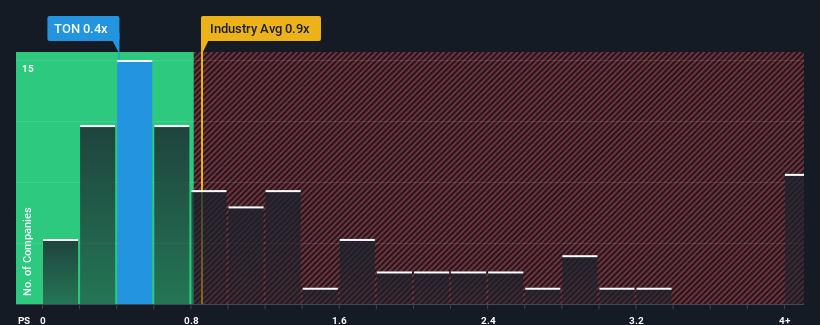

With a median price-to-sales (or "P/S") ratio of close to 0.7x in the Building industry in the United Kingdom, you could be forgiven for feeling indifferent about Titon Holdings Plc's (LON:TON) P/S ratio of 0.4x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Titon Holdings

What Does Titon Holdings' Recent Performance Look Like?

Recent times haven't been great for Titon Holdings as its revenue has been falling quicker than most other companies. Perhaps the market is expecting future revenue performance to begin matching the rest of the industry, which has kept the P/S from declining. You'd much rather the company improve its revenue if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Titon Holdings.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Titon Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 15% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 8.3% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Turning to the outlook, the next year should generate growth of 4.9% as estimated by the only analyst watching the company. With the industry predicted to deliver 3.0% growth , the company is positioned for a comparable revenue result.

In light of this, it's understandable that Titon Holdings' P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Key Takeaway

Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

A Titon Holdings' P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Building industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. If all things remain constant, the possibility of a drastic share price movement remains fairly remote.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Titon Holdings that you should be aware of.

If these risks are making you reconsider your opinion on Titon Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Titon Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TON

Titon Holdings

Designs, manufactures, and markets ventilation products, and door and window fittings in the United Kingdom, South Korea, the United States, and Europe.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives