- United Kingdom

- /

- Consumer Services

- /

- LSE:MEGP

3 UK Dividend Stocks Offering Up To 8.9% Yield

Reviewed by Simply Wall St

The United Kingdom's stock market, particularly the FTSE 100, has recently experienced some turbulence due to weak trade data from China and declining commodity prices, impacting companies with significant exposure to the Chinese economy. In such uncertain times, dividend stocks can be attractive for investors seeking steady income streams, as they often provide a cushion against market volatility while offering potential long-term growth through reinvested dividends.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Treatt (LSE:TET) | 3.52% | ★★★★★☆ |

| Seplat Energy (LSE:SEPL) | 5.72% | ★★★★★☆ |

| RS Group (LSE:RS1) | 4.03% | ★★★★★☆ |

| Pets at Home Group (LSE:PETS) | 6.02% | ★★★★★★ |

| OSB Group (LSE:OSB) | 6.26% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.64% | ★★★★★☆ |

| MONY Group (LSE:MONY) | 6.55% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.36% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 5.61% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.67% | ★★★★★★ |

Click here to see the full list of 51 stocks from our Top UK Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

City of London Investment Group (LSE:CLIG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £178.59 million.

Operations: City of London Investment Group PLC generates revenue primarily through its Asset Management segment, which amounted to $73.04 million.

Dividend Yield: 9%

City of London Investment Group has seen its dividend payments increase over the past decade, yet they remain volatile and unreliable. Despite a high dividend yield of 8.95%, which ranks in the top 25% in the UK, sustainability is a concern with a payout ratio of 112.9%, indicating dividends are not well covered by earnings or cash flows. Recent earnings growth to US$19.68 million reflects some financial improvement, but auditor concerns about its going concern status add risk for investors seeking stable dividends.

- Get an in-depth perspective on City of London Investment Group's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of City of London Investment Group shares in the market.

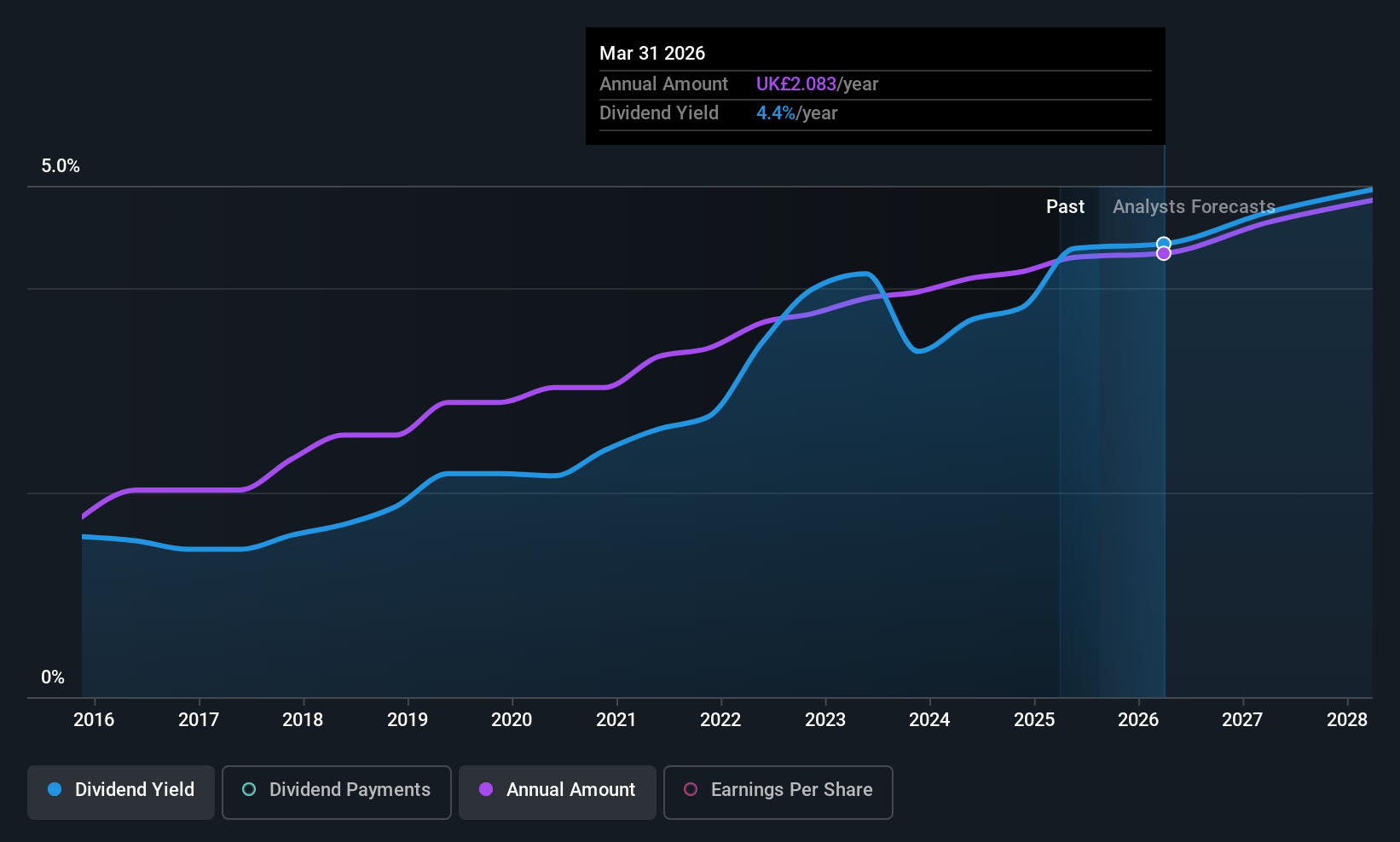

DCC (LSE:DCC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DCC plc is involved in the sales, marketing, and distribution of carbon energy solutions across Ireland, the UK, France, the US, and other international markets with a market cap of £4.53 billion.

Operations: DCC plc generates revenue through its primary segments: DCC Energy, which contributes £13.37 billion, and DCC Technology, which accounts for £4.64 billion.

Dividend Yield: 4.4%

DCC's dividend payments, while stable and reliable over the past decade, are not well covered by earnings due to a high payout ratio of 98.1%. However, dividends are supported by cash flows with a reasonable cash payout ratio of 54.4%. The current dividend yield of 4.36% is below the top tier in the UK market. Recently, DCC completed a £100 million share buyback, potentially enhancing shareholder value through reduced share count and improved per-share metrics.

- Unlock comprehensive insights into our analysis of DCC stock in this dividend report.

- Our comprehensive valuation report raises the possibility that DCC is priced lower than what may be justified by its financials.

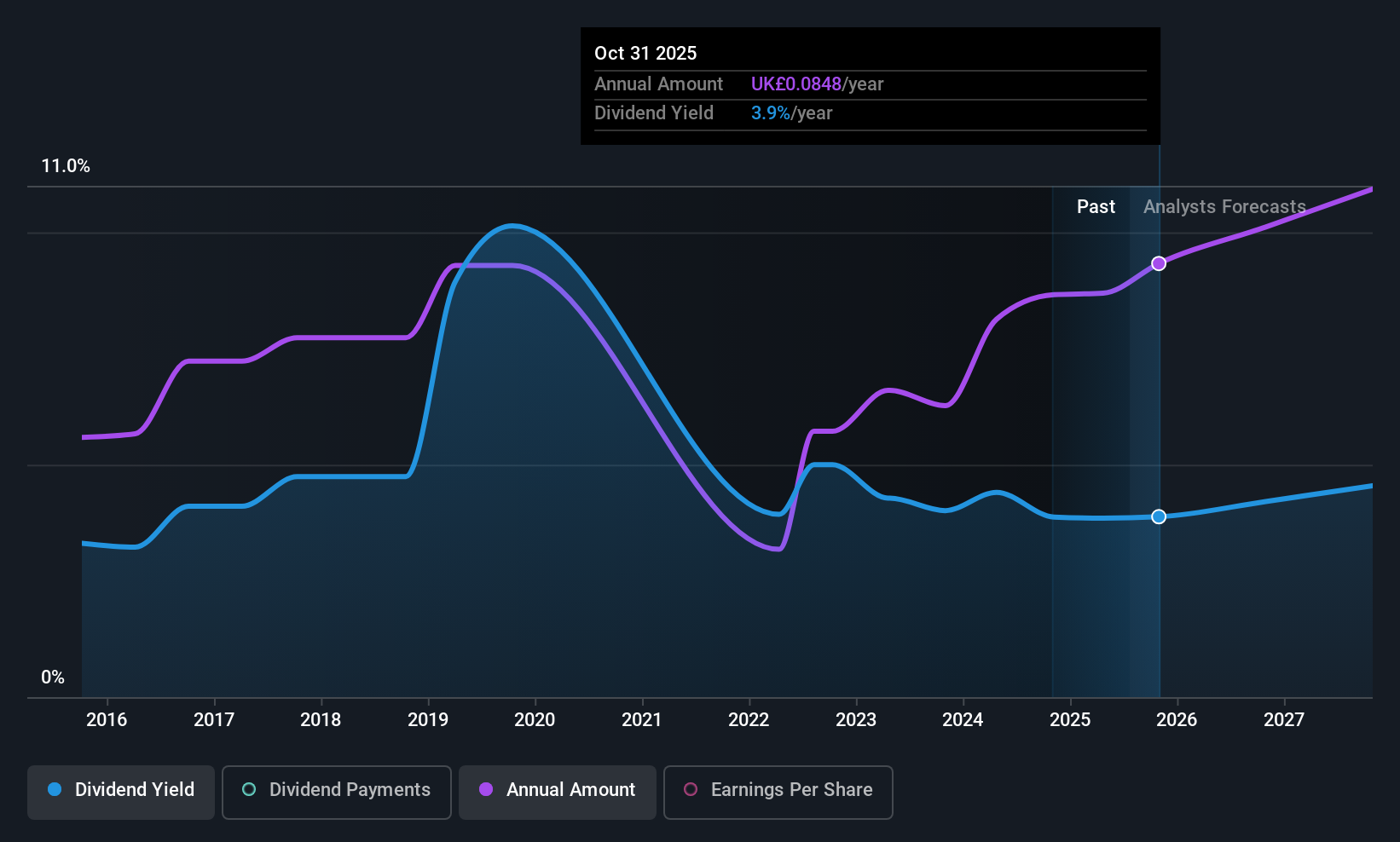

ME Group International (LSE:MEGP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ME Group International plc operates, sells, and services a variety of instant-service equipment in the United Kingdom with a market cap of £695.77 million.

Operations: ME Group International plc generates revenue of £311.32 million from its Personal Services segment.

Dividend Yield: 4.3%

ME Group International's dividend payments have been volatile over the past decade but are covered by earnings with a payout ratio of 54.8%. The cash payout ratio stands at 82.8%, indicating dividends are also backed by cash flows. Despite trading below estimated fair value, its dividend yield of 4.29% is lower than the top UK market payers. Recently, MEGP increased its interim dividend by 11.6%, reflecting improved financial performance and shareholder returns.

- Click here and access our complete dividend analysis report to understand the dynamics of ME Group International.

- Our valuation report unveils the possibility ME Group International's shares may be trading at a discount.

Next Steps

- Navigate through the entire inventory of 51 Top UK Dividend Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MEGP

ME Group International

Operates, sells, and services a range of instant-service equipment in the United Kingdom.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives