- United Kingdom

- /

- Capital Markets

- /

- LSE:CLIG

3 UK Dividend Stocks To Consider With Up To 7.9% Yield

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and pressures on commodity prices impacting major companies. In this environment, dividend stocks can offer a measure of stability and income potential for investors seeking to navigate these turbulent times.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.08% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 5.80% | ★★★★★☆ |

| RS Group (LSE:RS1) | 3.99% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.55% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.11% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.72% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.34% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.68% | ★★★★★☆ |

| IG Group Holdings (LSE:IGG) | 4.35% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.71% | ★★★★★★ |

Click here to see the full list of 49 stocks from our Top UK Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

City of London Investment Group (LSE:CLIG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £201.59 million.

Operations: City of London Investment Group PLC generates revenue primarily from its asset management segment, which amounts to $73.04 million.

Dividend Yield: 8%

City of London Investment Group's dividend, while in the top 25% of UK payers at 7.98%, is not well covered by earnings with a high payout ratio of 112.9%. Despite earnings growth to US$19.68 million for the year ended June 2025, its dividend stability remains questionable due to past volatility and sustainability concerns highlighted by an auditor's going concern doubt. The recommended final dividend holds steady at 22p per share, maintaining last year's total payout of 33p.

- Click here and access our complete dividend analysis report to understand the dynamics of City of London Investment Group.

- According our valuation report, there's an indication that City of London Investment Group's share price might be on the expensive side.

DCC (LSE:DCC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DCC plc is involved in the sales, marketing, and distribution of carbon energy solutions across various regions including the Republic of Ireland, the United Kingdom, France, and the United States, with a market cap of approximately £4.62 billion.

Operations: DCC plc generates revenue primarily through its DCC Energy segment, which accounts for £13.37 billion, and its DCC Technology segment, contributing £4.64 billion.

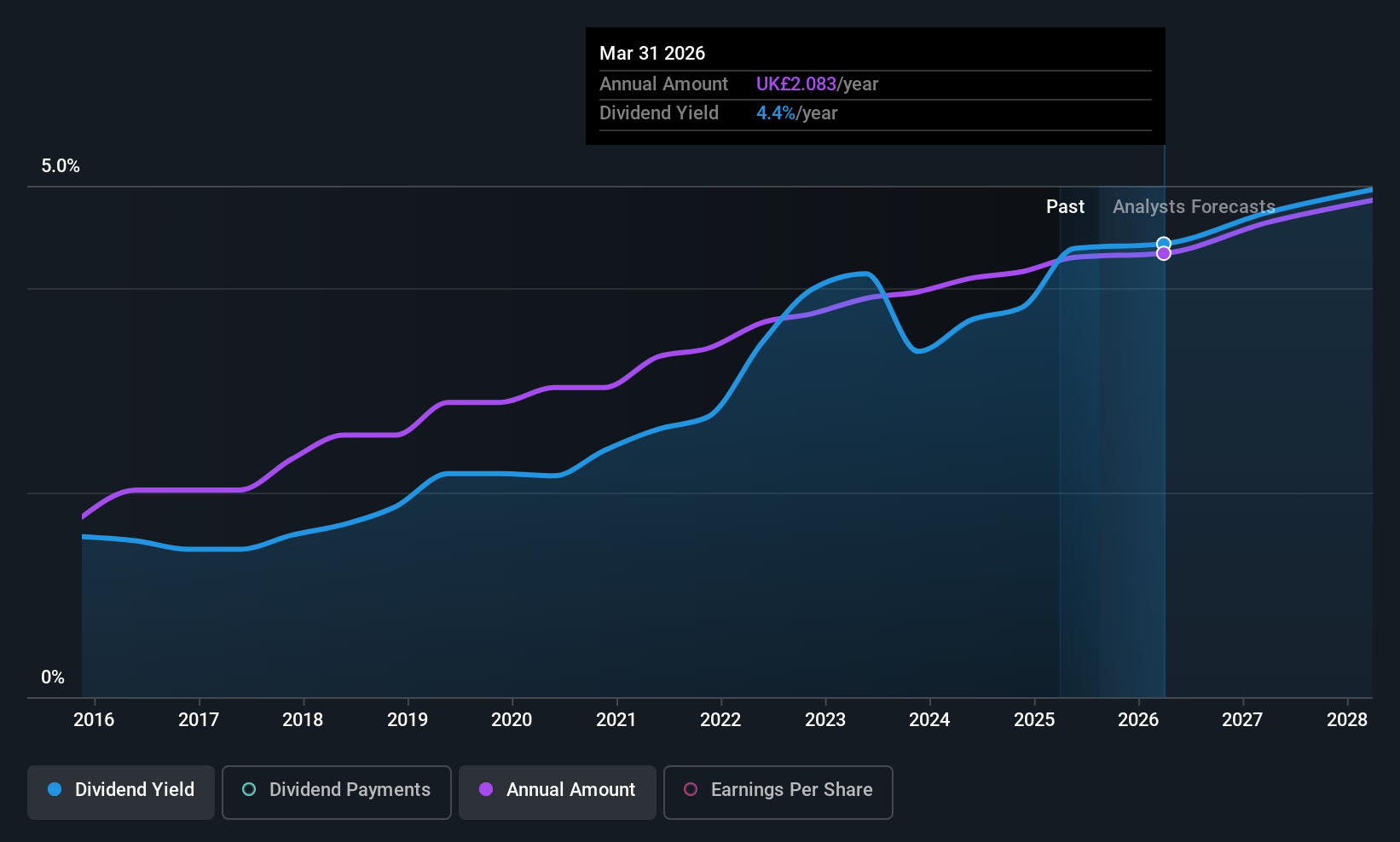

Dividend Yield: 4.3%

DCC's dividend, at 4.33%, lags behind the top UK payers and is not well covered by earnings, with a high payout ratio of 98.1%. However, dividends have grown steadily over the past decade with minimal volatility. Despite trading at a significant discount to estimated fair value and having stable cash flow coverage for dividends, concerns about sustainability remain due to large one-off items affecting earnings stability and strategic guidance indicating profit growth ahead.

- Take a closer look at DCC's potential here in our dividend report.

- Upon reviewing our latest valuation report, DCC's share price might be too pessimistic.

ME Group International (LSE:MEGP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc operates, sells, and services a range of instant-service equipment in the United Kingdom with a market cap of £706.34 million.

Operations: ME Group International plc generates revenue of £311.32 million from its Personal Services segment in the UK.

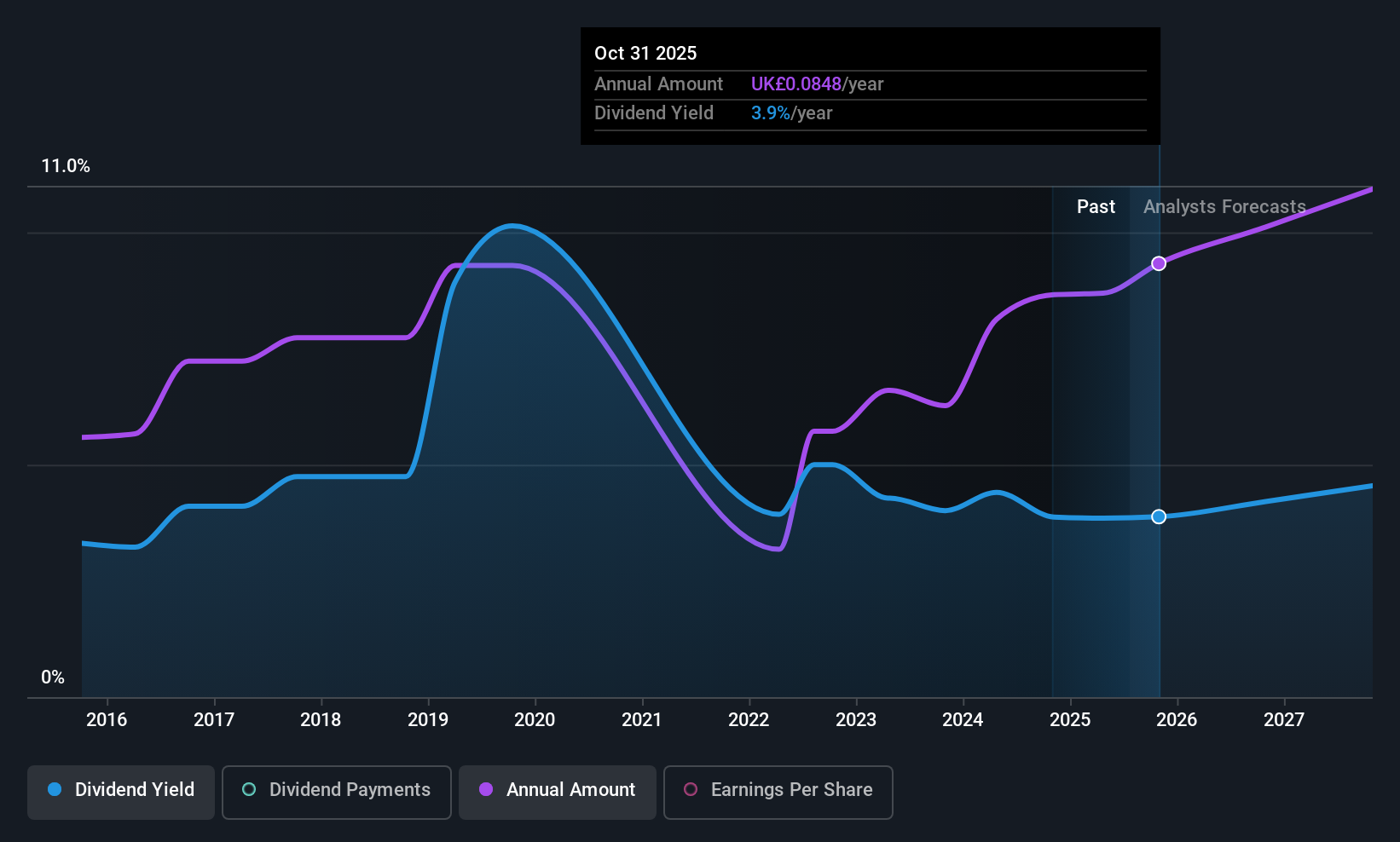

Dividend Yield: 4.2%

ME Group International's recent interim dividend increase to 3.85 pence per share reflects a positive move, returning £14.5 million to shareholders. However, its dividend yield of 4.22% is below the UK market's top payers and has been unreliable over the past decade due to volatility. Despite this, dividends are covered by earnings with a payout ratio of 54.8% and cash flows at an 82.8% ratio, suggesting sustainability concerns may be mitigated by current financial health indicators.

- Delve into the full analysis dividend report here for a deeper understanding of ME Group International.

- Our valuation report unveils the possibility ME Group International's shares may be trading at a discount.

Key Takeaways

- Reveal the 49 hidden gems among our Top UK Dividend Stocks screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CLIG

City of London Investment Group

City of London Investment Group PLC is a publically owned investment manager.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives