- United Kingdom

- /

- Banks

- /

- LSE:BARC

Imagine Owning Barclays (LON:BARC) And Wondering If The 31% Share Price Slide Is Justified

The main aim of stock picking is to find the market-beating stocks. But in any portfolio, there will be mixed results between individual stocks. So we wouldn't blame long term Barclays PLC (LON:BARC) shareholders for doubting their decision to hold, with the stock down 31% over a half decade. But it's up 5.2% in the last week.

See our latest analysis for Barclays

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Barclays became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

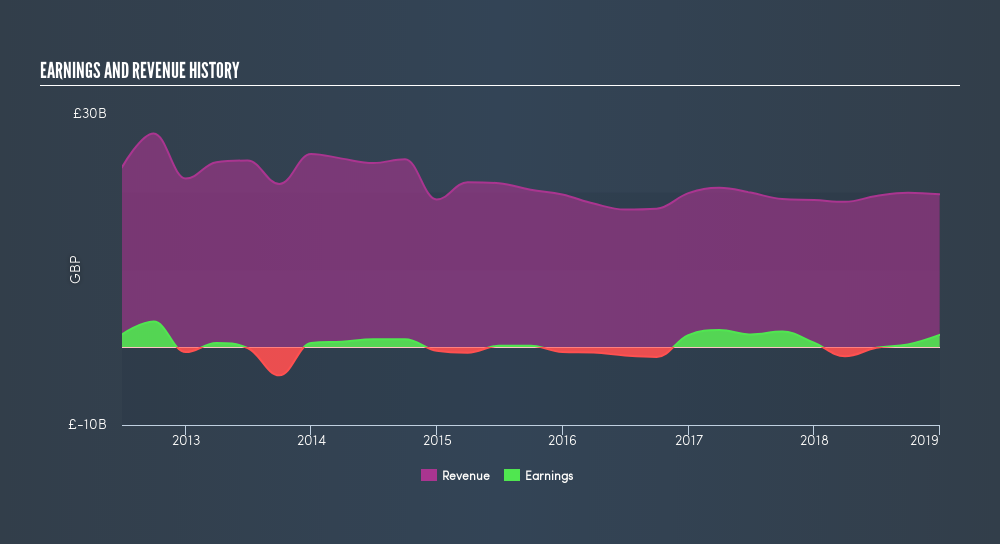

We note that the dividend has remained healthy, so that wouldn't really explain the share price drop. However, revenue has declined at a compound annual rate of 4.6% per year. With revenue weak, and increased payouts of cash, the market might be taking the view that its best days are behind it.

The chart below shows how revenue and earnings have changed with time, (if you click on the chart you can see the actual values).

It's good to see that there was some significant insider buying in the last three months. That's a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. This freereport showing analyst forecasts should help you form a view on Barclays

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Barclays the TSR over the last 5 years was -22%, which is better than the share price return mentioned above. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

Investors in Barclays had a tough year, with a total loss of 19% (including dividends), against a market gain of about 6.1%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 4.8% over the last half decade. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Barclays by clicking this link.

Barclays is not the only stock that insiders are buying. For those who like to find winning investments this freelist of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on GB exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About LSE:BARC

Barclays

Provides various financial services in the United Kingdom, Europe, the Americas, Africa, the Middle East, and Asia.

Undervalued with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives