- United Kingdom

- /

- Machinery

- /

- AIM:MCON

Hargreaves Services And Two More Top UK Dividend Stocks

Reviewed by Simply Wall St

As the FTSE 100 appears poised to break its three-month winning streak amidst a backdrop of regulatory scrutiny and political uncertainty, investors are navigating a complex landscape in the United Kingdom's financial markets. In such times, identifying stocks with robust dividend yields can offer a semblance of stability and potential for steady income, making them an attractive consideration for those looking to mitigate broader market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Record (LSE:REC) | 8.15% | ★★★★★★ |

| Keller Group (LSE:KLR) | 3.60% | ★★★★★☆ |

| Impax Asset Management Group (AIM:IPX) | 7.23% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.24% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.86% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.83% | ★★★★★☆ |

| Rio Tinto Group (LSE:RIO) | 6.45% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.86% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.38% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.70% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Hargreaves Services (AIM:HSP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hargreaves Services Plc, operating in the United Kingdom, Southeast Asia, and South Africa, offers environmental and industrial services with a market capitalization of approximately £176.17 million.

Operations: Hargreaves Services Plc generates £205.29 million from environmental and industrial services and £2.58 million from its Hargreaves Land division.

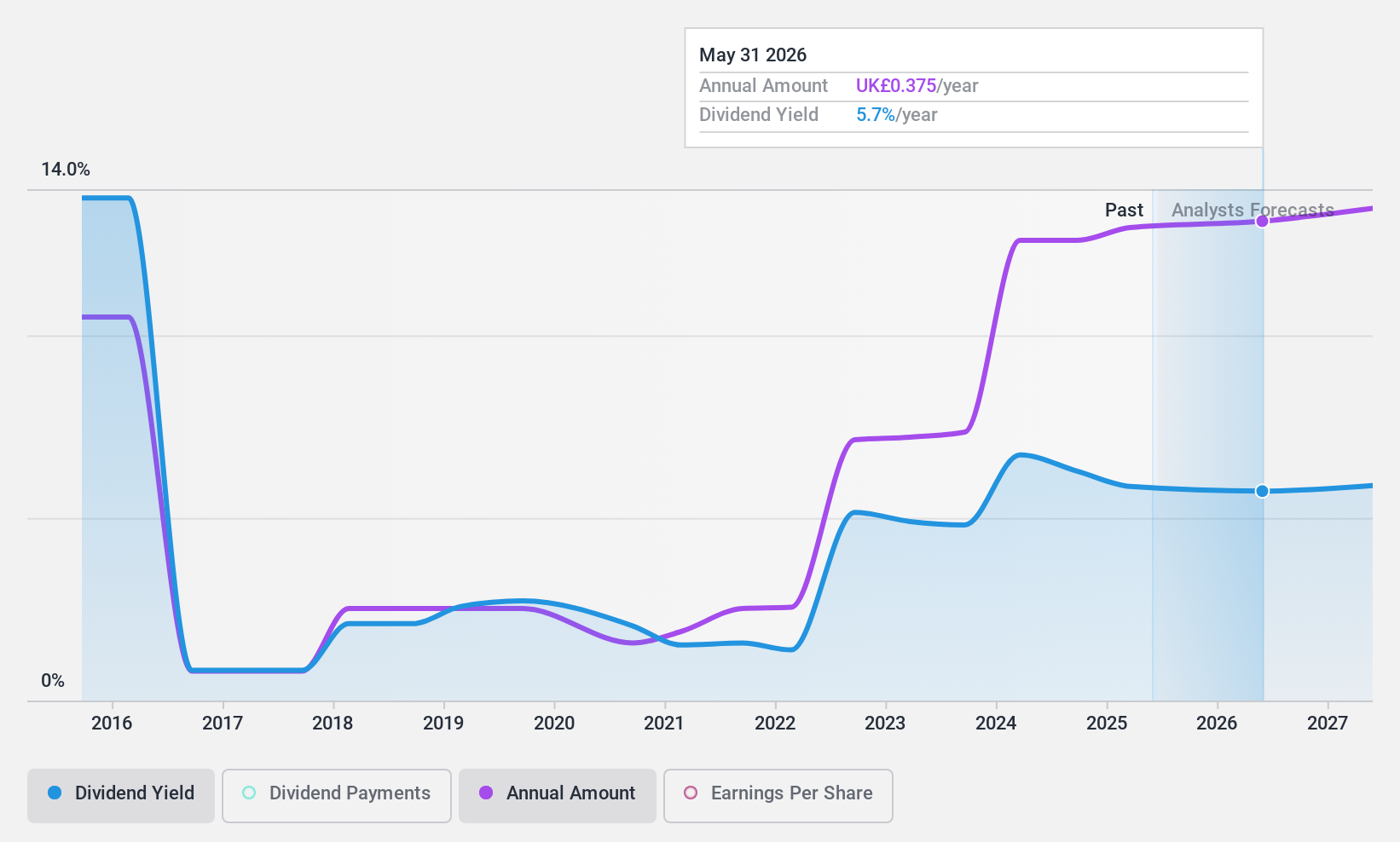

Dividend Yield: 6.7%

Hargreaves Services exhibits a mixed dividend profile. While the stock maintains a reasonable payout ratio of 61.8% and cash payout ratio of 53.8%, ensuring dividends are covered by earnings and cash flows, its dividend history has shown volatility over the past decade. Despite this, dividends have grown during this period. The company's profit margins have declined from last year's 18.2% to 6.2%. Additionally, it trades at a P/E ratio of 13.9x, below the UK market average of 16.3x.

- Navigate through the intricacies of Hargreaves Services with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Hargreaves Services' current price could be inflated.

Mincon Group (AIM:MCON)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mincon Group plc specializes in designing, manufacturing, selling, and servicing rock drilling tools and associated products across regions including Ireland, the Americas, Australasia, Europe, the Middle East, and Africa with a market capitalization of £94.55 million.

Operations: Mincon Group plc generates €156.93 million from the sale of drilling equipment.

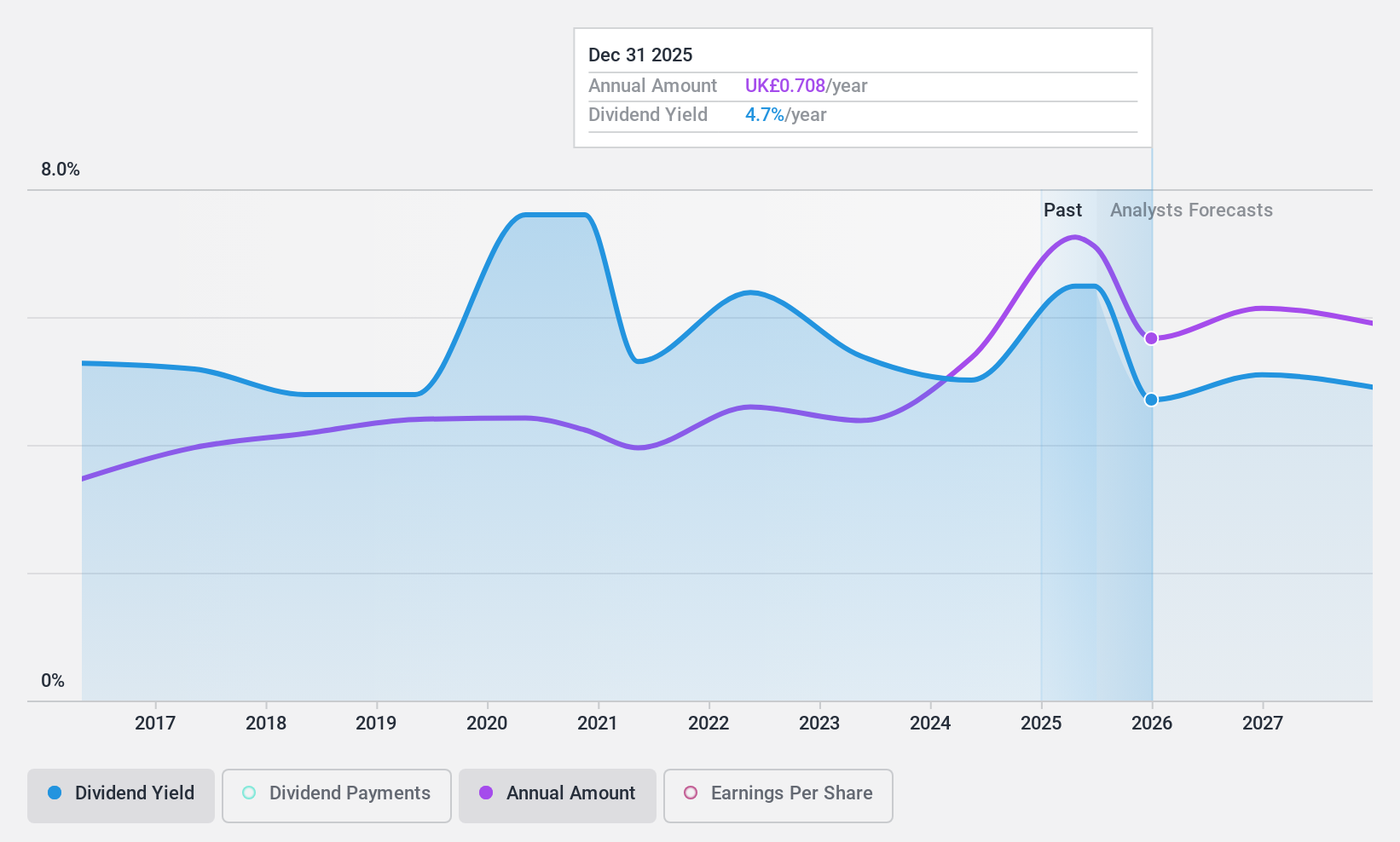

Dividend Yield: 4%

Mincon Group's dividend sustainability is underpinned by a cash payout ratio of 36.8%, indicating that dividends are well-covered by cash flows, despite earnings coverage being slightly higher at 59.7%. The company's recent trading update highlighted flat revenues in Q1 2024, continuing the subdued market trend from H2 2023. Profit margins have declined to 4.8% from last year’s 8.6%. Mincon trades about 2.4% below estimated fair value but has experienced unstable and unreliable dividend payments over the past decade.

- Dive into the specifics of Mincon Group here with our thorough dividend report.

- Our valuation report unveils the possibility Mincon Group's shares may be trading at a discount.

Ocean Wilsons Holdings (LSE:OCN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Ocean Wilsons Holdings Limited, an investment holding company based in Brazil, provides maritime and logistics services with a market capitalization of approximately £456.18 million.

Operations: Ocean Wilsons Holdings Limited generates $486.65 million from its maritime services in Brazil.

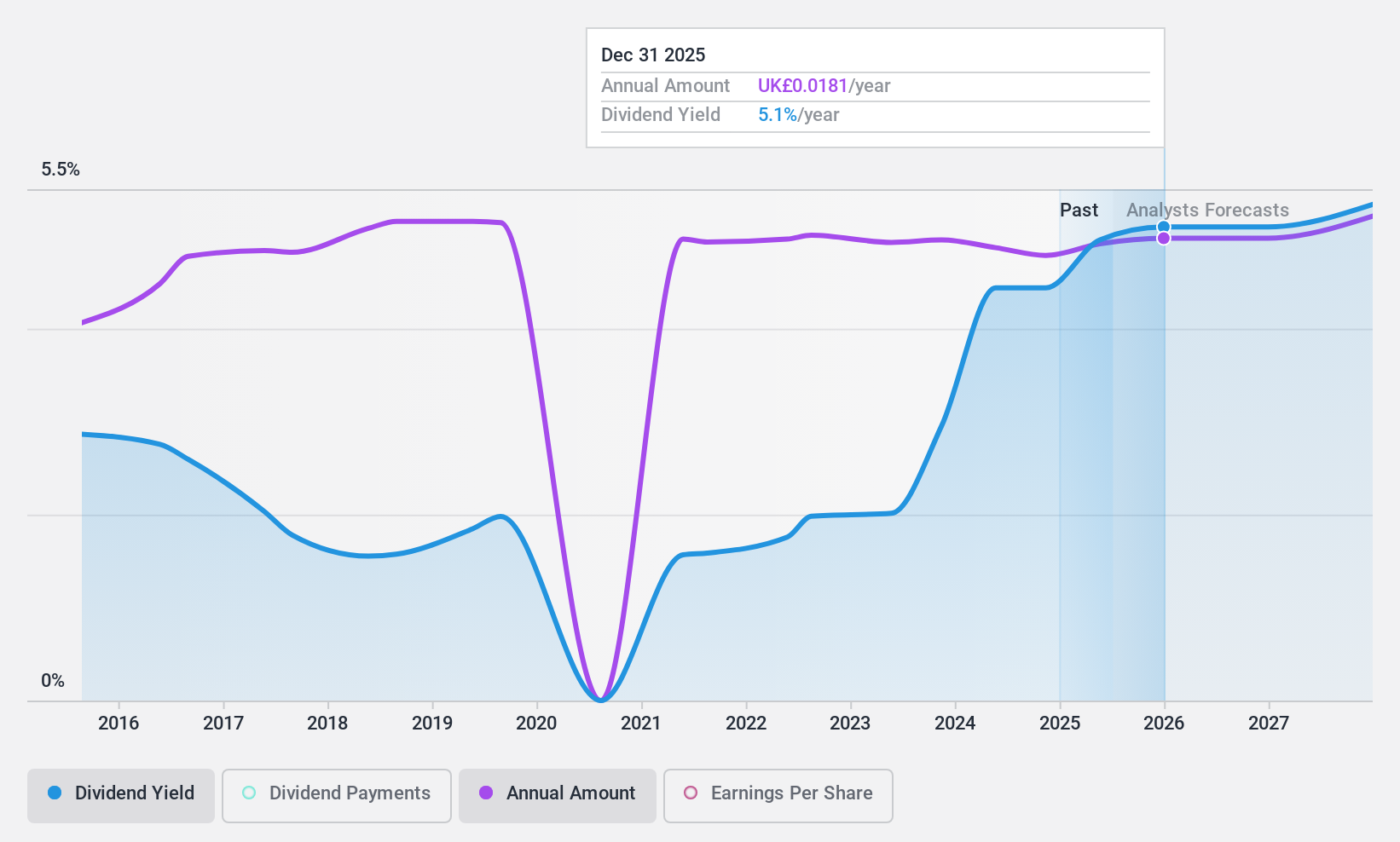

Dividend Yield: 5.2%

Ocean Wilsons Holdings has maintained stable dividend payments over the past decade, with a current yield of 5.21%, slightly below the top UK payers. Its dividends are well-supported by a payout ratio of 44.8% and a cash payout ratio of 48.1%, indicating good coverage by both earnings and cash flows. Despite this stability, its yield lags behind the UK's top quartile average of 5.67%. The company's P/E ratio stands at 8.6x, favorable compared to the UK market average of 16.3x.

- Click here and access our complete dividend analysis report to understand the dynamics of Ocean Wilsons Holdings.

- Our valuation report here indicates Ocean Wilsons Holdings may be undervalued.

Turning Ideas Into Actions

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 54 more companies for you to explore.Click here to unveil our expertly curated list of 57 Top Dividend Stocks.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:MCON

Mincon Group

Engages in designing, manufacturing, selling, and servicing of rock drilling tools and associated products in Ireland, the Americas, Europe, Australasia, the Middle East, and Africa.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives