- United Kingdom

- /

- Electrical

- /

- AIM:IKA

Introducing Ilika (LON:IKA), The Stock That Soared 418% In The Last Three Years

For us, stock picking is in large part the hunt for the truly magnificent stocks. Mistakes are inevitable, but a single top stock pick can cover any losses, and so much more. Take, for example, the Ilika plc (LON:IKA) share price, which skyrocketed 418% over three years. Also pleasing for shareholders was the 26% gain in the last three months. But this could be related to the strong market, which is up 12% in the last three months.

See our latest analysis for Ilika

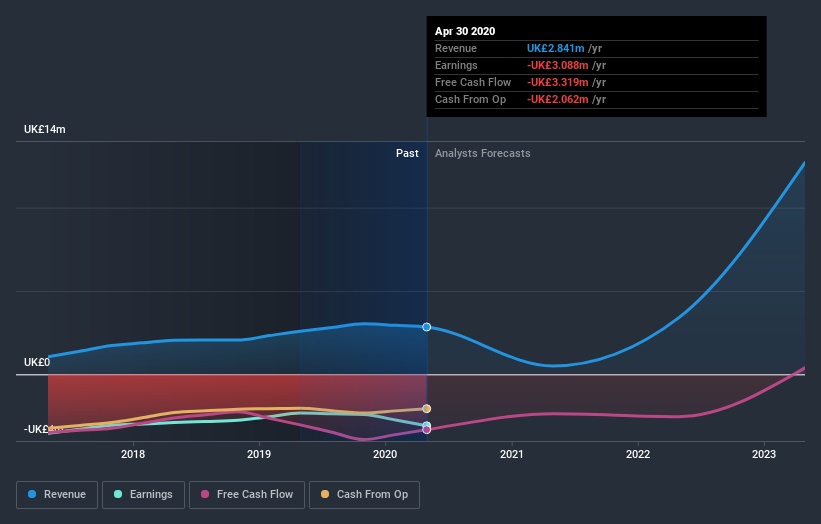

Because Ilika made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Ilika's revenue trended up 28% each year over three years. That's much better than most loss-making companies. In light of this attractive revenue growth, it seems somewhat appropriate that the share price has been rocketing, boasting a gain of 73% per year, over the same period. Despite the strong run, top performers like Ilika have been known to go on winning for decades. In fact, it might be time to put it on your watchlist, if you're not already familiar with the stock.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

We're pleased to report that Ilika shareholders have received a total shareholder return of 261% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 9% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. It's always interesting to track share price performance over the longer term. But to understand Ilika better, we need to consider many other factors. For instance, we've identified 3 warning signs for Ilika that you should be aware of.

We will like Ilika better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.

If you decide to trade Ilika, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About AIM:IKA

Ilika

Engages in designing, production, and development of solid state batteries in the United Kingdom, Asia, Europe, and North America.

Flawless balance sheet with low risk.

Market Insights

Community Narratives