- France

- /

- Other Utilities

- /

- ENXTPA:ENGI

What Engie (ENXTPA:ENGI)'s $900 Million Swenson Ranch Solar Deal With Meta Means For Shareholders

Reviewed by Sasha Jovanovic

- Meta announced it will purchase 100% of the output from ENGIE's new 600 MW Swenson Ranch Solar project in Stonewall County, Texas, which is now ENGIE’s largest U.S. renewable asset and is set to begin operation in 2027.

- This agreement marks over 1.3 GW of renewable power purchase commitments between ENGIE and Meta, underscoring the energy demand of large-scale data centers and ENGIE’s growing foothold in the expanding U.S. renewables market.

- We’ll now examine how ENGIE’s US$900 million Swenson Ranch solar project commitment with Meta supports its long-term renewable growth outlook.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Engie Investment Narrative Recap

Owning Engie shares means believing that the long-term shift to renewable energy and surging power demand from sectors like data centers can drive sustainable growth, even as utility earnings face pressure from lower wholesale prices and FX headwinds. The recent PPA with Meta underpins Engie's US renewables pipeline, but its near-term impact on core earnings catalysts and margin risks appears limited, as larger forces like price normalization and U.S. policy uncertainty continue to weigh more heavily on results.

Among recent company updates, Engie's July announcement of the Red Sea wind farm achieving full commissioning in Egypt is most relevant. It highlights Engie's ability to execute large-scale renewable projects internationally, echoing the Swenson Ranch solar project's significance as a catalyst in expanding Engie's renewables presence and asset base.

By contrast, investors should be aware of how evolving U.S. policy and regulatory hurdles could materially affect returns on new projects like Swenson Ranch, potentially impacting...

Read the full narrative on Engie (it's free!)

Engie's outlook suggests forecast revenues of €75.8 billion and earnings of €4.5 billion by 2028. This scenario assumes a -0.6% annual decline in revenue and a decrease in earnings of €0.5 billion from the current €5.0 billion.

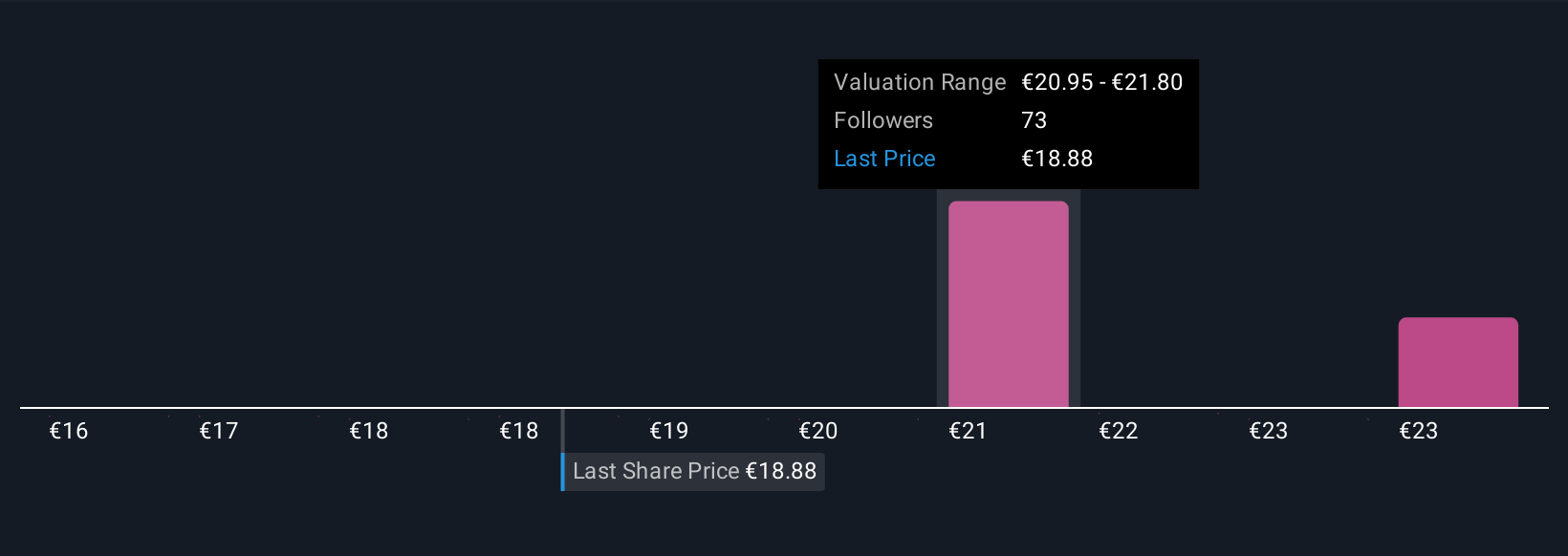

Uncover how Engie's forecasts yield a €21.47 fair value, a 7% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community provided fair value targets for Engie ranging from €17.51 to €24.34 per share. While many see promise in expanding renewable assets, some remain wary of execution and regulatory risks affecting future outcomes.

Explore 6 other fair value estimates on Engie - why the stock might be worth 13% less than the current price!

Build Your Own Engie Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Engie research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Engie research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Engie's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Engie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ENGI

Engie

Operates as an energy company, engages in the renewables and decentralized, low-carbon energy networks, and energy services businesses in France, Europe, North America, Asia, the Middle East, Oceania, South America, Africa, and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives