- United Kingdom

- /

- Machinery

- /

- AIM:RNO

Renold plc's (LON:RNO) CEO Will Probably Find It Hard To See A Huge Raise This Year

Shareholders of Renold plc (LON:RNO) will have been dismayed by the negative share price return over the last three years. However, what is unusual is that EPS growth has been positive, suggesting that the share price has diverged from fundamentals. These are some of the concerns that shareholders may want to bring up at the next AGM held on 23 August 2021. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We think shareholders might be reluctant to increase compensation for the CEO at the moment, according to our analysis below.

See our latest analysis for Renold

How Does Total Compensation For Rob Purcell Compare With Other Companies In The Industry?

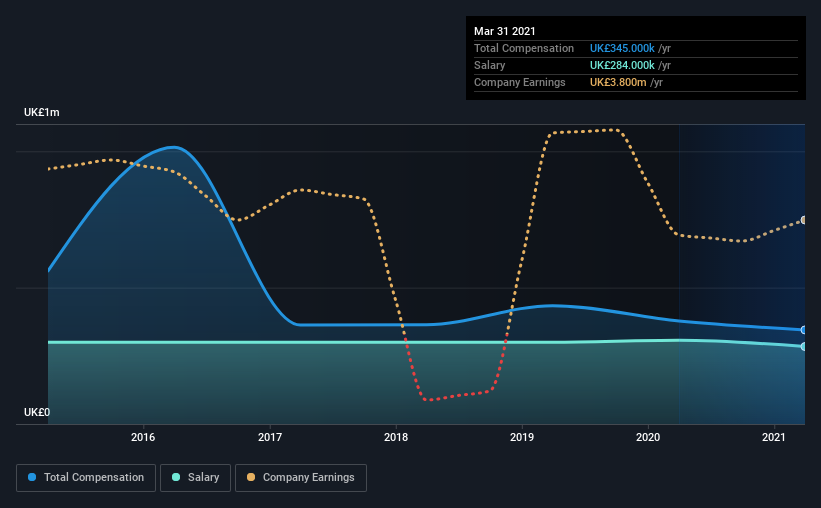

Our data indicates that Renold plc has a market capitalization of UK£44m, and total annual CEO compensation was reported as UK£345k for the year to March 2021. We note that's a decrease of 8.7% compared to last year. Notably, the salary which is UK£284.0k, represents most of the total compensation being paid.

In comparison with other companies in the industry with market capitalizations under UK£144m, the reported median total CEO compensation was UK£325k. This suggests that Renold remunerates its CEO largely in line with the industry average. Moreover, Rob Purcell also holds UK£931k worth of Renold stock directly under their own name.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | UK£284k | UK£307k | 82% |

| Other | UK£61k | UK£71k | 18% |

| Total Compensation | UK£345k | UK£378k | 100% |

Talking in terms of the industry, salary represented approximately 63% of total compensation out of all the companies we analyzed, while other remuneration made up 37% of the pie. Renold pays out 82% of remuneration in the form of a salary, significantly higher than the industry average. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Renold plc's Growth

Renold plc's earnings per share (EPS) grew 44% per year over the last three years. Its revenue is down 13% over the previous year.

Shareholders would be glad to know that the company has improved itself over the last few years. It's always a tough situation when revenues are not growing, but ultimately profits are more important. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Renold plc Been A Good Investment?

Few Renold plc shareholders would feel satisfied with the return of -42% over three years. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

The fact that shareholders are sitting on a loss on the value of their shares in the past few years is certainly disconcerting. The fact that the stock price hasn't grown along with earnings may indicate that other issues may be affecting that stock. Shareholders would probably be keen to find out what are the other factors could be weighing down the stock. These concerns should be addressed at the upcoming AGM, where shareholders can question the board and evaluate if their judgement and decision making is still in line with their expectations.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. We did our research and identified 5 warning signs (and 2 which are concerning) in Renold we think you should know about.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

When trading Renold or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:RNO

Renold

Engages in the manufacture and sale of high precision engineered products and solutions in the United Kingdom, rest of Europe, the United States, Canada, Australasia, China, India, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives