- United Kingdom

- /

- Construction

- /

- LSE:CTO

If You Like EPS Growth Then Check Out TClarke (LON:CTO) Before It's Too Late

Like a puppy chasing its tail, some new investors often chase 'the next big thing', even if that means buying 'story stocks' without revenue, let alone profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.'

So if you're like me, you might be more interested in profitable, growing companies, like TClarke (LON:CTO). While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for TClarke

TClarke's Earnings Per Share Are Growing.

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS). It's no surprise, then, that I like to invest in companies with EPS growth. Impressively, TClarke has grown EPS by 30% per year, compound, in the last three years. As a general rule, we'd say that if a company can keep up that sort of growth, shareholders will be smiling.

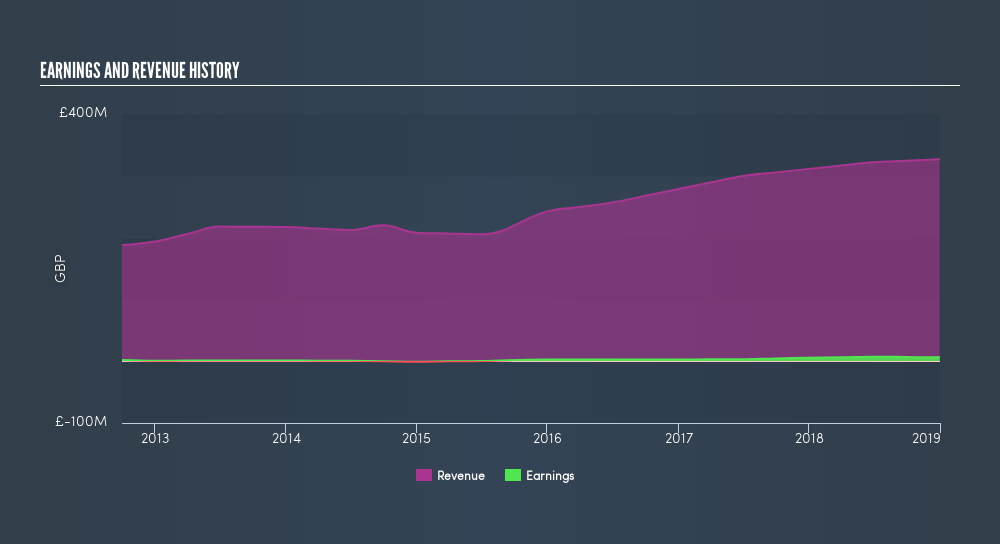

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. TClarke maintained stable EBIT margins over the last year, all while growing revenue 5.0% to UK£327m. That's progress.

Since TClarke is no giant, with a market capitalization of UK£50m, so you should definitely check its cash and debt before getting too excited about its prospects.

Are TClarke Insiders Aligned With All Shareholders?

Like that fresh smell in the air when the rains are coming, insider buying fills me with optimistic anticipation. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

Over the last 12 months TClarke insiders spent UK£42k more buying shares than they received from selling them. On balance, that's a good sign. Zooming in, we can see that the biggest insider purchase was by CEO, MD of London Operations Mark Lawrence for UK£18k worth of shares, at about UK£0.89 per share.

Does TClarke Deserve A Spot On Your Watchlist?

You can't deny that TClarke has grown its earnings per share at a very impressive rate. That's attractive. Not only is that growth rate rather juicy, but the insider buying makes my mouth water. To put it succinctly; TClarke is a strong candidate for your watchlist. Now, you could try to make up your mind on TClarke by focusing on just these factors, or you could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of TClarke, you'll probably love this free list of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:CTO

TClarke

Engages in the design, installation, integration, and maintenance of the mechanical and electrical systems and technologies in the United Kingdom.

High growth potential with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives