- United Kingdom

- /

- Banks

- /

- LSE:LLOY

What Recent Policy Updates Mean for Lloyds After Its Sharp Price Swings

Reviewed by Bailey Pemberton

- Wondering whether Lloyds Banking Group is undervalued, overhyped or sitting quietly in prime investment territory? You're not alone, and that's exactly what we're breaking down here.

- The stock has climbed 66% over the past year and a hefty 189.5% over five years, but there has been a recent dip of 7.9% this week after surging 5.6% last month.

- Market sentiment toward Lloyds has shifted rapidly this month, driven by fresh updates on UK economic policy and optimism about the financial sector's stability. This comes even as global markets grapple with shifting interest rate forecasts. Investors are now weighing up whether the rally can hold or if volatility is back for another round.

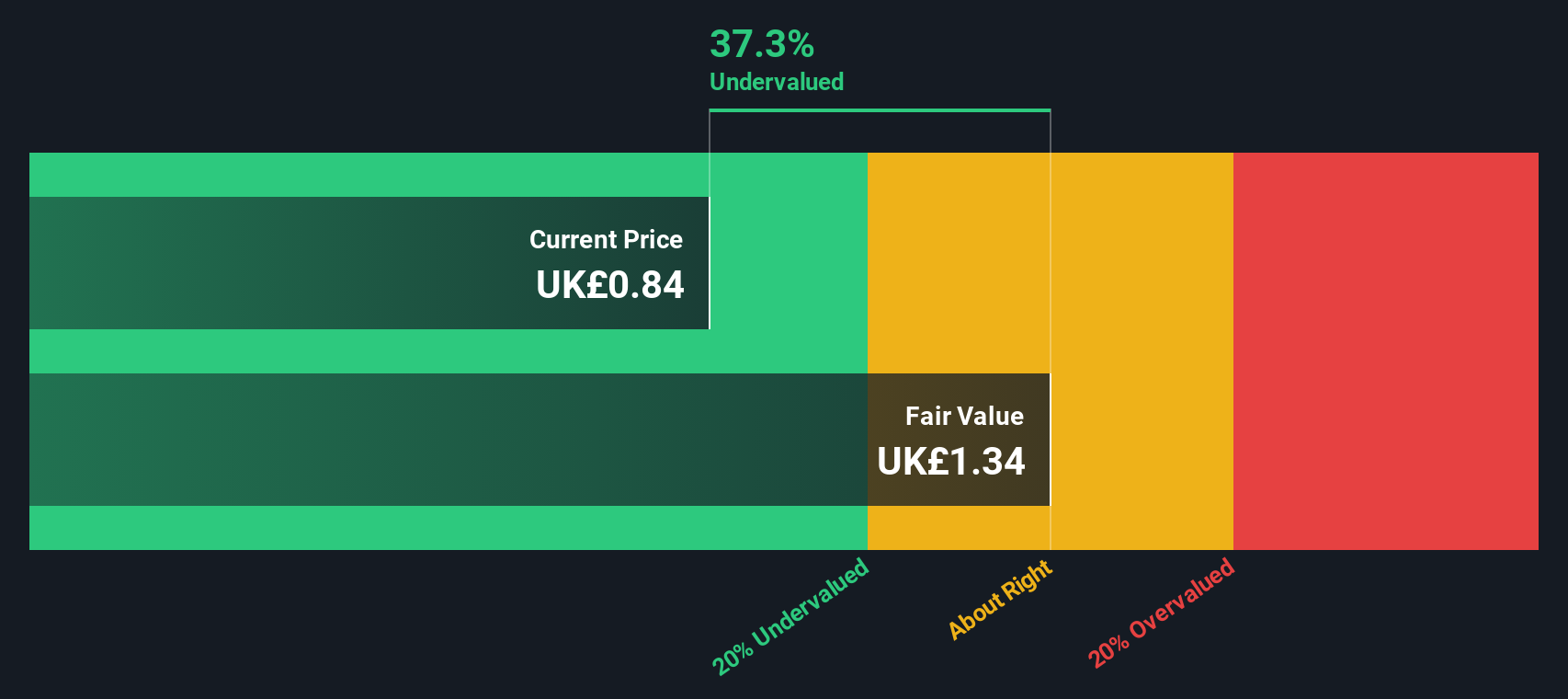

- Looking at the numbers, Lloyds scores 2 out of 6 on our valuation check. The classic metrics tell just part of the story, and we'll dive deeper into those next, plus share a smarter way to think about value by the end of this article.

Lloyds Banking Group scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Lloyds Banking Group Excess Returns Analysis

The Excess Returns Model is a straightforward way to assess value by looking at how much profit a company generates above its cost of equity. Instead of focusing solely on dividends or cash flow, this approach examines Lloyds Banking Group’s ability to generate truly value-added returns for shareholders, beyond what investors could earn elsewhere with similar risk.

For Lloyds, analysts estimate a Book Value of £0.77 per share, supported by a Stable Earnings Per Share (EPS) of £0.10. These earnings are based on weighted future Return on Equity (ROE) projections from 14 analysts. The Cost of Equity is £0.07 per share, which sets a relatively high bar for excess profit. The bank’s Excess Return works out to £0.04 per share, and the average ROE is a robust 13.15%. Stable Book Value is also expected to hold at £0.77 per share, based on projections from 9 analysts.

The Excess Returns approach places Lloyds Banking Group’s intrinsic value at £1.44 per share, which is 39.0% above the current share price. This suggests the stock is trading at a significant discount to what it is fundamentally worth based on the returns it is expected to generate.

Result: UNDERVALUED

Our Excess Returns analysis suggests Lloyds Banking Group is undervalued by 39.0%. Track this in your watchlist or portfolio, or discover 909 more undervalued stocks based on cash flows.

Approach 2: Lloyds Banking Group Price vs Earnings

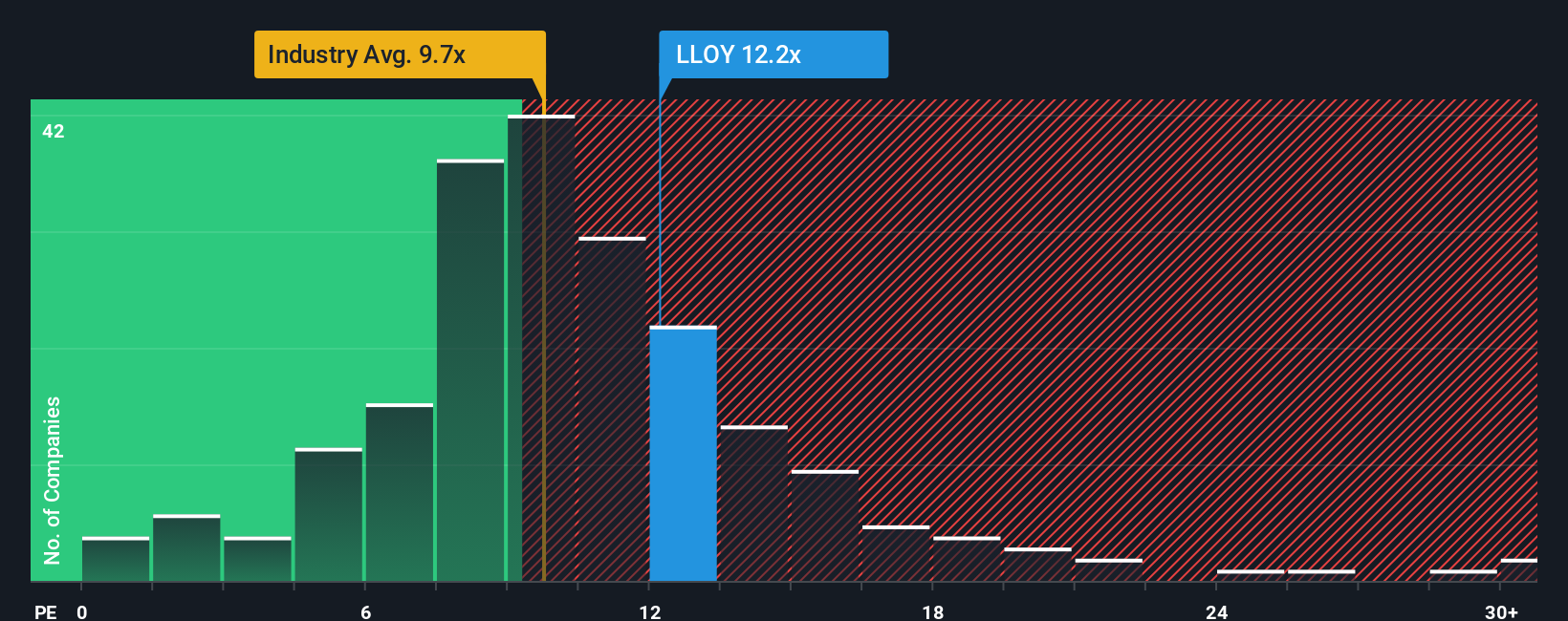

The Price-to-Earnings (PE) ratio is often the most telling valuation metric for profitable banks like Lloyds Banking Group, as it directly links the share price to the company’s earnings power. For companies that post steady profits, the PE ratio acts as a shorthand for how much investors are paying for each pound of earnings.

Expectations for future growth and risk both play a critical role in setting what counts as a “normal” PE ratio. Companies with higher earnings growth or lower perceived risks typically command higher PE ratios, while slumping growth or extra uncertainty tend to push PE ratios lower.

Currently, Lloyds trades at a PE ratio of 14.91x. For context, the average PE for its UK banking peers is 10.64x, while the broader industry average sits at 10.02x. Based on Simply Wall St’s research, the Fair Ratio for Lloyds is 9.67x, reflecting factors like its expected earnings growth, profitability, industry standing, and risk profile.

The Fair Ratio stands out as a more tailored benchmark compared to peer or industry averages, as it incorporates elements specific to Lloyds such as growth, risk, market cap, and profit margins. This gives a more accurate picture of the multiple the company actually deserves in today’s market.

Comparing Lloyds’ current PE ratio of 14.91x with its Fair Ratio of 9.67x, shares appear to be trading well above the valuation justified by its fundamentals. This suggests the stock may be getting ahead of itself relative to its growth and risk outlook.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1412 companies where insiders are betting big on explosive growth.

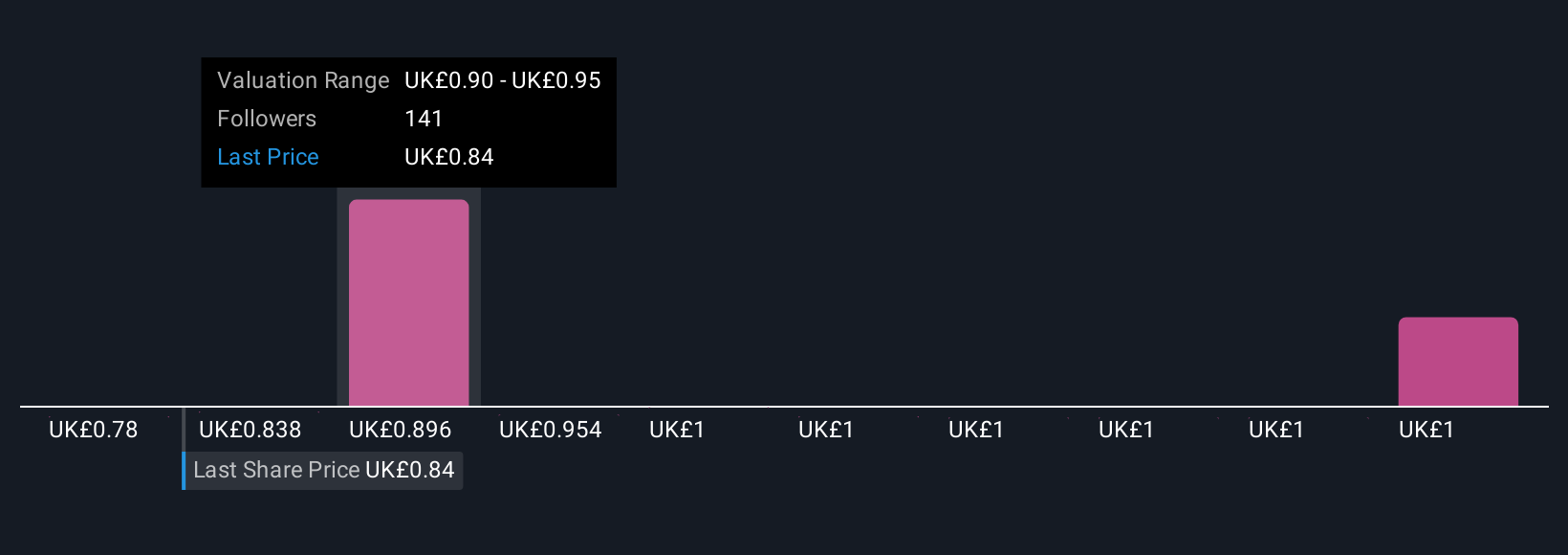

Upgrade Your Decision Making: Choose your Lloyds Banking Group Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is your unique perspective or "story" of a company, shaped by your views on its business model, growth, risks, and the numbers you believe the company will deliver, such as future revenue, earnings, and profit margins. Rather than just relying on averages or market benchmarks, Narratives link your personal view of Lloyds Banking Group’s future to a financial forecast and, from there, to a fair value estimate, providing a clear rationale for buying or selling shares.

Narratives are simple and accessible, and you can create or explore them on Simply Wall St’s Community page, where millions of investors share and update their ideas in real time. This means as the news changes or new earnings are released, Narratives (and their fair values) update automatically to help you stay on top of your investment thesis. For example, one investor might be optimistic, believing Lloyds will grow rapidly and deserves a price near £1.03 per share, while another focuses on economic risks and values it closer to £0.53. Comparing these perspectives with the current price lets you see whether your Narrative signals Lloyds is a buy, sell, or hold.

Do you think there's more to the story for Lloyds Banking Group? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LLOY

Lloyds Banking Group

Provides a range of banking and financial products and services in the United Kingdom and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives