- France

- /

- Other Utilities

- /

- ENXTPA:ENGI

Engie (ENXTPA:ENGI): Assessing Valuation After Major Renewable Energy Deals With Apple and AstraZeneca

Reviewed by Simply Wall St

Engie (ENXTPA:ENGI) is in the spotlight after announcing major renewable energy agreements with Apple and AstraZeneca, and confirming improved financial guidance for 2025. These moves underscore the company's expanding global green energy footprint.

See our latest analysis for Engie.

Recent momentum in Engie's share price has been impressive, with a 1-month return of nearly 11% and a year-to-date gain above 40%. The company continues to land major renewable energy agreements and deliver upbeat guidance. That strength caps off an even bigger long-term story, with total shareholder return reaching 54% over the past year and soaring 163% over five years. This reflects building investor confidence in Engie's global green energy push.

If you’re looking to spot other companies making bold moves in the energy transition, now’s a smart time to discover fast growing stocks with high insider ownership

With strong share price gains and promising financial guidance, the big question now is whether Engie’s recent momentum presents a rare buying opportunity, or if the market has already factored future growth into the stock price.

Most Popular Narrative: Fairly Valued

With Engie's fair value estimate of €21.48 nearly matching the last close of €21.80, sentiment is at a crossroads as investors weigh growth tailwinds against normalizing energy markets. The stage is set to examine what is really powering this equilibrium view on valuation.

Strategic expansion in renewables and energy storage, highlighted by nearly 53 GW of installed renewables/BESS capacity and a 118 GW development pipeline diversified across multiple geographies, positions Engie to capture an outsized share of the multi-decade shift to clean energy, supporting sustainable top-line and earnings growth.

Want to know what lies beneath this razor-sharp valuation call? The narrative hinges on an ambitious growth pipeline and long-term profitability targets that rival the sector’s heaviest hitters. Curious how future earnings projections and a bold profit multiple build the case for Engie’s current share price? Find out what else could change the story.

Result: Fair Value of €21.48 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent pressure on margins from normalizing energy markets and the risk of regulatory uncertainty could quickly shift sentiment and challenge current valuations.

Find out about the key risks to this Engie narrative.

Another View: What Do Earnings Multiples Say?

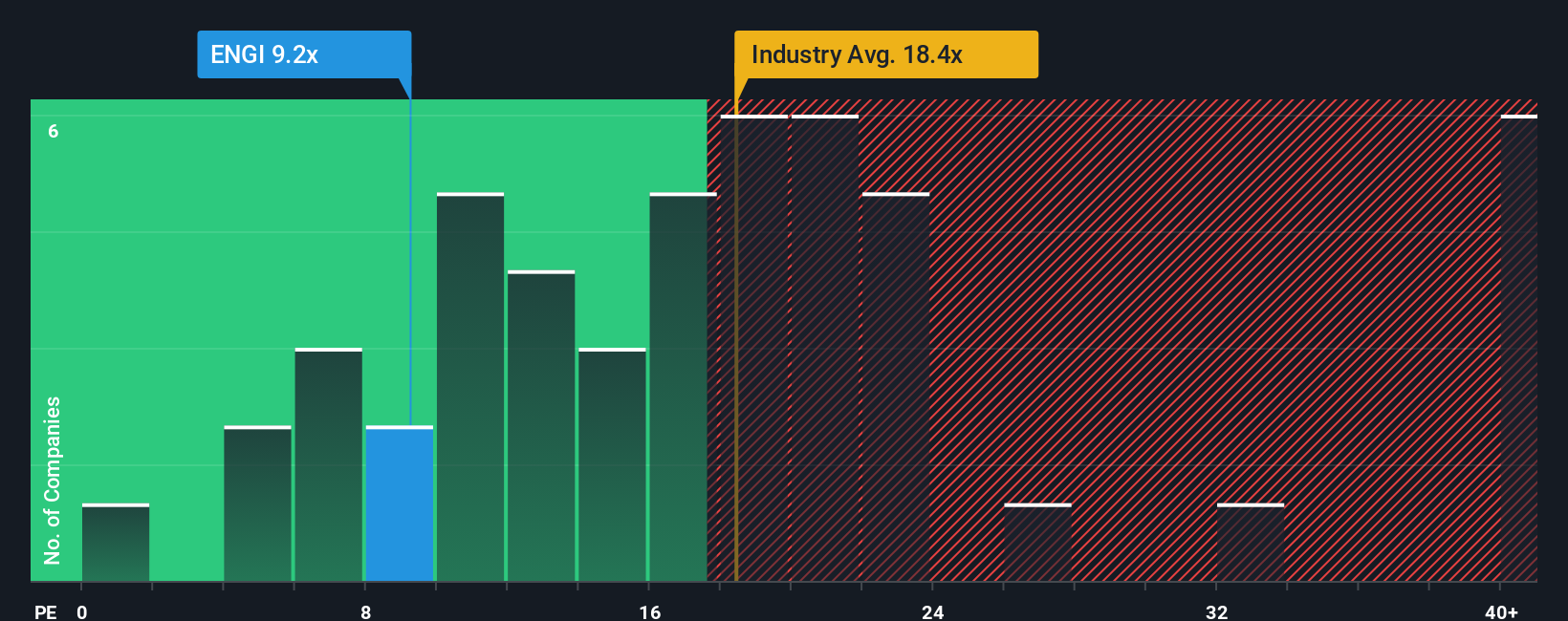

Looking beyond fair value estimates, Engie's earnings multiple of 10.7x stands out as notably lower than the global industry average of 18.2x, its peer group’s 21.5x, and even the fair ratio of 14.1x. This discount may signal opportunity, but could it just as easily be a warning?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Engie Narrative

If you have your own perspective or want to examine the numbers firsthand, it takes just minutes to build your own view and shape the narrative, so why not Do it your way

A great starting point for your Engie research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Don’t miss out on high-potential stocks. Use the Simply Wall Street Screener to spot fresh investment ideas shaping tomorrow’s market leaders right now.

- Accelerate your portfolio’s growth by targeting strong cash flow potential with these 886 undervalued stocks based on cash flows and catch companies the market is overlooking.

- Power up your returns with secure income. Uncover better-than-average yields with these 16 dividend stocks with yields > 3% among reliable dividend payers.

- Get in early on futuristic breakthroughs by tapping into these 25 AI penny stocks that are driving the next wave of artificial intelligence innovation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Engie might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ENGI

Engie

Operates as an energy company, engages in the renewables and decentralized, low-carbon energy networks, and energy services businesses in France, Europe, North America, Asia, the Middle East, Oceania, South America, Africa, and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Community Narratives