- United Kingdom

- /

- Auto

- /

- LSE:AML

Not Many Are Piling Into Aston Martin Lagonda Global Holdings plc (LON:AML) Stock Yet As It Plummets 25%

Aston Martin Lagonda Global Holdings plc (LON:AML) shareholders that were waiting for something to happen have been dealt a blow with a 25% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 59% loss during that time.

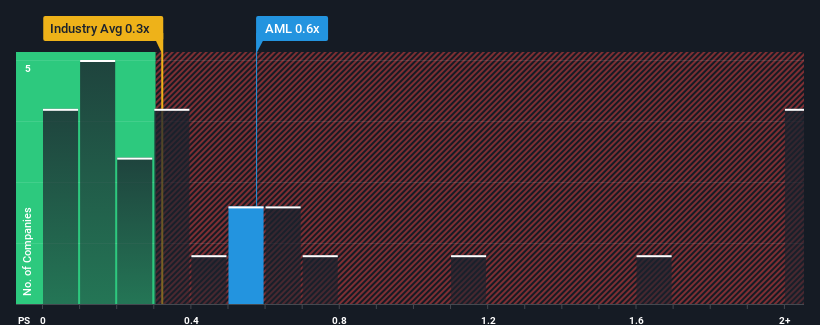

Even after such a large drop in price, there still wouldn't be many who think Aston Martin Lagonda Global Holdings' price-to-sales (or "P/S") ratio of 0.6x is worth a mention when the median P/S in the United Kingdom's Auto industry is similar at about 0.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Aston Martin Lagonda Global Holdings

How Aston Martin Lagonda Global Holdings Has Been Performing

Recent times have been advantageous for Aston Martin Lagonda Global Holdings as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Aston Martin Lagonda Global Holdings.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Aston Martin Lagonda Global Holdings' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 2.7%. This was backed up an excellent period prior to see revenue up by 62% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the nine analysts watching the company. Meanwhile, the rest of the industry is forecast to only expand by 3.2% per annum, which is noticeably less attractive.

In light of this, it's curious that Aston Martin Lagonda Global Holdings' P/S sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What Does Aston Martin Lagonda Global Holdings' P/S Mean For Investors?

Aston Martin Lagonda Global Holdings' plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Despite enticing revenue growth figures that outpace the industry, Aston Martin Lagonda Global Holdings' P/S isn't quite what we'd expect. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Aston Martin Lagonda Global Holdings that you should be aware of.

If these risks are making you reconsider your opinion on Aston Martin Lagonda Global Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:AML

Aston Martin Lagonda Global Holdings

Engages in the design, development, manufacture, and marketing of luxury sports cars in the United Kingdom, the Americas, the Middle East, Africa, rest of Europe, and the Asia Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives