- United Kingdom

- /

- Banks

- /

- LSE:HSBA

Does HSBC Offer Value After a 6.2% Weekly Drop and Strategic Restructuring?

Reviewed by Bailey Pemberton

- If you have ever wondered whether HSBC Holdings is fairly priced or hiding good value, you are in the right place for a clear and straightforward look at its stock.

- Despite a recent 6.2% dip over the past week, HSBC has posted strong returns this year, up 33.7% year-to-date and an impressive 53.0% over the last year. This signals both growth potential and changing risk perceptions.

- Much of the recent price movement has followed headlines around global banking trends and HSBC’s ongoing strategic shifts, including restructurings in key markets and increased investments in its core Asian operations. These moves have put the company in the spotlight as investors weigh what is next for one of the world’s biggest financial institutions.

- On our valuation checks, HSBC scores 2 out of 6, so there is clearly more to unpack about how the market is valuing the business. Let us dive into how analysts, investors, and even algorithms have sized up HSBC before we explore an even smarter framework that could help you decide what it is really worth.

HSBC Holdings scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: HSBC Holdings Excess Returns Analysis

The Excess Returns valuation model focuses on how efficiently a company generates returns above its cost of equity using invested capital. In other words, it measures whether HSBC Holdings is delivering profits that exceed what investors demand for putting their money at risk in the business.

For HSBC Holdings, the key data points include a Book Value of £9.94 per share and a Stable EPS of £1.53 per share, based on weighted future Return on Equity estimates from 17 analysts. The cost of equity stands at £0.92 per share, leading to an Excess Return of £0.61 per share. HSBC’s average Return on Equity is a solid 14.07%, while its Stable Book Value is projected to reach £10.88 per share, calculated from weighted estimates by eight analysts.

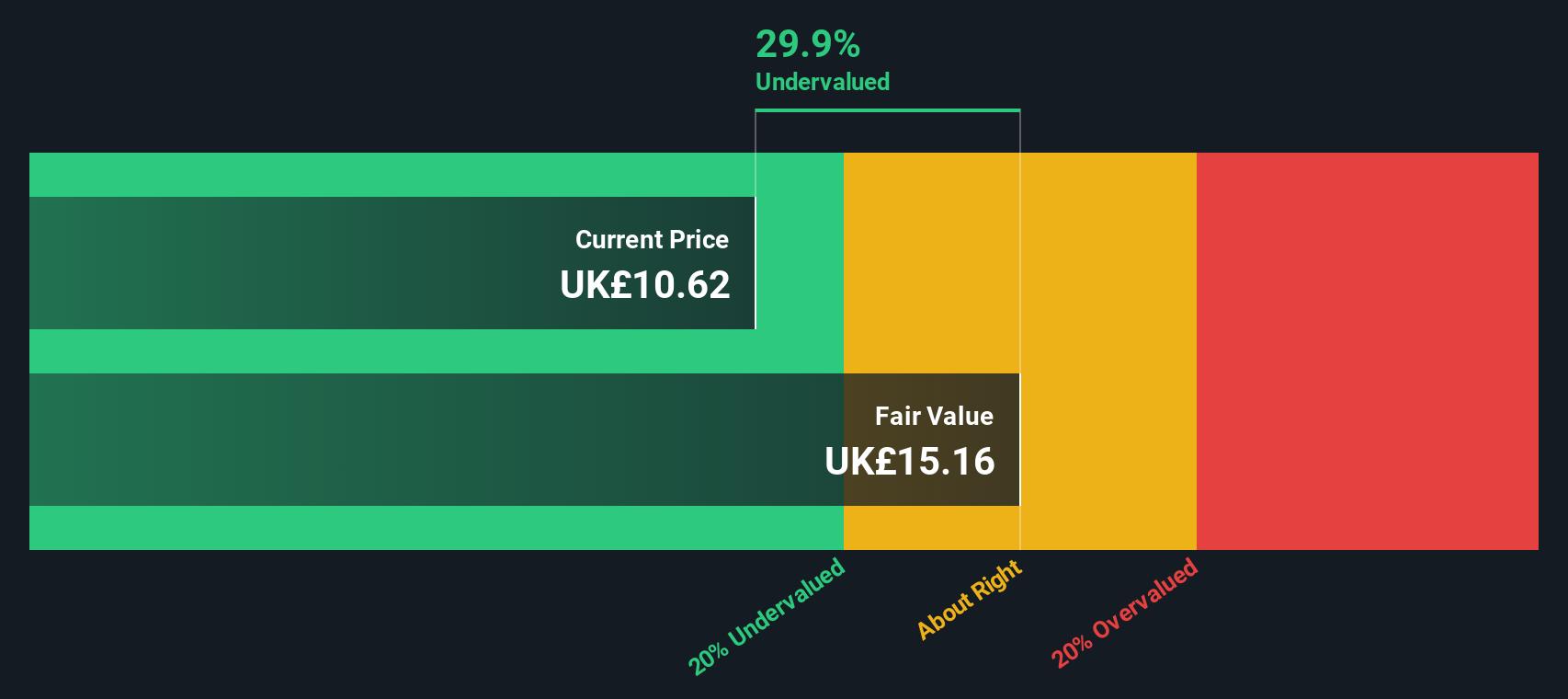

This approach concludes that HSBC’s share price is currently 37.9% below its intrinsic value, based on these excess returns and growth projections. That sizable discount suggests the stock is currently undervalued by the market, especially when compared to its peers in the banking sector.

Result: UNDERVALUED

Our Excess Returns analysis suggests HSBC Holdings is undervalued by 37.9%. Track this in your watchlist or portfolio, or discover 901 more undervalued stocks based on cash flows.

Approach 2: HSBC Holdings Price vs Earnings

The price-to-earnings (PE) ratio is a popular valuation tool for profitable companies like HSBC Holdings because it directly relates a company’s market price to its bottom-line earnings. For banks, a consistent earnings track record makes the PE ratio a quick way to gauge whether investor optimism aligns with the actual ability to generate profits.

The “right” PE ratio depends on both how fast a company is expected to grow and how much risk is perceived by the market. Companies with stronger growth prospects or lower risk profiles typically warrant a higher PE, while those facing headwinds trade on lower multiples.

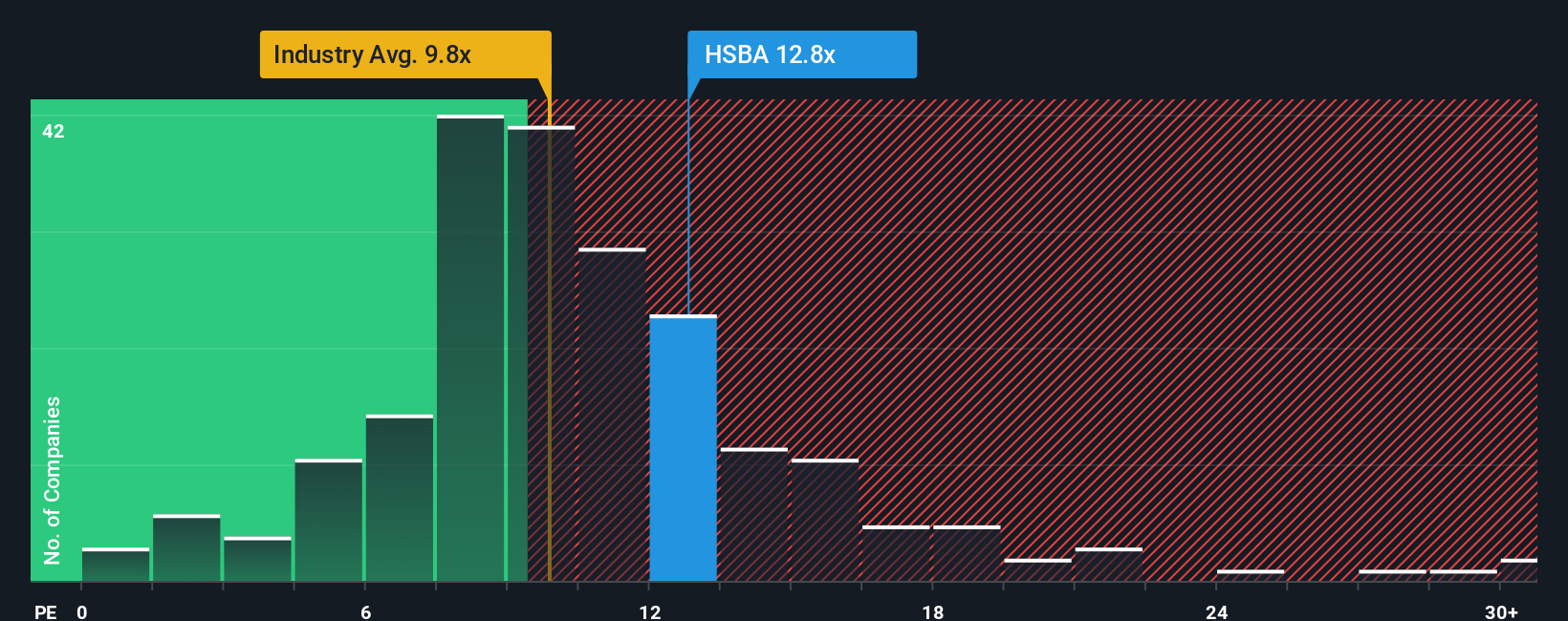

HSBC currently trades at a PE of 14.19x. For context, this sits above both the peer average of 10.80x and the banks industry average of 10.02x. This at first glance might suggest the stock is expensive compared to its direct competitors and the broader sector.

However, Simply Wall St’s proprietary Fair Ratio model for HSBC stands at 9.85x. This metric takes a further step than standard peer or industry comparisons by blending together the company’s growth outlook, risks, profit margins, business model, industry group and market capitalization. In doing so, it produces a more nuanced picture of what would be a justified valuation multiple for HSBC at this point in its cycle.

Comparing HSBC’s Fair Ratio of 9.85x with its actual PE of 14.19x shows that the stock is currently valued above what these fundamentals would suggest, indicating it is overvalued on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1413 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your HSBC Holdings Narrative

Earlier we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives, a dynamic approach that lets you shape your investment decision by telling the story behind the numbers.

A Narrative is simply your perspective on HSBC Holdings, where you explain what is behind your fair value estimate and your forecasts for future revenue, earnings, and profit margins. Narratives link the company’s business story directly to a financial forecast, which then shows you what HSBC could really be worth under your assumptions.

This tool is easy to use and is available on the Simply Wall St Community page, where millions of investors share their views. Narratives help you decide whether to buy or sell by directly comparing your Fair Value (based on your story and assumptions) against the current market price. The best part is that they update automatically as important news and earnings are released, so your outlook is always relevant.

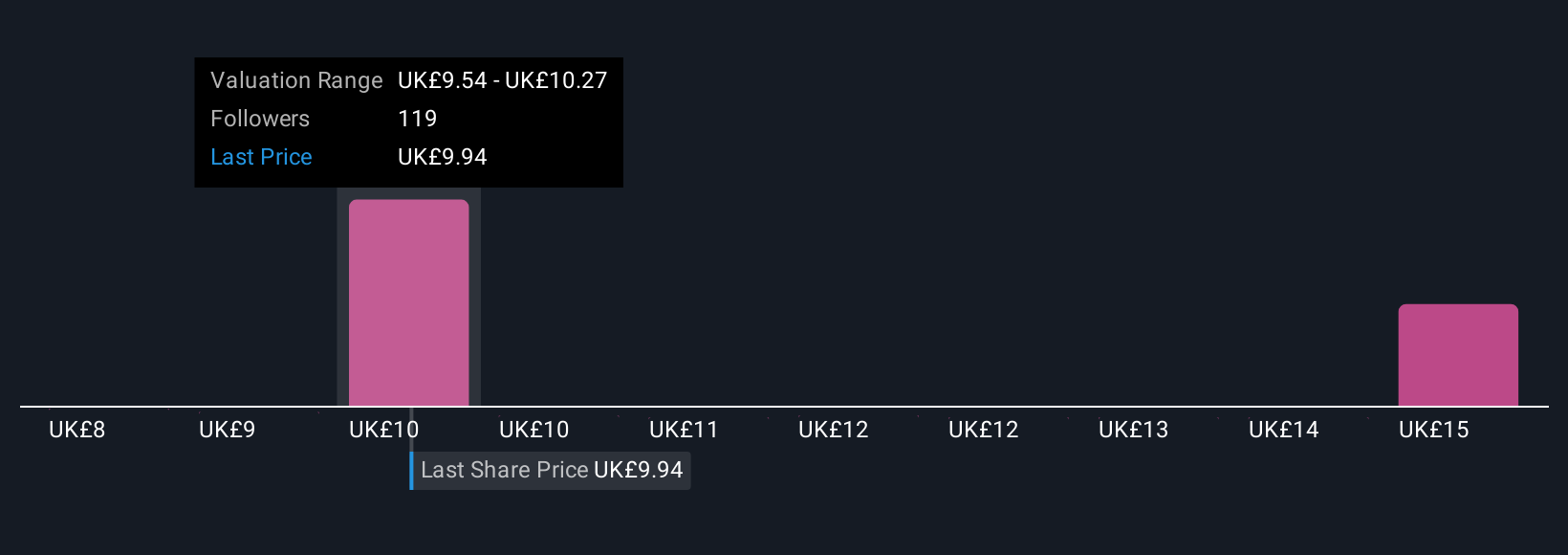

For example, some investors are optimistic about HSBC Holdings, expecting as much as £11.29 per share if Asian growth and margins keep improving. Others foresee nearer £7.93 per share, reflecting risks in commercial real estate, regulation, or the pace of digital transformation.

Do you think there's more to the story for HSBC Holdings? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HSBC Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HSBA

HSBC Holdings

Engages in the provision of banking and financial products and services worldwide.

Adequate balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives