- United Kingdom

- /

- Banks

- /

- LSE:HSBA

HSBC (LSE:HSBA) Valuation in Focus Following Latest Share Price Gains

Reviewed by Simply Wall St

See our latest analysis for HSBC Holdings.

HSBC Holdings has continued its winning streak, with the latest 1% share price lift adding to an impressive year-to-date gain of 38.6%. The bank's robust rally signals growing optimism, especially given its remarkable 59.9% total shareholder return over the past year. Momentum is very much on its side.

If HSBC's strong run piques your interest, now could be a smart time to expand your search and discover fast growing stocks with high insider ownership

But after such a rapid ascent, is HSBC still undervalued based on its fundamentals, or has the market already factored in the bank's future growth prospects? Could this be a fresh entry point, or is everything priced in?

Most Popular Narrative: Fairly Valued

Despite HSBC’s strong share price climb, the most closely followed narrative now aligns the fair value almost perfectly with the current market price. This close match raises questions: is recent momentum fully justified, or is caution finally prevailing?

Disproportionate investment in digital transformation, including AI-driven efficiency gains and digital onboarding, will generate structural cost reductions (organizational simplification savings), directly improving the cost-to-income ratio and lifting long-term operating leverage and net margins. The strong and growing deposit base, especially in Asia, enables HSBC to capitalize on future loan growth opportunities tied to regional economic expansion, enhancing net interest income and providing a stable foundation for earnings growth as financial inclusion and credit penetration increase.

Want to know which financial forecast underpins this near-perfect fair value match? The narrative builds on a set of ambitious projections: margin gains, digital leverage, and a bold bet on regional strength. If you want to uncover the core assumptions behind HSBC’s high-stakes outlook, the real story is just a click away.

Result: Fair Value of $10.66 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in Hong Kong real estate or unexpected regional slowdowns could quickly undermine the positive fair value outlook for HSBC.

Find out about the key risks to this HSBC Holdings narrative.

Another View: DCF Model Suggests Big Upside

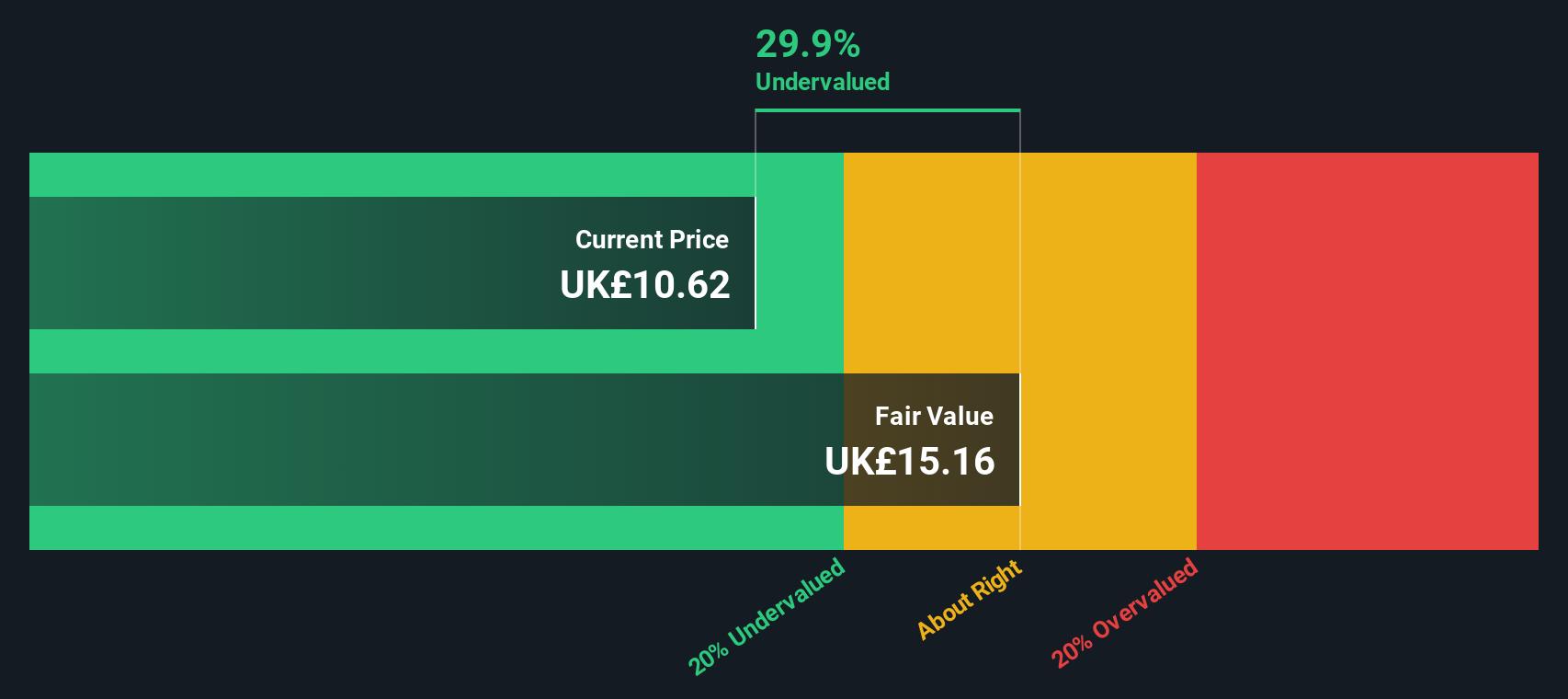

While analysts see HSBC as being fairly valued based on its earnings and future profits, our SWS DCF model points to a different story entirely. It values HSBC nearly 37% higher than where shares trade today, which suggests the market might be overlooking long-term cash flow potential. Could there be hidden value the consensus is missing?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out HSBC Holdings for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 838 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own HSBC Holdings Narrative

If you have a different take or want to dig into the numbers yourself, you can craft your own HSBC story. It only takes a few minutes — Do it your way

A great starting point for your HSBC Holdings research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Expand your investing horizons with hand-picked opportunities. Don’t sit on the sidelines while others move ahead. These screeners could spark your next winning move.

- Tap into tomorrow’s leaders in artificial intelligence by starting with these 26 AI penny stocks that stand out for innovation and growth.

- Maximize your income and enjoy peace of mind by reviewing these 20 dividend stocks with yields > 3%, offering reliable yields above 3%.

- Ride the momentum of digital asset adoption by checking out these 81 cryptocurrency and blockchain stocks driving breakthroughs in blockchain and cryptocurrencies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBA

HSBC Holdings

Engages in the provision of banking and financial products and services worldwide.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives