- United Kingdom

- /

- Electrical

- /

- AIM:IES

Revenues Tell The Story For Invinity Energy Systems plc (LON:IES) As Its Stock Soars 35%

Invinity Energy Systems plc (LON:IES) shareholders are no doubt pleased to see that the share price has bounced 35% in the last month, although it is still struggling to make up recently lost ground. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 67% share price drop in the last twelve months.

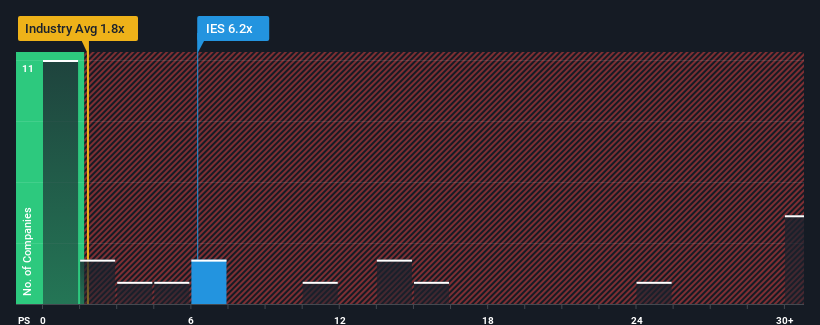

Since its price has surged higher, when almost half of the companies in the United Kingdom's Electrical industry have price-to-sales ratios (or "P/S") below 1.8x, you may consider Invinity Energy Systems as a stock not worth researching with its 6.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for Invinity Energy Systems

How Invinity Energy Systems Has Been Performing

Invinity Energy Systems hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the market is expecting the poor revenue to reverse, justifying it's current high P/S.. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Invinity Energy Systems' future stacks up against the industry? In that case, our free report is a great place to start.How Is Invinity Energy Systems' Revenue Growth Trending?

Invinity Energy Systems' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered a frustrating 46% decrease to the company's top line. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. Accordingly, shareholders will be pleased, but also have some serious questions to ponder about the last 12 months.

Turning to the outlook, the next three years should generate growth of 139% per annum as estimated by the four analysts watching the company. With the industry only predicted to deliver 76% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why Invinity Energy Systems' P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What Does Invinity Energy Systems' P/S Mean For Investors?

The strong share price surge has lead to Invinity Energy Systems' P/S soaring as well. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Invinity Energy Systems maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Electrical industry, as expected. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Invinity Energy Systems (2 don't sit too well with us!) that you should be aware of before investing here.

If these risks are making you reconsider your opinion on Invinity Energy Systems, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:IES

Invinity Energy Systems

Manufactures and sells vanadium flow batteries and related hardware for energy storage markets in Asia, Australia, Europe, and North America.

Flawless balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives