- United Kingdom

- /

- Banks

- /

- AIM:ARBB

Top UK Dividend Stocks Including Arbuthnot Banking Group

Reviewed by Simply Wall St

The recent performance of the FTSE 100 and FTSE 250 indices reflects broader concerns about global economic health, particularly influenced by China's sluggish recovery from the pandemic. Amid these uncertainties, identifying strong dividend stocks in the UK market can provide a measure of stability and income for investors.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| Impax Asset Management Group (AIM:IPX) | 7.10% | ★★★★★☆ |

| Big Yellow Group (LSE:BYG) | 3.72% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.20% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.48% | ★★★★★☆ |

| Plus500 (LSE:PLUS) | 5.67% | ★★★★★☆ |

| DCC (LSE:DCC) | 3.81% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.84% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.54% | ★★★★★☆ |

| Hargreaves Services (AIM:HSP) | 6.25% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 5.47% | ★★★★★☆ |

Click here to see the full list of 59 stocks from our Top UK Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Arbuthnot Banking Group (AIM:ARBB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arbuthnot Banking Group PLC, with a market cap of £159.11 million, offers private and commercial banking products and services in the United Kingdom through its subsidiaries.

Operations: Arbuthnot Banking Group PLC generates revenue from several segments, including Wealth Management (£12.32 million), Asset Alliance Group (£14.81 million), Renaissance Asset Finance (£9.42 million), Arbuthnot Commercial Asset Based Lending (£16.03 million), and other divisions (£19.82 million).

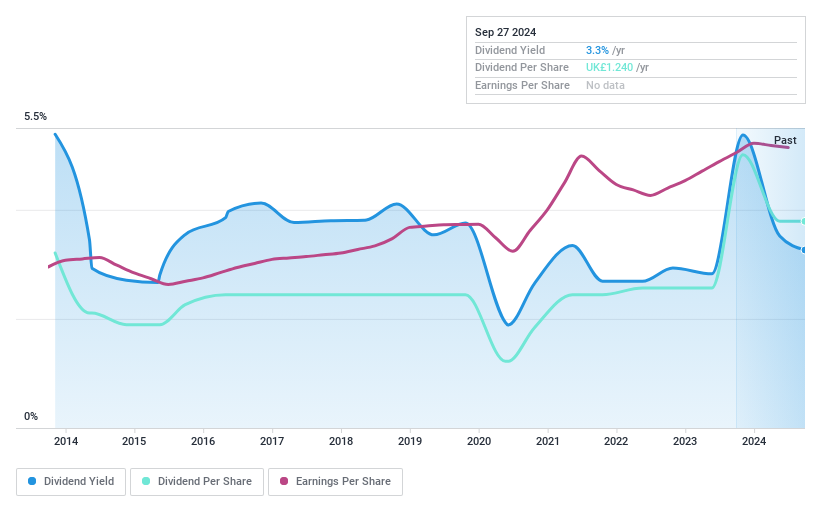

Dividend Yield: 4.8%

Arbuthnot Banking Group recently announced a special dividend of £0.20 per share and increased its interim dividend to £0.20, reflecting confidence in its prospects despite a decline in net income to £15.44 million for H1 2024 from £19.97 million last year. The company’s dividends are well covered by earnings with a low payout ratio of 24.9%, though the dividend track record has been volatile over the past decade, indicating some instability in payments.

- Dive into the specifics of Arbuthnot Banking Group here with our thorough dividend report.

- Our valuation report here indicates Arbuthnot Banking Group may be undervalued.

London Security (AIM:LSC)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: London Security plc, with a market cap of £478.14 million, manufactures, sells, and rents fire protection equipment across the United Kingdom, Belgium, the Netherlands, Austria, France, Germany, Denmark, and Luxembourg.

Operations: London Security plc generates £219.71 million in revenue from the provision and maintenance of fire protection and security equipment.

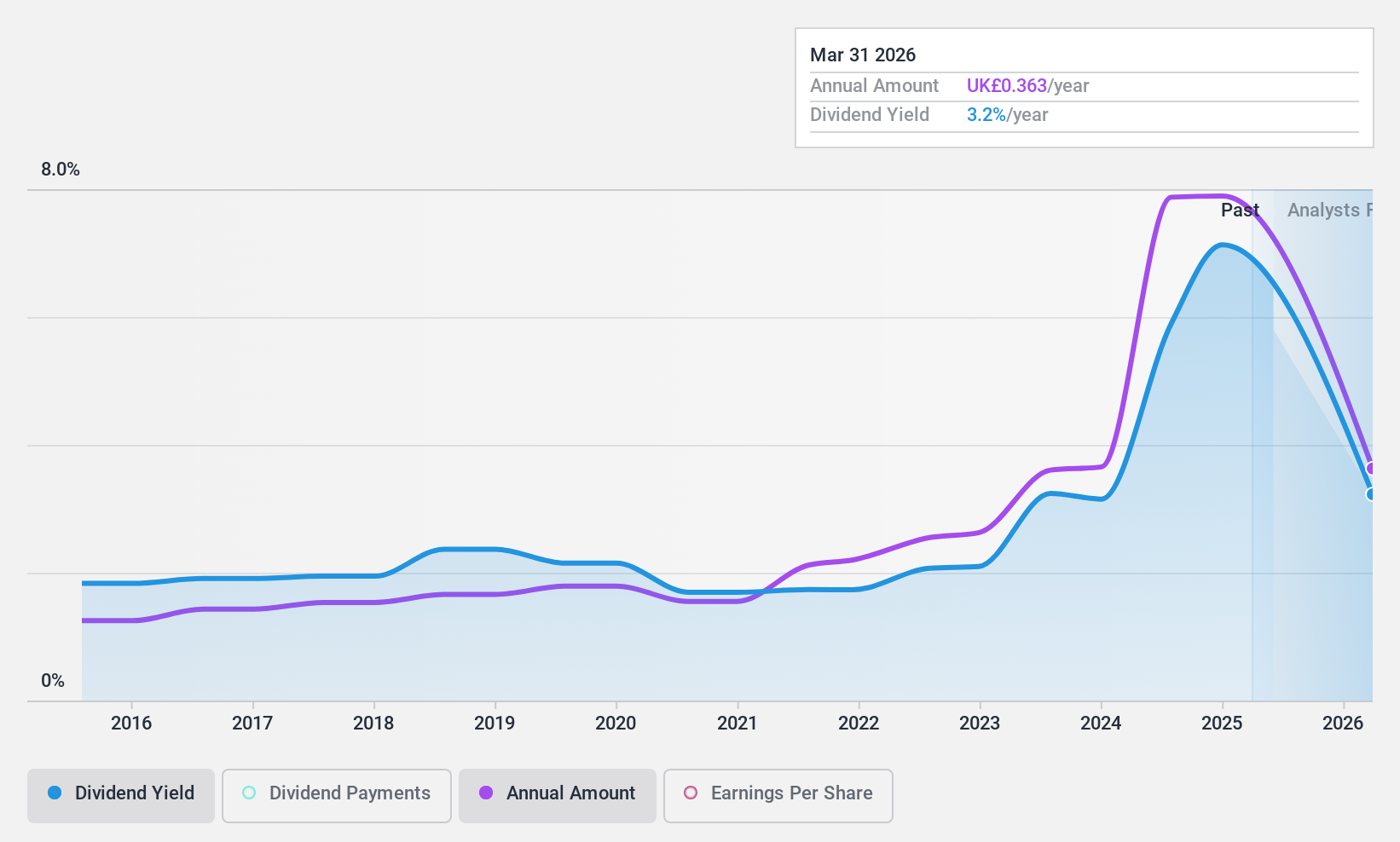

Dividend Yield: 3.2%

London Security's dividend payments are covered by earnings (payout ratio: 65.3%) and cash flows (cash payout ratio: 79.8%), though they have been volatile over the past decade. The company recently affirmed a final dividend of £0.42 per share for 2023, consistent with last year, to be paid on July 12, 2024. Despite an earnings growth of 15.1% over the past year, its dividend yield is lower than the top quartile of UK dividend payers at 3.18%.

- Click here and access our complete dividend analysis report to understand the dynamics of London Security.

- Upon reviewing our latest valuation report, London Security's share price might be too optimistic.

James Latham (AIM:LTHM)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: James Latham plc, with a market cap of £287.44 million, imports and distributes timbers, panels, and decorative surfaces across the United Kingdom, the Republic of Ireland, Europe, and internationally.

Operations: The company's revenue segment, Timber Importing and Distribution, generated £366.51 million.

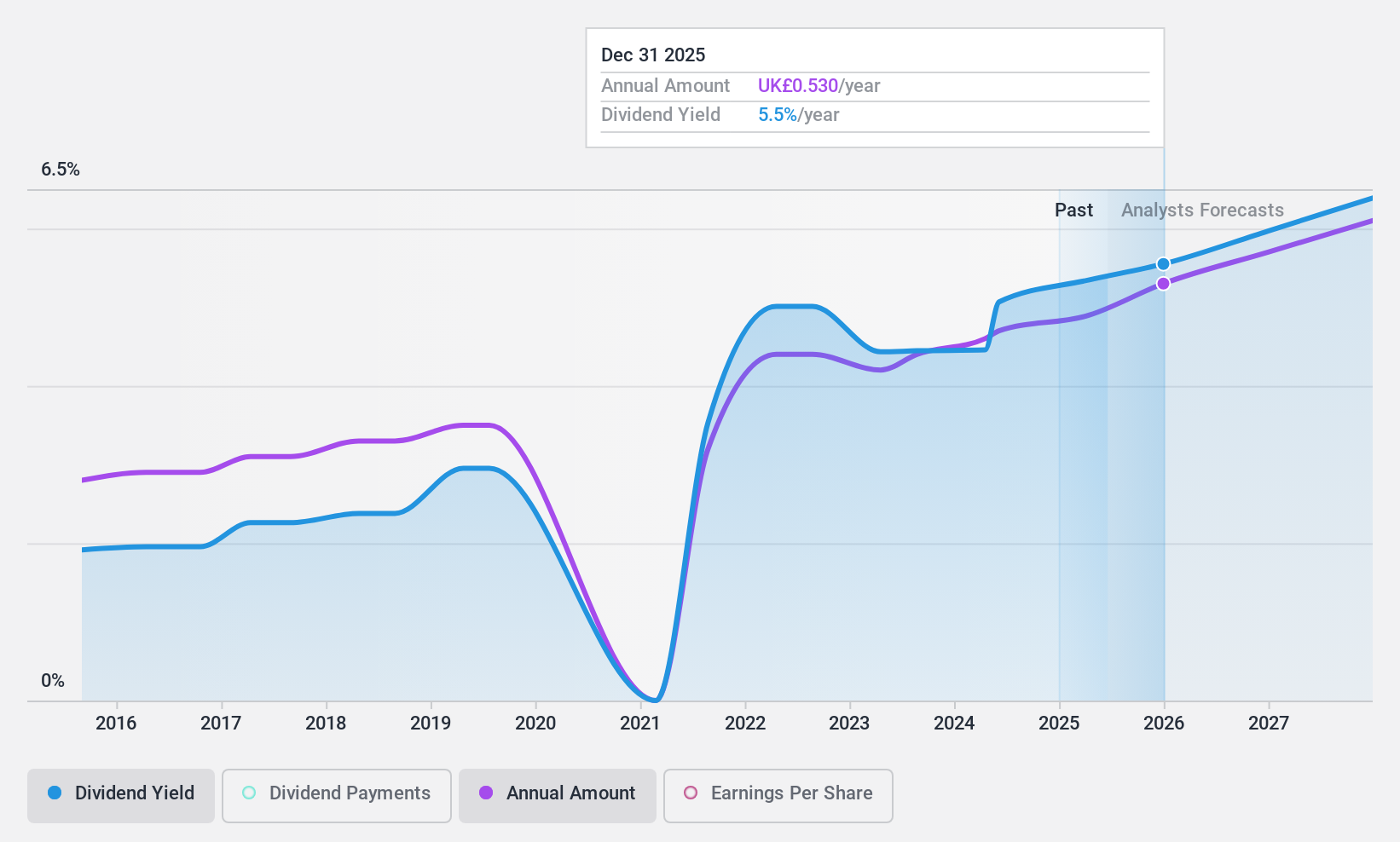

Dividend Yield: 5.5%

James Latham plc has declared a final dividend of £0.26 per share and a special dividend of £0.45 per share, both payable on August 23, 2024. Despite a decline in earnings for the year ended March 31, 2024, the company's dividends are well-covered by earnings (payout ratio: 30%) and cash flows (cash payout ratio: 87.4%). The dividend yield stands at 5.47%, slightly below the top quartile of UK dividend payers but remains reliable and stable over the past decade.

- Delve into the full analysis dividend report here for a deeper understanding of James Latham.

- Our valuation report unveils the possibility James Latham's shares may be trading at a premium.

Make It Happen

- Click here to access our complete index of 59 Top UK Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ARBB

Arbuthnot Banking Group

Provides private and commercial banking products and services in the United Kingdom.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives