- United Kingdom

- /

- Auto Components

- /

- AIM:STG

Some Confidence Is Lacking In Strip Tinning Holdings plc (LON:STG) As Shares Slide 31%

Unfortunately for some shareholders, the Strip Tinning Holdings plc (LON:STG) share price has dived 31% in the last thirty days, prolonging recent pain. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 46% share price drop.

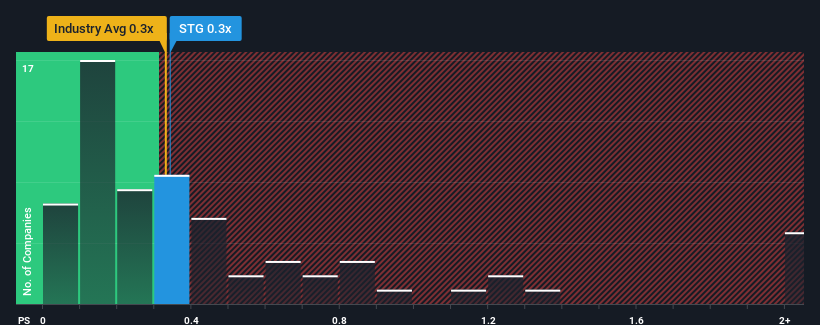

Although its price has dipped substantially, you could still be forgiven for feeling indifferent about Strip Tinning Holdings' P/S ratio of 0.3x, since the median price-to-sales (or "P/S") ratio for the Auto Components industry in the United Kingdom is also close to 0.5x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Strip Tinning Holdings

How Strip Tinning Holdings Has Been Performing

Recent times haven't been great for Strip Tinning Holdings as its revenue has been falling quicker than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. You'd much rather the company improve its revenue if you still believe in the business. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Strip Tinning Holdings.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Strip Tinning Holdings' to be considered reasonable.

Retrospectively, the last year delivered a frustrating 11% decrease to the company's top line. This has erased any of its gains during the last three years, with practically no change in revenue being achieved in total. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the one analyst covering the company suggest revenue growth is heading into negative territory, declining 6.6% over the next year. That's not great when the rest of the industry is expected to grow by 4.2%.

In light of this, it's somewhat alarming that Strip Tinning Holdings' P/S sits in line with the majority of other companies. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Strip Tinning Holdings' P/S Mean For Investors?

With its share price dropping off a cliff, the P/S for Strip Tinning Holdings looks to be in line with the rest of the Auto Components industry. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our check of Strip Tinning Holdings' analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If the declining revenues were to materialize in the form of a declining share price, shareholders will be feeling the pinch.

Before you settle on your opinion, we've discovered 3 warning signs for Strip Tinning Holdings that you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:STG

Strip Tinning Holdings

Manufactures and supplies flexible electrical connectors for heating and antennae systems embedded within automotive glazing and to the connection of the cells within electric vehicle (EV) battery packs in the United Kingdom, rest of Europe, and internationally.

Low risk and slightly overvalued.

Market Insights

Community Narratives