James Halstead plc (LON:JHD) will pay a dividend of £0.0225 on the 9th of June. This means that the annual payment will be 4.2% of the current stock price, which is in line with the average for the industry.

View our latest analysis for James Halstead

James Halstead's Earnings Easily Cover The Distributions

Solid dividend yields are great, but they only really help us if the payment is sustainable. Prior to this announcement, James Halstead's dividend was making up a very large proportion of earnings and perhaps more concerning was that it was 333% of cash flows. Paying out such a high proportion of cash flows certainly exposes the company to cutting the dividend if cash flows were to reduce.

Earnings per share is forecast to rise by 10.0% over the next year. If the dividend continues along recent trends, we estimate the payout ratio could reach 79%, which is on the higher side, but certainly still feasible.

James Halstead Has A Solid Track Record

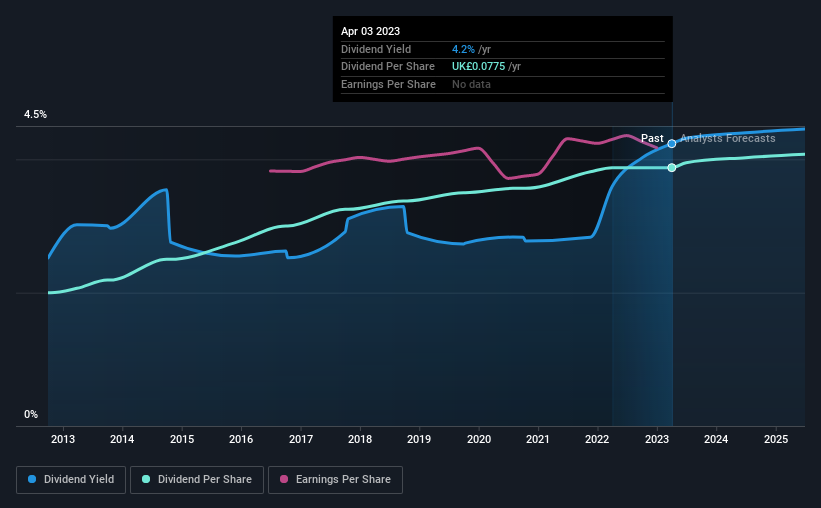

The company has an extended history of paying stable dividends. The dividend has gone from an annual total of £0.04 in 2013 to the most recent total annual payment of £0.0775. This works out to be a compound annual growth rate (CAGR) of approximately 6.8% a year over that time. Companies like this can be very valuable over the long term, if the decent rate of growth can be maintained.

James Halstead May Find It Hard To Grow The Dividend

Investors who have held shares in the company for the past few years will be happy with the dividend income they have received. Unfortunately, James Halstead's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year. James Halstead's earnings per share has barely grown, which is not ideal - perhaps this is why the company pays out the majority of its earnings to shareholders. That's fine as far as it goes, but we're less enthusiastic as this often signals that the dividend is likely to grow slower in the future.

James Halstead's Dividend Doesn't Look Sustainable

In summary, while it's good to see that the dividend hasn't been cut, we are a bit cautious about James Halstead's payments, as there could be some issues with sustaining them into the future. We can't deny that the payments have been very stable, but we are a little bit worried about the very high payout ratio. We don't think James Halstead is a great stock to add to your portfolio if income is your focus.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. To that end, James Halstead has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about. Is James Halstead not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:JHD

James Halstead

Manufactures and supplies flooring products for commercial and domestic uses in the United Kingdom, rest of Europe, Scandinavia, Australasia, Asia, and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026