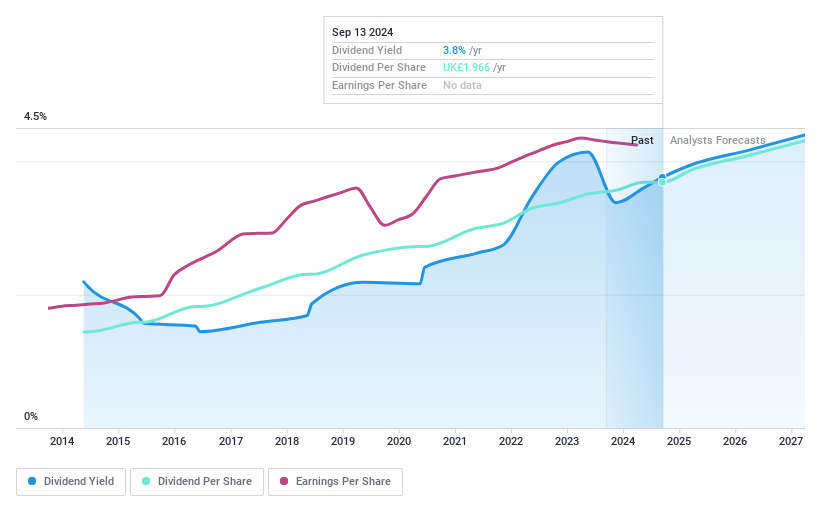

Dividend Yield: 3.7%

DCC plc has announced a 5% increase in its interim dividend to 66.19 pence per share, reflecting a decade of stable and growing dividends. Despite a relatively low yield of 3.66%, the dividend is well covered by earnings and cash flows, with payout ratios of 59.9% and 49.5%, respectively. Recent strategic shifts towards energy focus suggest potential for enhanced profitability, while maintaining disciplined capital allocation to support shareholder returns amidst divestments in healthcare and technology sectors.

- Dive into the specifics of DCC here with our thorough dividend report.

- Our expertly prepared valuation report DCC implies its share price may be lower than expected.

Make It Happen

- Click here to access our complete index of 63 Top UK Dividend Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hargreaves Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:HSP

Hargreaves Services

Provides environmental and industrial services in the United Kingdom, Europe, Hong Kong, and internationally.

Flawless balance sheet average dividend payer.