- United Kingdom

- /

- Building

- /

- AIM:ETP

Take Care Before Jumping Onto Eneraqua Technologies plc (LON:ETP) Even Though It's 43% Cheaper

Unfortunately for some shareholders, the Eneraqua Technologies plc (LON:ETP) share price has dived 43% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 44% share price drop.

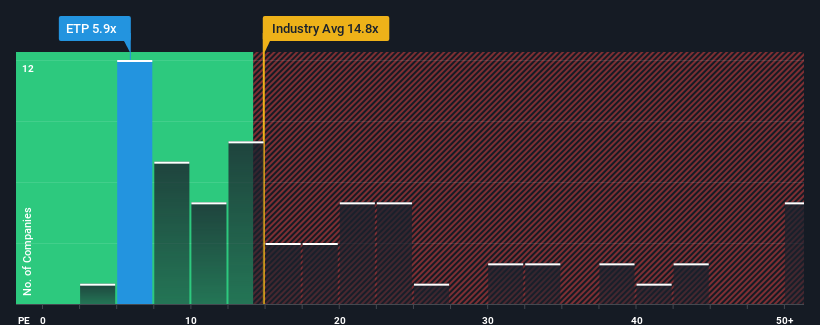

In spite of the heavy fall in price, given about half the companies in the United Kingdom have price-to-earnings ratios (or "P/E's") above 15x, you may still consider Eneraqua Technologies as a highly attractive investment with its 5.9x P/E ratio. However, the P/E might be quite low for a reason and it requires further investigation to determine if it's justified.

Eneraqua Technologies certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Eneraqua Technologies

How Is Eneraqua Technologies' Growth Trending?

Eneraqua Technologies' P/E ratio would be typical for a company that's expected to deliver very poor growth or even falling earnings, and importantly, perform much worse than the market.

Taking a look back first, we see that the company grew earnings per share by an impressive 40% last year. However, this wasn't enough as the latest three year period has seen a very unpleasant 85% drop in EPS in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Turning to the outlook, the next year should generate growth of 6.7% as estimated by the dual analysts watching the company. That's shaping up to be similar to the 7.1% growth forecast for the broader market.

In light of this, it's peculiar that Eneraqua Technologies' P/E sits below the majority of other companies. It may be that most investors are not convinced the company can achieve future growth expectations.

The Final Word

Having almost fallen off a cliff, Eneraqua Technologies' share price has pulled its P/E way down as well. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Eneraqua Technologies' analyst forecasts revealed that its market-matching earnings outlook isn't contributing to its P/E as much as we would have predicted. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

You should always think about risks. Case in point, we've spotted 3 warning signs for Eneraqua Technologies you should be aware of, and 2 of them are concerning.

Of course, you might also be able to find a better stock than Eneraqua Technologies. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Eneraqua Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:ETP

Eneraqua Technologies

Provides turnkey solutions for water efficiency and decarbonization through district heating and ground source heat pump systems for commercial clients, and social housing and residential sectors.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives