- United Kingdom

- /

- Trade Distributors

- /

- AIM:LTHM

Slowing Rates Of Return At James Latham (LON:LTHM) Leave Little Room For Excitement

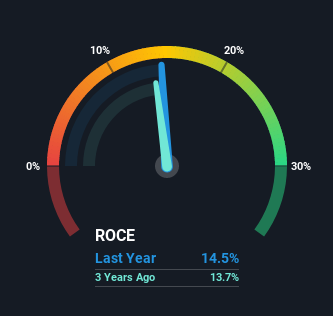

What trends should we look for it we want to identify stocks that can multiply in value over the long term? Firstly, we'll want to see a proven return on capital employed (ROCE) that is increasing, and secondly, an expanding base of capital employed. Ultimately, this demonstrates that it's a business that is reinvesting profits at increasing rates of return. So, when we ran our eye over James Latham's (LON:LTHM) trend of ROCE, we liked what we saw.

What is Return On Capital Employed (ROCE)?

If you haven't worked with ROCE before, it measures the 'return' (pre-tax profit) a company generates from capital employed in its business. Analysts use this formula to calculate it for James Latham:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.14 = UK£19m ÷ (UK£167m - UK£36m) (Based on the trailing twelve months to March 2021).

Therefore, James Latham has an ROCE of 14%. That's a relatively normal return on capital, and it's around the 13% generated by the Trade Distributors industry.

See our latest analysis for James Latham

While the past is not representative of the future, it can be helpful to know how a company has performed historically, which is why we have this chart above. If you're interested in investigating James Latham's past further, check out this free graph of past earnings, revenue and cash flow.

What The Trend Of ROCE Can Tell Us

The trend of ROCE doesn't stand out much, but returns on a whole are decent. Over the past five years, ROCE has remained relatively flat at around 14% and the business has deployed 55% more capital into its operations. 14% is a pretty standard return, and it provides some comfort knowing that James Latham has consistently earned this amount. Stable returns in this ballpark can be unexciting, but if they can be maintained over the long run, they often provide nice rewards to shareholders.

The Key Takeaway

In the end, James Latham has proven its ability to adequately reinvest capital at good rates of return. And the stock has followed suit returning a meaningful 79% to shareholders over the last five years. So even though the stock might be more "expensive" than it was before, we think the strong fundamentals warrant this stock for further research.

If you want to continue researching James Latham, you might be interested to know about the 1 warning sign that our analysis has discovered.

While James Latham isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About AIM:LTHM

James Latham

Distributes timbers, panels, and decorative panels in the United Kingdom, the Republic of Ireland, rest of Europe, and internationally.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success