- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:BA.

How Pentagon’s Missile Push Shapes BAE Systems’ Soaring 2025 Valuation

Reviewed by Bailey Pemberton

If you are standing on the sidelines wondering whether to buy, hold, or cash in on BAE Systems, you are not alone. The defense giant's stock has had an impressive run this year, with a year-to-date return of 74.8% and a five-year climb of almost 383%. Even in just the last month, the stock has surged 13.4%, suggesting that investors are responding to more than just routine headlines.

Recent news has only stoked the fire. The Pentagon is pushing missile makers to ramp up production in light of mounting global tensions, and BAE Systems is front and center in these conversations. Meanwhile, big meetings among U.S. generals and fresh regulatory changes on military exports are grabbing attention for the whole sector. It is no wonder that, despite a slight dip of 1.5% in the last week, the long-term momentum remains clearly upward.

But with these gains, the real question is valuation: has the market already priced in all the good news, or is there more room for growth? According to our valuation framework, BAE Systems scores a 3 out of 6, indicating the company passes half of the major undervaluation checks we track. This is a solid position, but it also means there is more nuance to unpack beyond just the headline numbers.

Up next, we will break down how BAE Systems stacks up against different valuation measures, and hint at a smarter, more holistic way to think about what the company is truly worth.

Why BAE Systems is lagging behind its peers

Approach 1: BAE Systems Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model forecasts a company's future cash flows and then discounts them back to today's value to estimate what the company is truly worth right now. In BAE Systems' case, analysts start with the latest reported Free Cash Flow (FCF), which stands at £2.14 billion, and forecast steady growth over the next decade.

According to analyst estimates and extended projections, BAE Systems' annual FCF is expected to climb to approximately £3.35 billion by 2029. These cash flows, projected further out to 2035, suggest a gradual and consistent increase, driven by both analyst forecasts in the near term and model extrapolation in later years.

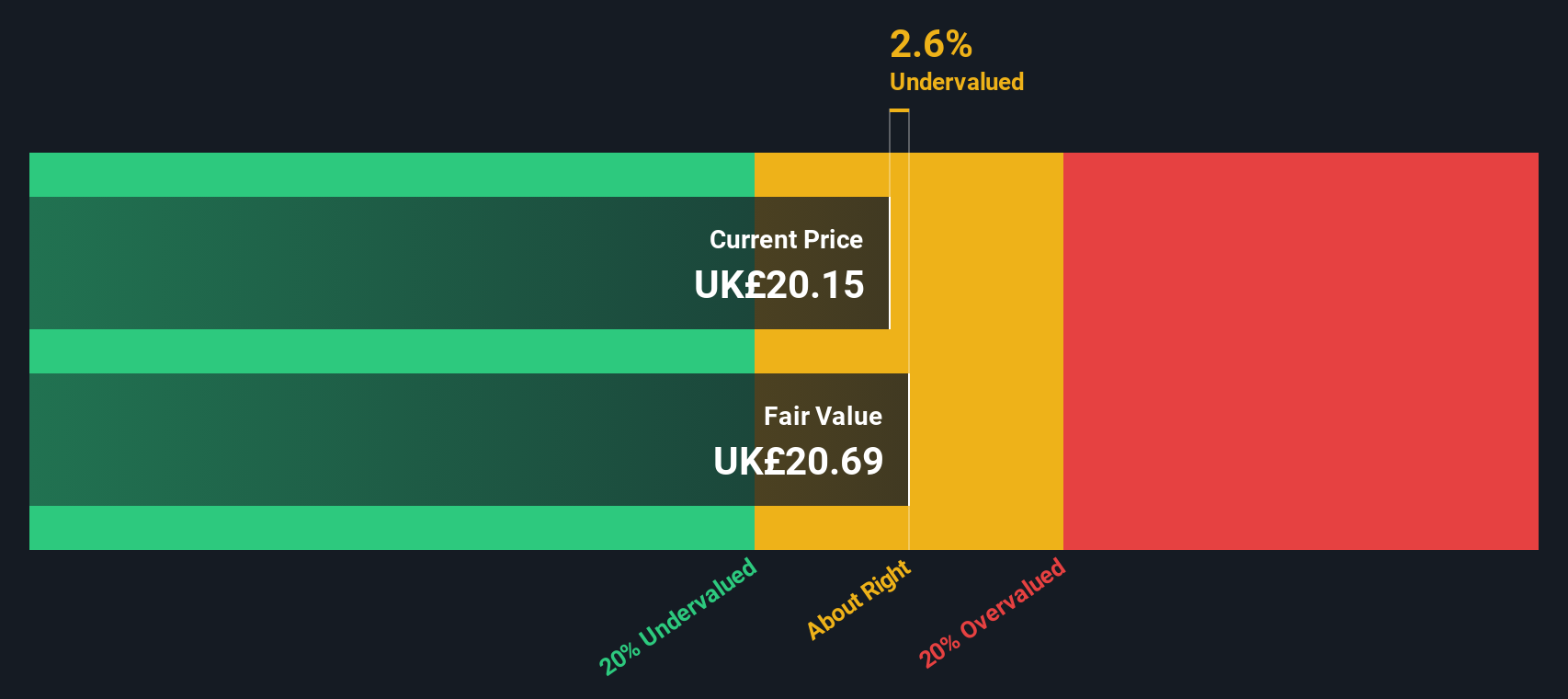

By bringing these projected cash flows back to their present value, the DCF model arrives at an intrinsic fair value of £20.81 per share. The current share price is trading just 3.1% below this intrinsic value, indicating that BAE Systems stock is currently priced about right based on its long-term cash-generating potential.

Result: ABOUT RIGHT

Simply Wall St performs a valuation analysis on every stock in the world every day (check out BAE Systems's valuation analysis). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes.

Approach 2: BAE Systems Price vs Earnings

The Price-to-Earnings (PE) ratio is often the go-to metric for valuing profitable companies like BAE Systems because it compares the current share price to its per-share earnings, providing a snapshot of how much investors are willing to pay for a pound of profit. It is particularly useful here since BAE Systems has strong, consistent earnings and operates in an industry where profitability is a key focus for investors.

What constitutes a “fair” PE ratio depends on factors such as how quickly a company is expected to grow, the risks it faces, and how stable its earnings are. Generally, faster-growing or lower-risk businesses justify higher PE multiples, while slower or riskier companies trade at lower ones.

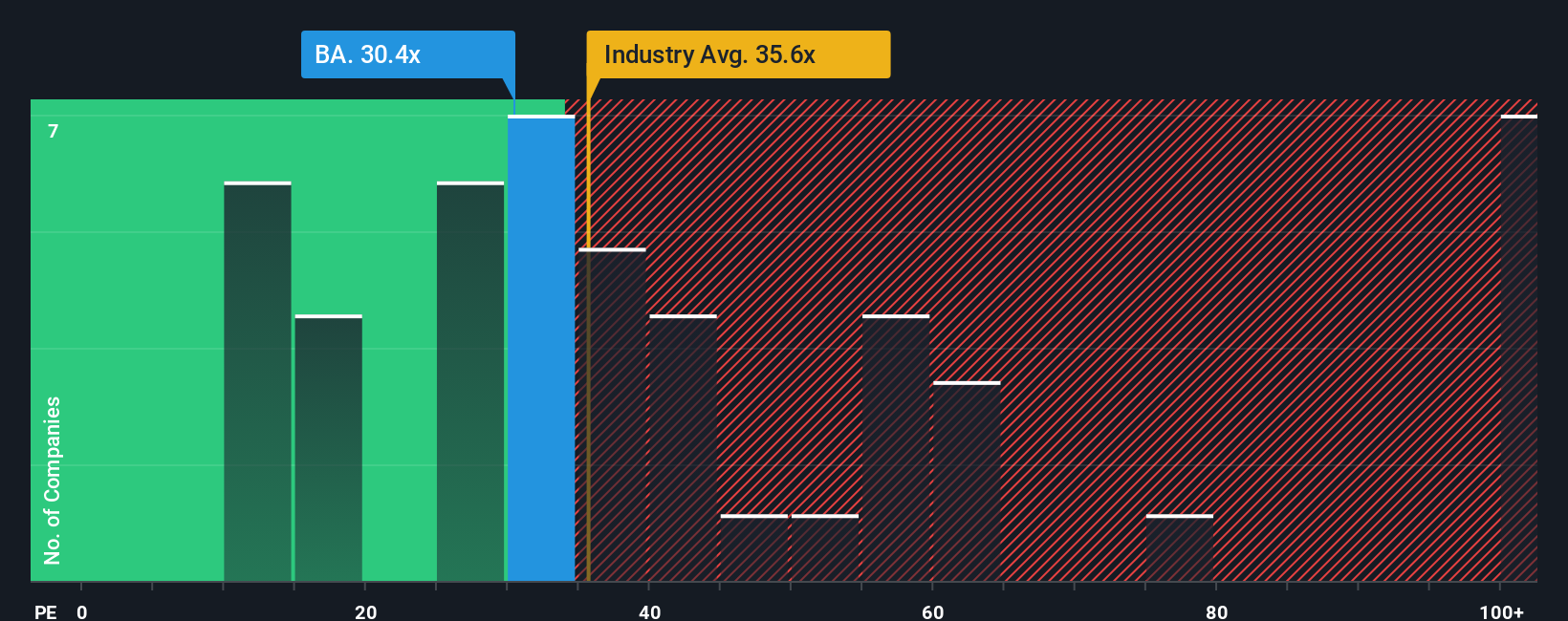

BAE Systems is currently trading at a PE ratio of 30.4x. This is well below the Aerospace & Defense industry average of 47.4x but above the average of its direct peers, which is 24.7x. Simply Wall St's proprietary “Fair Ratio” for BAE Systems, which is 32.4x, is designed to provide an objective benchmark by considering not only industry and peer comparisons but also the company’s growth outlook, margins, scale, and risk factors. This is a more nuanced tool than a simple industry average, as it tailors expectations to what is appropriate for BAE specifically.

With a current PE ratio just a touch below the Fair Ratio, BAE Systems shares appear to be priced about right on this measure too.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your BAE Systems Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives, a smarter, more dynamic approach to investing that connects the company's story with its financial forecast and fair value.

A Narrative in Simply Wall St's platform is an easy-to-build perspective that lets you put your reasoning behind the numbers, linking your view of BAE Systems’ future (like revenue and margin forecasts) to a fair value and, ultimately, a buy or sell decision. Narratives empower investors to go beyond static models, allowing you to quickly compare your own fair value with the current price and clearly see the reasoning behind your stance.

This tool is available to everyone within the Community page, used by millions, and is continuously updated as new events such as earnings announcements, industry news, or regulatory updates impact the company, so your Narrative always reflects the latest information.

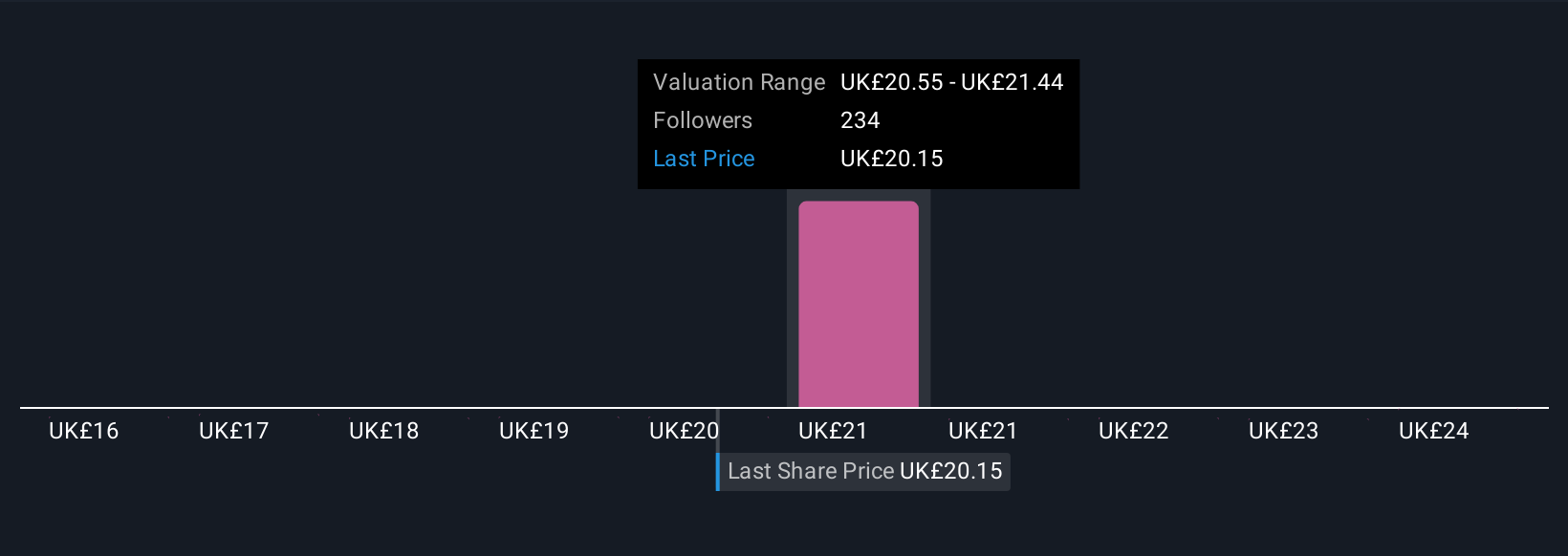

For BAE Systems, investors can see that some Narratives expect a bullish fair value as high as £25.00 per share, anticipating strong defense spending and innovation, while others are more cautious, forecasting just £13.00 per share due to risks like contract concentration and supply chain pressure. This demonstrates how Narratives help you make decisions with both context and confidence.

Do you think there's more to the story for BAE Systems? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BAE Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BA.

BAE Systems

Provides defense, aerospace, and security solutions in the United States, the United Kingdom, the Middle East, Australia, Japan, Europe, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives