- France

- /

- Other Utilities

- /

- ENXTPA:ENGI

Engie (ENXTPA:ENGI): Exploring Valuation After Recent Share Price Movements Without Major News

Reviewed by Simply Wall St

If you have been watching Engie (ENXTPA:ENGI), the recent movement in its share price might catch your eye. There has not been a headline event driving the action, so the stock’s latest shift raises the usual questions: are investors starting to see something others do not, or is this just the ebb and flow of market sentiment? When shares move without a major news catalyst, it often prompts people to check if there is a story in the numbers that is not being talked about yet.

Looking at Engie’s performance over the past year, the stock has shown meaningful growth, gaining 21% for investors while oscillating through short-term ups and downs. Its three- and five-year gains have also outpaced many peers. Even with modest revenue growth and a slight dip in net profits annually, the company’s shares have continued to build momentum over the longer term, despite a recent pullback in the last month and quarter.

With no clear event triggering these movements, the big question is whether Engie is now offering a true value opportunity, or if the market is simply betting early on further growth to come. What’s it going to be?

Most Popular Narrative: 16.4% Undervalued

The dominant narrative suggests that Engie is undervalued by a significant margin, based on analyst expectations for future performance, structural industry changes, and resilient cash flows.

"Strategic expansion in renewables and energy storage, highlighted by nearly 53 GW of installed renewables/BESS capacity and a 118 GW development pipeline diversified across multiple geographies, positions Engie to capture an outsized share of the multi-decade shift to clean energy, supporting sustainable top-line and earnings growth."

Curious about how analysts see Engie’s future? There’s one detail, hidden among aggressive growth targets and controversial market expectations, that underpins this bold undervaluation call. What bold financial leap do the numbers reveal? The answer might challenge everything you expect about where this stock could go next.

Result: Fair Value of €21.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, shifting energy prices and unpredictable currency fluctuations could quickly reverse optimism. This reminds investors that risks may alter the company’s growth trajectory.

Find out about the key risks to this Engie narrative.Another View: What the DCF Model Suggests

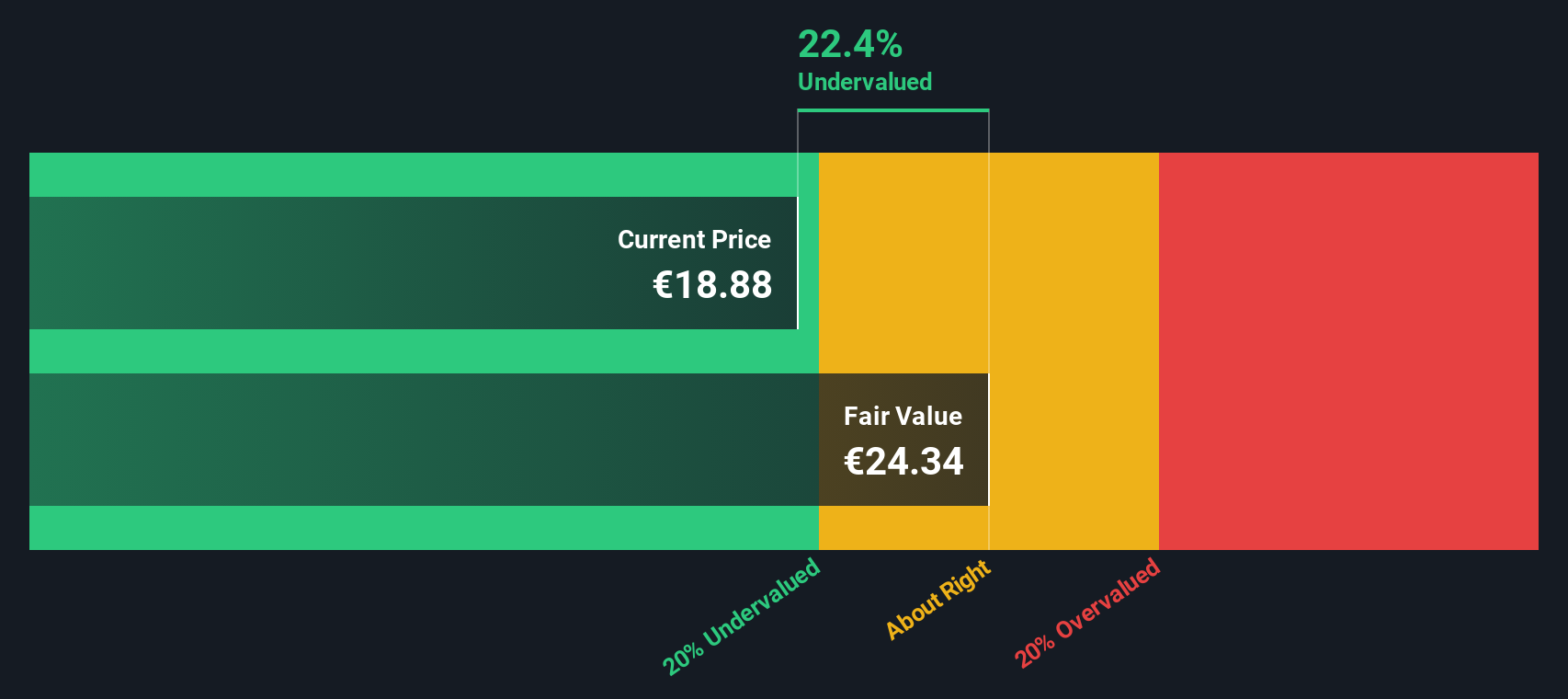

Looking at things from the perspective of our DCF model paints a similar story and suggests Engie is still trading below its estimated fair value. But do both valuations capture all the risks, or could one be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Engie for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Engie Narrative

If these conclusions do not quite fit your perspective, or you like to draw your own insights from the numbers, you can quickly develop a personal view in just a few minutes. Do it your way.

A great starting point for your Engie research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment opportunities?

Smart investors always keep an eye on what’s next. Stay ahead of the curve and target stocks shaping the future with these hand-picked ideas.

- Uncover stocks offering remarkable value. Start growing your watchlist by searching for undervalued stocks based on cash flows and find companies overlooked by the market.

- Charge into next-generation tech with AI penny stocks and back pioneers building tomorrow’s artificial intelligence breakthroughs today.

- Strengthen your portfolio with reliable income by tapping into dividend stocks with yields > 3% that regularly deliver robust yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Engie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About ENXTPA:ENGI

Engie

Operates as an energy company, engages in the renewables and decentralized, low-carbon energy networks, and energy services businesses in France, Europe, North America, Asia, the Middle East, Oceania, South America, Africa, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives