- France

- /

- Other Utilities

- /

- ENXTPA:ENGI

Engie Shares Surge 35% as Renewables Policy Boosts Growth Prospects in 2025

Reviewed by Bailey Pemberton

If you are weighing what to do with Engie shares right now, you are far from alone. The stock has delivered impressive returns lately, climbing 7.4% in the last month and notching a remarkable 35.5% gain over the past year. Even more striking is Engie’s long-term trajectory, with the stock up nearly 172% over five years. That kind of steady value creation naturally raises the question: is there still more room for growth, or is the market finally catching up with Engie’s true worth?

Some of this price momentum stems from investors responding to positive changes in the European energy landscape. Recent policy shifts toward renewables and the acceleration of infrastructure investments have played in Engie’s favor, positioning the company for solid long-term prospects. News around expanded wind and solar projects, as well as fresh government incentives, continues to boost confidence in the stock and may explain part of this year’s upward swing, with a 26.5% gain year-to-date.

However, even with all the excitement, the real decision for investors comes down to value. Engie’s valuation score stands at 4 out of 6 possible checks, pointing to clear signs that the company remains undervalued on several important measures. But how reliable are these traditional valuation checks, and could there be an even sharper way to gauge what Engie is truly worth? Let’s break down the numbers and hint at a smarter approach you will not want to miss by the end of this article.

Approach 1: Engie Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting its expected future free cash flows and discounting them back to today's value in euro. This offers a grounded perspective on what the entire business could be worth, based on its ability to generate cash over time.

For Engie, the starting point is its latest twelve-month Free Cash Flow, which stands at negative €6.64 billion, a low base reflecting recent reinvestments and sector volatility. However, projections suggest a swift turnaround, with analysts forecasting annual free cash flow growth. By 2029, Engie's Free Cash Flow is expected to reach €2.42 billion, while the ten-year outlook, extrapolated by Simply Wall St, shows further, steady increases year by year.

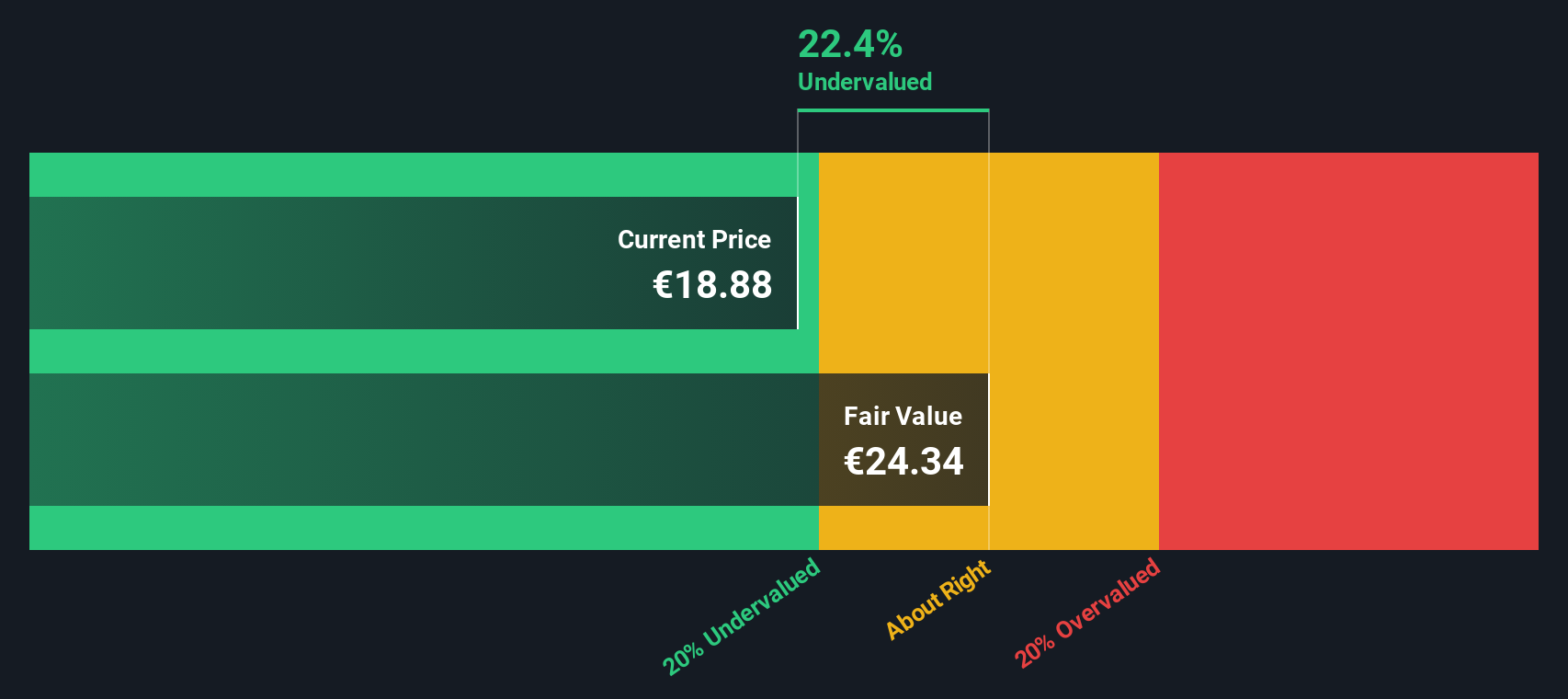

The DCF analysis arrives at an estimated fair value of €24.34 per share for Engie. Compared to the current share price, this implies a 19.3% discount, meaning the stock is potentially undervalued based on cash flow prospects and the assumptions baked into the model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Engie is undervalued by 19.3%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Engie Price vs Earnings

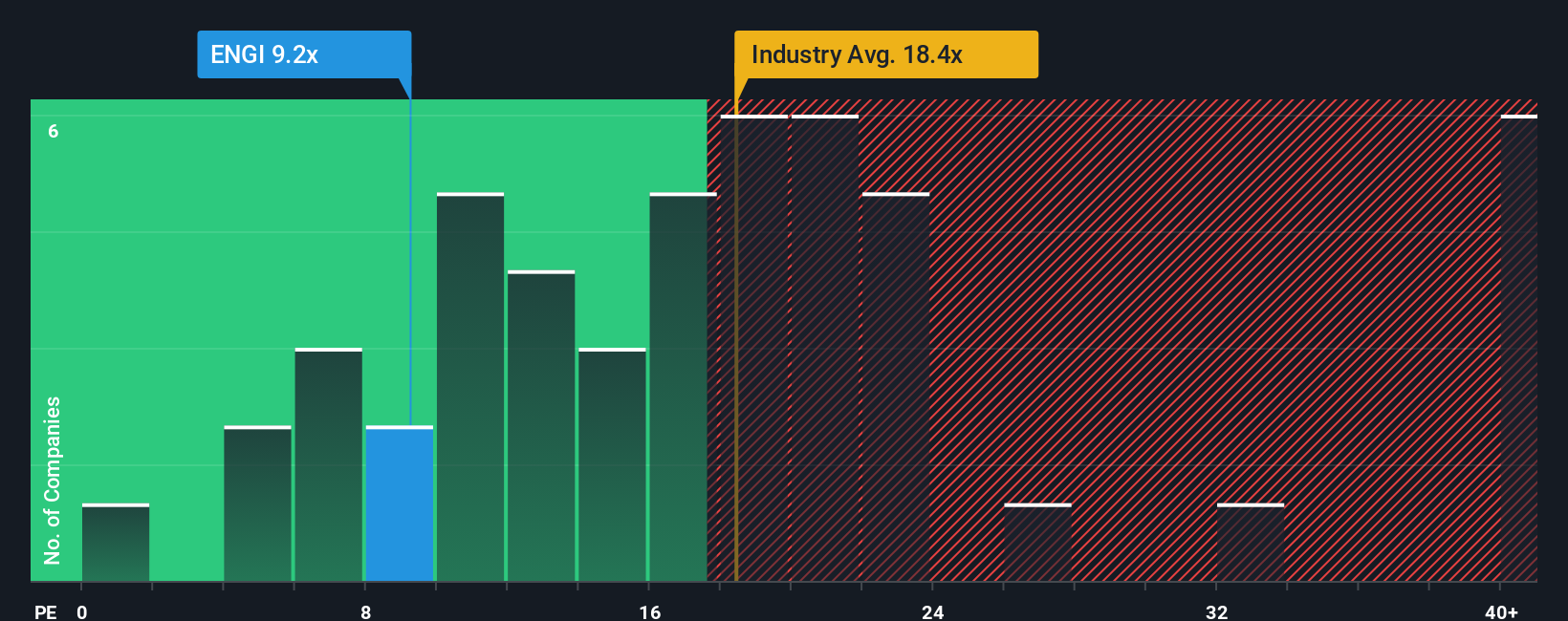

For profitable companies like Engie, the Price-to-Earnings (PE) ratio is a widely accepted measure of value. It allows investors to see how much they are paying for each euro of current earnings, making it a solid starting point to compare Engie to its peers and the wider Integrated Utilities industry.

Growth expectations and risk play a major role in setting a “normal” or “fair” PE ratio. In general, faster-growing and less risky companies are worth a higher PE, while slower growth or more risk tends to push that number down. That is why it is important to look beyond just the headline multiple and dig into the context behind it.

Engie is currently trading at a 9.6x PE, noticeably lower than the industry average of 18.3x and the peer average of 18.6x. While this initially makes Engie look cheap, it is important to introduce the concept of a “Fair Ratio.” Simply Wall St’s proprietary Fair Ratio for Engie is calculated at 16.4x. This figure is more insightful than simple industry or peer averages, as it reflects Engie’s specific earnings growth forecast, profit margin, market cap, and sector risks.

Comparing Engie’s actual PE (9.6x) to its Fair Ratio (16.4x) shows the stock is trading at a meaningful discount. This suggests the market may be undervaluing Engie based on its individual risk and growth profile, not just broad comparisons.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Engie Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, interactive way for you to connect your personal perspective or story about a company, such as your beliefs about Engie’s strategy, earnings growth, or sector trends, to your own forecast for its future revenue, earnings, and margins. You can then see what these mean for its fair value today.

Narratives link a company’s fundamental story directly to numbers and valuation, helping you visualize how your expectations compare to the current market price. On Simply Wall St’s Community page, millions of investors use Narratives to easily input their view of Engie’s future, see the resulting fair value, and then decide whether to buy, hold, or sell.

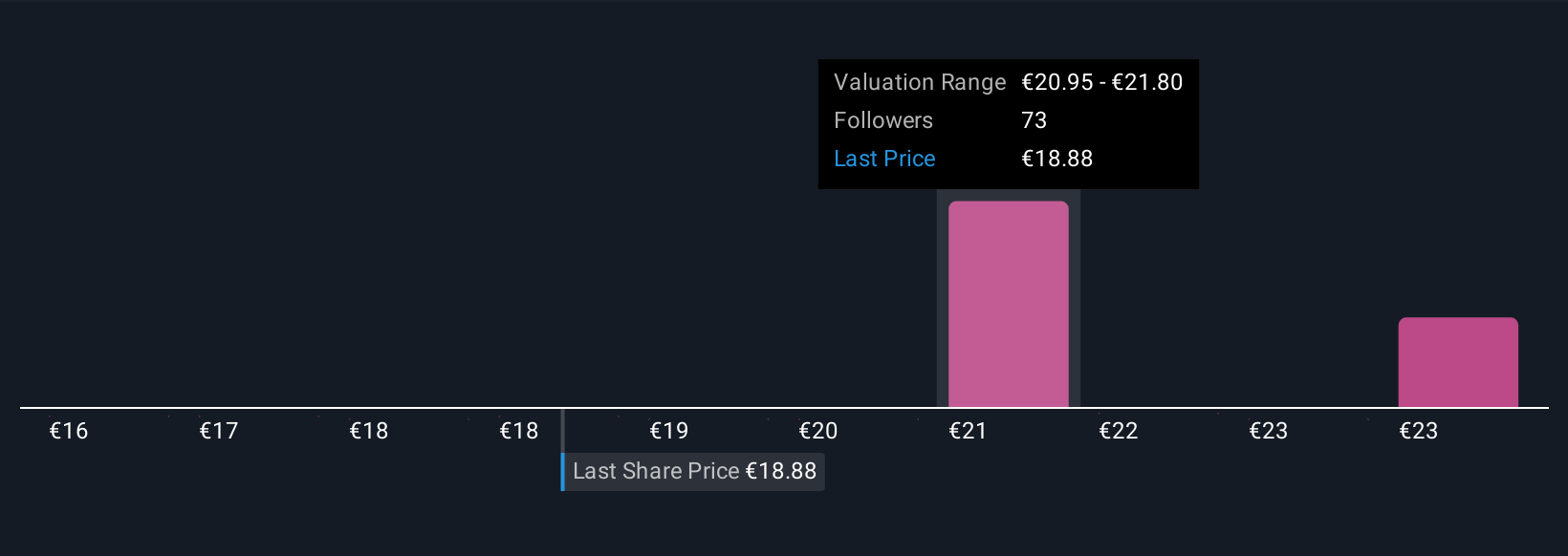

The power of Narratives is that they update automatically as new news or earnings come in, keeping your investment thesis live and current. For example, one investor might believe Engie’s profit margins will shrink and estimate a fair value near the most bearish analyst target of €17.5. Another might see long-term renewables tailwinds and assign a fair value closer to the bullish €24.0 target. With Narratives, you see your reasoning and fair value side-by-side with others', making more confident, personalized decisions as the facts evolve.

Do you think there's more to the story for Engie? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Engie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ENGI

Engie

Operates as an energy company, engages in the renewables and decentralized, low-carbon energy networks, and energy services businesses in France, Europe, North America, Asia, the Middle East, Oceania, South America, Africa, and internationally.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives