- United Kingdom

- /

- Insurance

- /

- AIM:PGH

IQE Leads The Charge With 2 Other Promising Penny Stocks On UK Exchange

Reviewed by Simply Wall St

The United Kingdom's market has recently faced challenges, with the FTSE 100 and FTSE 250 indices reflecting global economic concerns, especially due to weaker trade data from China. Despite these broader market pressures, certain investment opportunities remain attractive, particularly in the realm of penny stocks. While the term 'penny stocks' might seem dated, they continue to offer potential for growth and value discovery when backed by solid financial fundamentals.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Polar Capital Holdings (AIM:POLR) | £4.85 | £467.47M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.20 | £828.88M | ★★★★★★ |

| Supreme (AIM:SUP) | £1.74 | £202.9M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.415 | £347M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.9644 | £394.28M | ★★★★☆☆ |

| Stelrad Group (LSE:SRAD) | £1.48 | £188.48M | ★★★★★☆ |

| Luceco (LSE:LUCE) | £1.328 | £204.82M | ★★★★★☆ |

| Tristel (AIM:TSTL) | £4.20 | £200.13M | ★★★★★★ |

| Character Group (AIM:CCT) | £2.80 | £52.57M | ★★★★★★ |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.4745 | $275.84M | ★★★★★★ |

Click here to see the full list of 472 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

IQE (AIM:IQE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: IQE plc, along with its subsidiaries, develops, manufactures, and sells advanced semiconductor materials and has a market cap of £117.58 million.

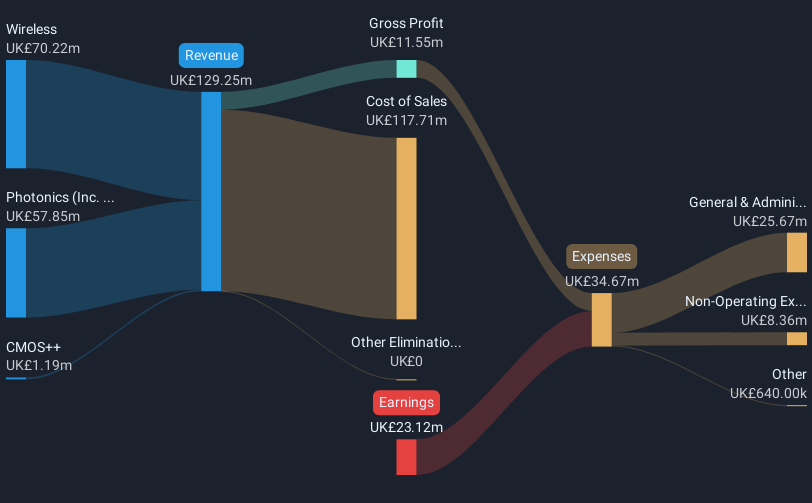

Operations: The company's revenue is derived from three segments: CMOS++ (£1.19 million), Wireless (£70.22 million), and Photonics including Infra-Red (£57.85 million).

Market Cap: £117.58M

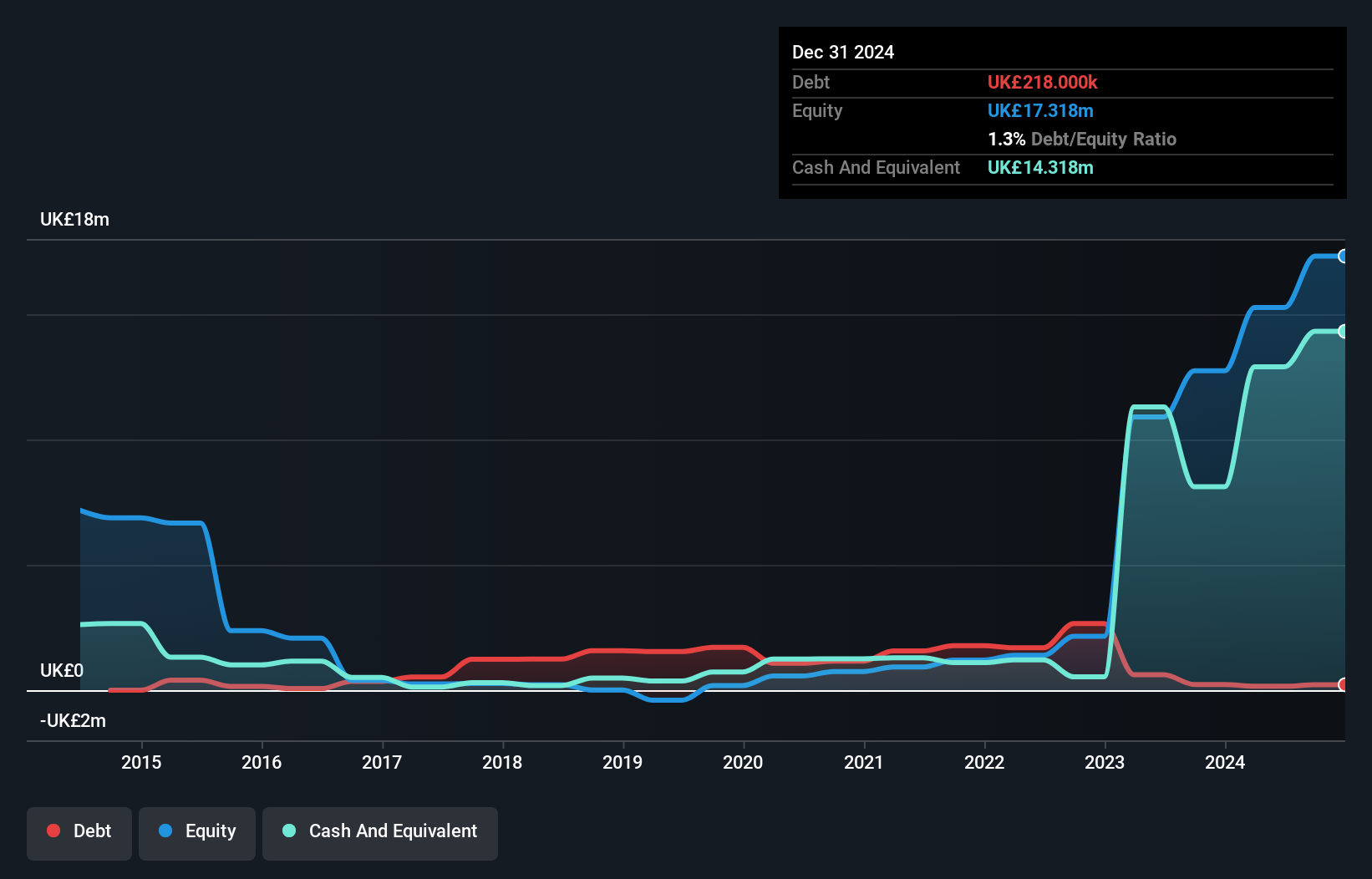

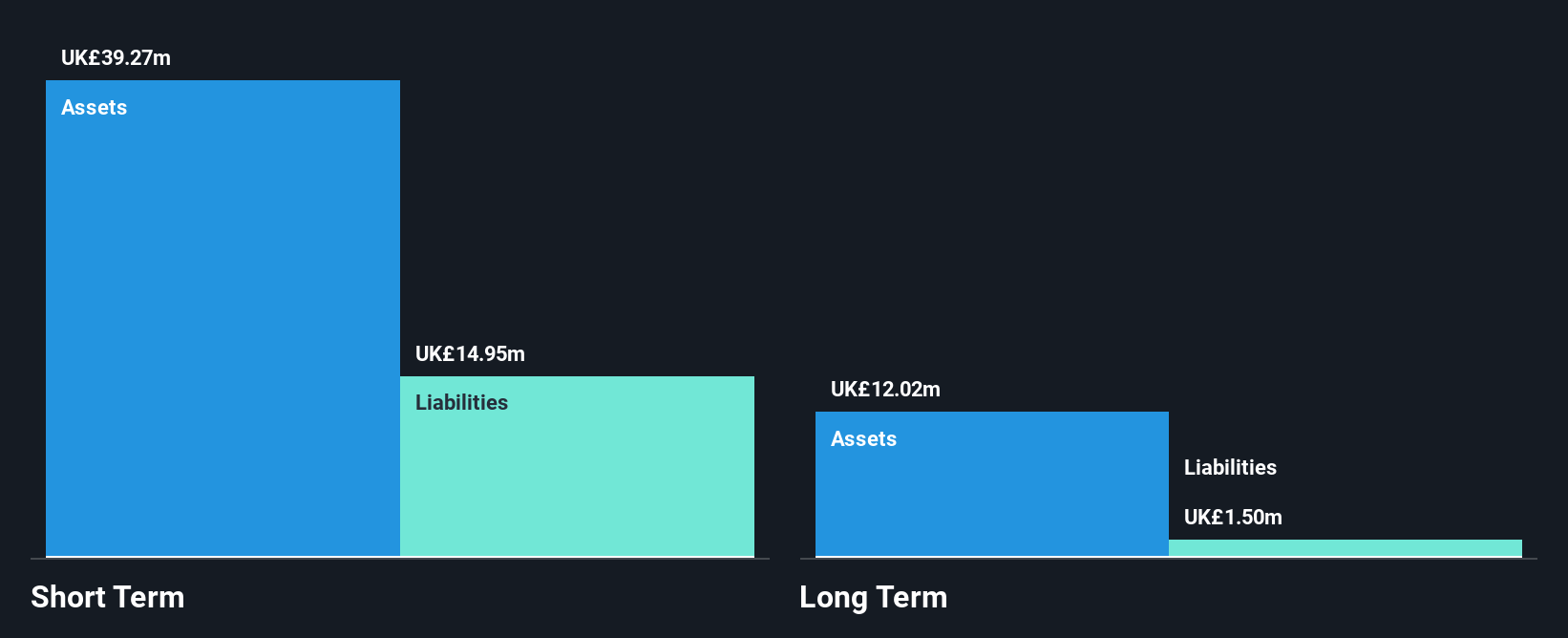

IQE plc, with a market cap of £117.58 million, has seen recent executive changes with the departure of CEO Americo Lemos and interim appointment of CFO Jutta Meier as CEO. The company remains unprofitable, reporting a net loss of £15.07 million for H1 2024 despite increased sales (£66.02 million). IQE's debt to equity ratio rose to 15.9% over five years, yet it maintains short-term asset coverage over liabilities. The stock trades significantly below estimated fair value but exhibits high volatility and negative return on equity (-14.85%). Revenue is forecasted to grow by 12.44% annually amidst these challenges.

- Get an in-depth perspective on IQE's performance by reading our balance sheet health report here.

- Evaluate IQE's prospects by accessing our earnings growth report.

Journeo (AIM:JNEO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Journeo plc offers solutions for capturing, processing, and displaying essential information to improve transport journeys in the UK and mainland Europe, with a market cap of £45.30 million.

Operations: The company's revenue is derived from three main segments: Infotec (£18.85 million), Fleet Systems (£17.69 million), and Passenger Systems (£9.62 million).

Market Cap: £45.3M

Journeo plc, with a market cap of £45.30 million, has demonstrated strong financial performance with earnings growth of 91.1% over the past year, surpassing its five-year average of 75.7%. The company's operating cash flow comfortably covers its debt and interest payments are well managed by EBIT. Journeo's short-term assets exceed both short- and long-term liabilities, indicating solid financial health. Recent half-year results show increased sales (£25.62 million) and net income (£2.52 million). The company is exploring acquisitions to expand its customer base and capabilities further enhancing shareholder value without recent dilution concerns.

- Take a closer look at Journeo's potential here in our financial health report.

- Understand Journeo's earnings outlook by examining our growth report.

Personal Group Holdings (AIM:PGH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Personal Group Holdings Plc offers benefits and platform products, pay and reward consultancy services, and salary sacrifice technology products in the United Kingdom with a market cap of £62.92 million.

Operations: The company's revenue is primarily derived from Affordable Insurance (£30.27 million), the Benefits Platform (£10.09 million), and Pay & Reward services (£2.37 million).

Market Cap: £62.92M

Personal Group Holdings Plc, with a market cap of £62.92 million, has reported improved financial results for the first half of 2024, with revenue reaching £21.04 million and net income at £1.69 million. The company has become profitable this year and maintains a debt-free balance sheet, which alleviates concerns about interest payments. Despite having high non-cash earnings and stable weekly volatility (5%), its return on equity is relatively low at 14.2%. The interim dividend increased by 11% to 6.5 pence per share, though it is not fully covered by free cash flows, raising sustainability questions.

- Click here and access our complete financial health analysis report to understand the dynamics of Personal Group Holdings.

- Gain insights into Personal Group Holdings' future direction by reviewing our growth report.

Make It Happen

- Access the full spectrum of 472 UK Penny Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:PGH

Personal Group Holdings

Provides benefits and platform products, pay and reward consultancy services, and salary sacrifice technology products in the United Kingdom.

Flawless balance sheet second-rate dividend payer.