- France

- /

- Other Utilities

- /

- ENXTPA:VIE

Veolia Environnement (ENXTPA:VIE) Expands with Toronto Facility and Morocco Partnership for Growth

Reviewed by Simply Wall St

Veolia Environnement (ENXTPA:VIE) continues to strengthen its market position with strategic initiatives such as the recent contract to manage Toronto's Dufferin organics processing facility and a significant seawater desalination project in Morocco. These developments align with the company's sustainability goals and promise long-term revenue streams, despite challenges such as stagnant earnings growth and high financial leverage. In the following discussion, we will explore Veolia's core advantages, critical issues, growth avenues, and external factors impacting its performance.

Navigate through the intricacies of Veolia Environnement with our comprehensive report here.

Core Advantages Driving Sustained Success for Veolia Environnement

Veolia Environnement's earnings forecast, with an expected growth rate of 12.72% annually, underscores its financial health. The company's strategic initiatives, such as the recent contract to manage Toronto's Dufferin organics processing facility, highlight its ability to secure significant projects that enhance its market position. This contract not only expands Veolia's operational footprint but also aligns with its sustainability goals by reducing greenhouse gas emissions. Additionally, the strategic partnership with Morocco to develop a massive seawater desalination project further cements its leadership in water technologies, promising long-term revenue streams.

Critical Issues Affecting the Performance of Veolia Environnement and Areas for Growth

Veolia faces challenges with stagnant earnings growth over the past year, contrasting its 5-year average of 21.2%. This stagnation, coupled with low net profit margins of 2.4%, indicates potential inefficiencies that need addressing. The company's high net debt to equity ratio of 122% also raises concerns about financial leverage. While its Price-To-Earnings Ratio of 18.9x is higher than the industry average, it remains attractive compared to peers, suggesting room for improvement in operational efficiencies to enhance profitability.

Growth Avenues Awaiting Veolia Environnement

Veolia's focus on technological investments, particularly in AI, is set to enhance operational capabilities and drive future growth. The company's commitment to expanding its product lines and exploring new markets is evident in its strategic alliances and partnerships. The anticipated revenue growth of 4.2%, although slightly below the market average, indicates a steady expansion trajectory. Analysts' prediction of a 25.3% stock price increase reflects confidence in Veolia's ability to capitalize on these opportunities.

External Factors Threatening Veolia Environnement

Veolia must navigate economic headwinds and regulatory hurdles that could impact its operations. The high level of debt not well covered by operating cash flow poses a significant threat, necessitating careful financial management. Additionally, the presence of large one-off items in financial results could obscure true performance, requiring transparency in reporting. The company must also address supply chain challenges to maintain operational efficiency and customer satisfaction.

Conclusion

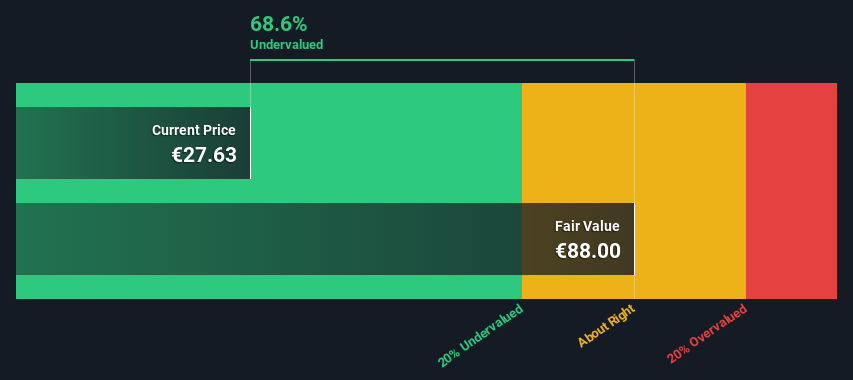

Veolia Environnement's strategic initiatives and partnerships, such as managing Toronto's Dufferin organics processing facility and the seawater desalination project in Morocco, demonstrate its capability to secure pivotal projects that align with its sustainability goals, promising significant long-term revenue streams. However, the company faces challenges with stagnant earnings growth and low profit margins, highlighting the need for improved operational efficiencies, especially given its high net debt to equity ratio of 122%. Despite being considered expensive with a Price-To-Earnings Ratio of 18.9x compared to the industry average, Veolia remains attractive relative to its peers and is trading below its estimated fair value, suggesting potential for stock price appreciation. The focus on AI and technological investments, along with a predicted 25.3% stock price increase, indicates confidence in Veolia's ability to navigate external threats and capitalize on growth opportunities, ensuring a steady expansion trajectory.

Next Steps

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

If you're looking to trade Veolia Environnement, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About ENXTPA:VIE

Veolia Environnement

Designs and provides water, waste, and energy management solutions.

Proven track record average dividend payer.

Similar Companies

Market Insights

Community Narratives