- United Kingdom

- /

- Hospitality

- /

- LSE:ENT

Exploring Dividend Stocks: Choosing One Over Entain For Better Returns

Reviewed by Sasha Jovanovic

The appeal of dividend stocks in the United Kingdom, where the average yield hovers around 3.8%, can be quite enticing for those looking to generate income from their investments. However, it's crucial to scrutinize the sustainability of these dividends. Companies like Entain, with high payout ratios, may signal a red flag that their dividends could be at risk, potentially impacting investor returns adversely. In this article, we will explore two such stocks: one that offers promising returns and another that investors might consider avoiding due to concerns about its dividend sustainability.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| James Latham (AIM:LTHM) | 6.35% | ★★★★★★ |

| Impax Asset Management Group (AIM:IPX) | 7.28% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 7.33% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.55% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.87% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.88% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.85% | ★★★★★☆ |

| Rio Tinto Group (LSE:RIO) | 6.42% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.42% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.74% | ★★★★★☆ |

Click here to see the full list of 56 stocks from our Top Dividend Stocks screener.

Here we highlight one of our preferred stocks from the screener and one that could be better to shun.

Top Pick

Mincon Group (AIM:MCON)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mincon Group plc specializes in designing, manufacturing, selling, and servicing rock drilling tools and associated products across Ireland, the Americas, Australasia, Europe, the Middle East, and Africa with a market capitalization of £99.86 million.

Operations: The company generates €156.93 million in revenue from the sale of drilling equipment.

Dividend Yield: 3.8%

Mincon Group's dividend attractiveness is nuanced, with a solid yield of 3.79% but below the UK market's top quartile at 5.7%. The company's dividends are well-supported by earnings and cash flows, with payout ratios of 59.7% and 36.8%, respectively, indicating more sustainability compared to firms with higher risks from excessive payout ratios. However, Mincon has experienced volatility in its dividend payments over the past decade, reflecting some instability despite recent coverage strengths. Additionally, recent trading updates suggest a continued challenging market environment as of early 2024.

- Dive into the specifics of Mincon Group here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Mincon Group is priced lower than what may be justified by its financials.

One To Reconsider

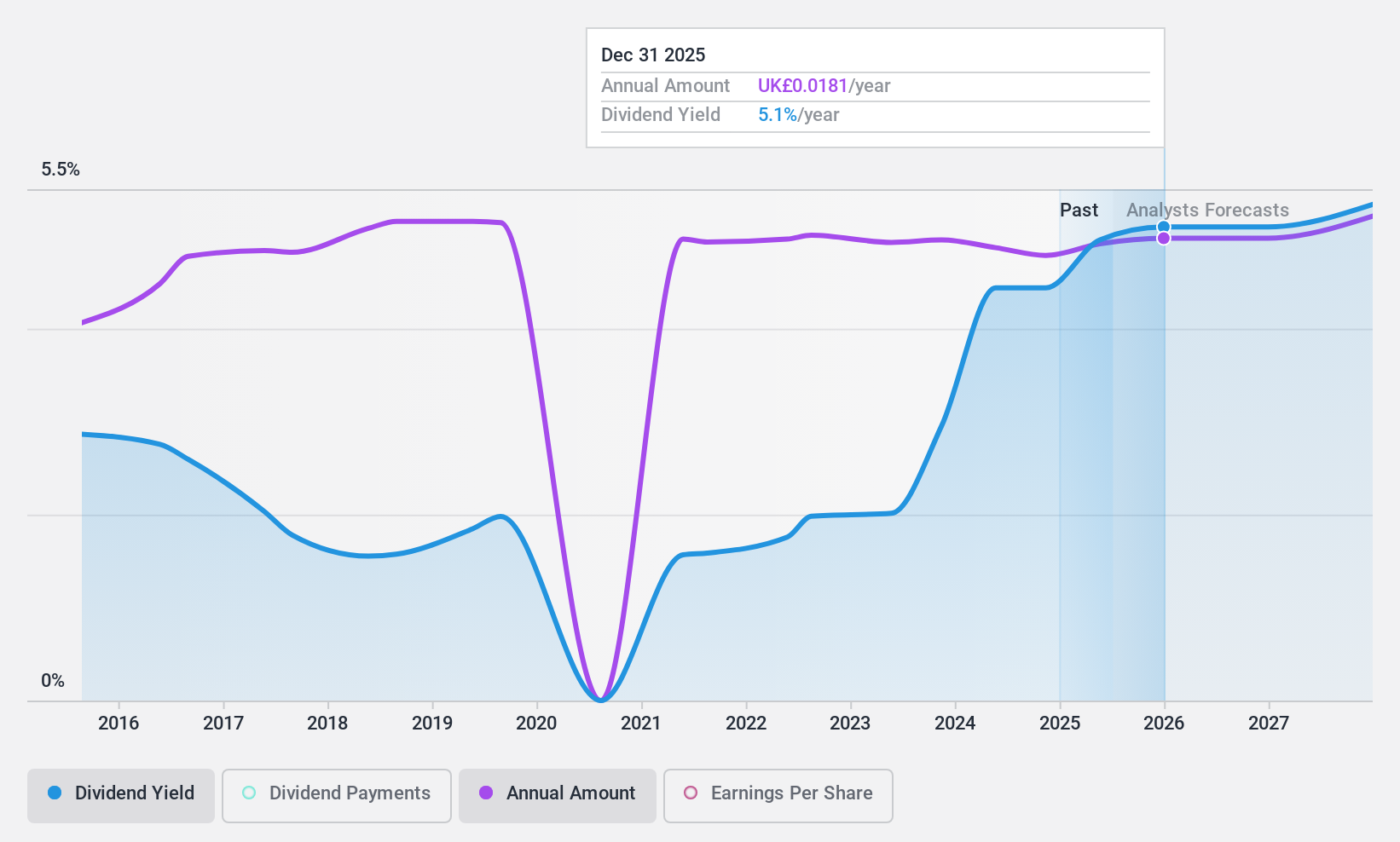

Entain (LSE:ENT)

Simply Wall St Dividend Rating: ★★☆☆☆☆

Overview: Entain Plc is a sports-betting and gaming company with a market capitalization of approximately £4.03 billion.

Operations: Entain's revenue is primarily derived from its Online and Retail segments, generating £3.37 billion and £1.38 billion respectively.

Dividend Yield: 2.8%

Entain Plc's dividend allure is compromised by its high payout ratio, making its 2.83% yield less appealing especially when compared to the top UK dividend payers at 5.7%. The dividends are not sufficiently covered by earnings or cash flows, reflecting deeper financial imprudence. Additionally, despite a strategic review aiming for operational improvement and growth in key markets like the US and Brazil, historical dividend payments have been inconsistent and unreliable over the past decade.

Summing It All Up

- Discover the full array of 56 Top Dividend Stocks right here.

- Already own any of these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Entain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ENT

Entain

Operates as a sports-betting and gaming company in the United Kingdom, Ireland, Italy, rest of Europe, Australia, New Zealand, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives