- United Kingdom

- /

- Machinery

- /

- AIM:RNO

The Market Doesn't Like What It Sees From Renold plc's (LON:RNO) Earnings Yet As Shares Tumble 26%

Renold plc (LON:RNO) shares have had a horrible month, losing 26% after a relatively good period beforehand. Longer-term shareholders would now have taken a real hit with the stock declining 9.3% in the last year.

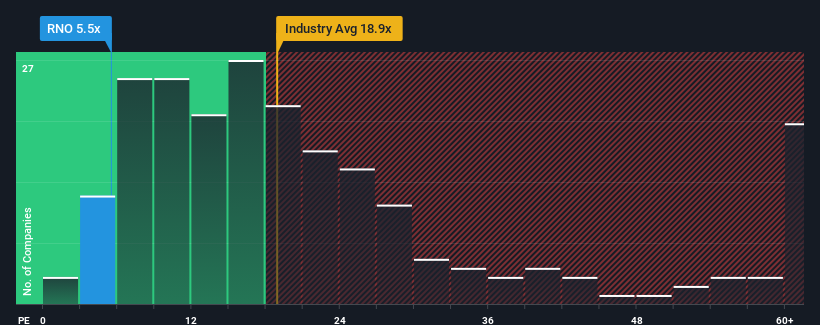

After such a large drop in price, given about half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 16x, you may consider Renold as a highly attractive investment with its 5.5x P/E ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/E.

Renold hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Check out our latest analysis for Renold

How Is Renold's Growth Trending?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Renold's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 7.0%. Even so, admirably EPS has lifted 98% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Looking ahead now, EPS is anticipated to climb by 7.0% each year during the coming three years according to the three analysts following the company. With the market predicted to deliver 13% growth each year, the company is positioned for a weaker earnings result.

With this information, we can see why Renold is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Renold's P/E

Having almost fallen off a cliff, Renold's share price has pulled its P/E way down as well. It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

As we suspected, our examination of Renold's analyst forecasts revealed that its inferior earnings outlook is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

We don't want to rain on the parade too much, but we did also find 1 warning sign for Renold that you need to be mindful of.

If you're unsure about the strength of Renold's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:RNO

Renold

Engages in the manufacture and sale of high precision engineered power transmission products and solutions in the United Kingdom, rest of Europe, the United States, Canada, Australasia, China, India, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives