- France

- /

- Other Utilities

- /

- ENXTPA:VIE

Veolia Environnement S.A.'s (EPA:VIE) CEO Compensation Looks Acceptable To Us And Here's Why

Veolia Environnement S.A. (EPA:VIE) has exhibited strong share price growth in the past few years. However, its earnings growth has not kept up, suggesting that there may be something amiss. The upcoming AGM on 22 April 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From what we gathered, we think shareholders should be wary of raising CEO compensation until the company shows some marked improvement.

Check out our latest analysis for Veolia Environnement

Comparing Veolia Environnement S.A.'s CEO Compensation With the industry

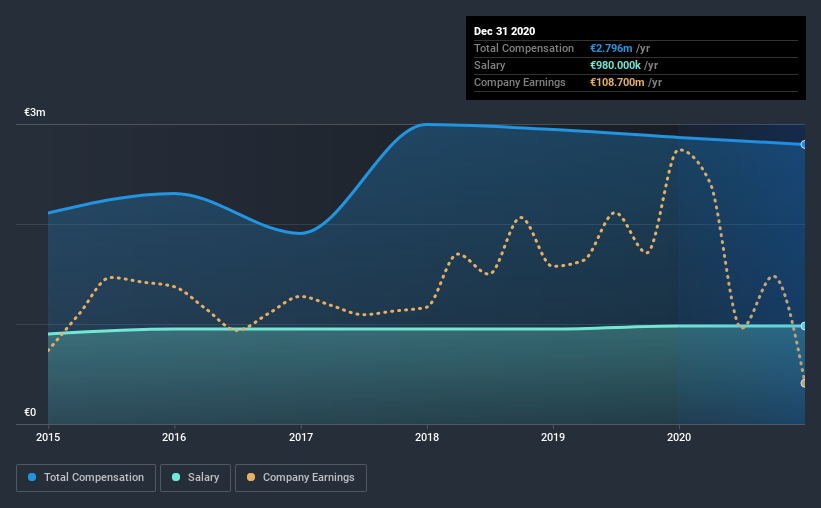

Our data indicates that Veolia Environnement S.A. has a market capitalization of €11b, and total annual CEO compensation was reported as €2.8m for the year to December 2020. This means that the compensation hasn't changed much from last year. We think total compensation is more important but our data shows that the CEO salary is lower, at €980k.

In comparison with other companies in the industry with market capitalizations over €6.7b , the reported median total CEO compensation was €3.2m. So it looks like Veolia Environnement compensates Antoine Frérot in line with the median for the industry. Furthermore, Antoine Frérot directly owns €962k worth of shares in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €980k | €980k | 35% |

| Other | €1.8m | €1.9m | 65% |

| Total Compensation | €2.8m | €2.9m | 100% |

Talking in terms of the industry, salary represented approximately 35% of total compensation out of all the companies we analyzed, while other remuneration made up 65% of the pie. Our data reveals that Veolia Environnement allocates salary more or less in line with the wider market. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

Veolia Environnement S.A.'s Growth

Veolia Environnement S.A. has reduced its earnings per share by 30% a year over the last three years. Its revenue is down 4.3% over the previous year.

The decline in EPS is a bit concerning. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future.

Has Veolia Environnement S.A. Been A Good Investment?

Boasting a total shareholder return of 41% over three years, Veolia Environnement S.A. has done well by shareholders. This strong performance might mean some shareholders don't mind if the CEO were to be paid more than is normal for a company of its size.

In Summary...

While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 5 warning signs for Veolia Environnement (1 is potentially serious!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

When trading Veolia Environnement or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:VIE

Veolia Environnement

Designs and provides water, waste, and energy management solutions.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives