Did you know there are some financial metrics that can provide clues of a potential multi-bagger? In a perfect world, we'd like to see a company investing more capital into its business and ideally the returns earned from that capital are also increasing. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. However, after briefly looking over the numbers, we don't think Avation (LON:AVAP) has the makings of a multi-bagger going forward, but let's have a look at why that may be.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. Analysts use this formula to calculate it for Avation:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.064 = US$57m ÷ (US$1.4b - US$467m) (Based on the trailing twelve months to December 2020).

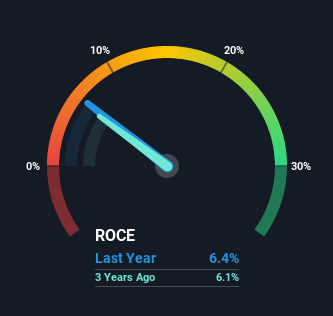

Therefore, Avation has an ROCE of 6.4%. In absolute terms, that's a low return and it also under-performs the Trade Distributors industry average of 12%.

Check out our latest analysis for Avation

In the above chart we have measured Avation's prior ROCE against its prior performance, but the future is arguably more important. If you'd like, you can check out the forecasts from the analysts covering Avation here for free.

What Does the ROCE Trend For Avation Tell Us?

There are better returns on capital out there than what we're seeing at Avation. The company has consistently earned 6.4% for the last five years, and the capital employed within the business has risen 55% in that time. Given the company has increased the amount of capital employed, it appears the investments that have been made simply don't provide a high return on capital.

Another point to note, we noticed the company has increased current liabilities over the last five years. This is intriguing because if current liabilities hadn't increased to 35% of total assets, this reported ROCE would probably be less than6.4% because total capital employed would be higher.The 6.4% ROCE could be even lower if current liabilities weren't 35% of total assets, because the the formula would show a larger base of total capital employed. So while current liabilities isn't high right now, keep an eye out in case it increases further, because this can introduce some elements of risk.

The Bottom Line

As we've seen above, Avation's returns on capital haven't increased but it is reinvesting in the business. And investors appear hesitant that the trends will pick up because the stock has fallen 15% in the last five years. In any case, the stock doesn't have these traits of a multi-bagger discussed above, so if that's what you're looking for, we think you'd have more luck elsewhere.

Avation does have some risks, we noticed 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

For those who like to invest in solid companies, check out this free list of companies with solid balance sheets and high returns on equity.

If you decide to trade Avation, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About LSE:AVAP

Avation

Avation PLC, together with its subsidiaries, leases commercial passenger aircraft to airlines in Europe and the Asia-Pacific.

Fair value with imperfect balance sheet.

Market Insights

Community Narratives