- France

- /

- Electric Utilities

- /

- ENXTPA:ELEC

Here's Why Électricite de Strasbourg Société Anonyme (EPA:ELEC) Has A Meaningful Debt Burden

Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. Importantly, Électricite de Strasbourg Société Anonyme (EPA:ELEC) does carry debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

Check out our latest analysis for Électricite de Strasbourg Société Anonyme

What Is Électricite de Strasbourg Société Anonyme's Debt?

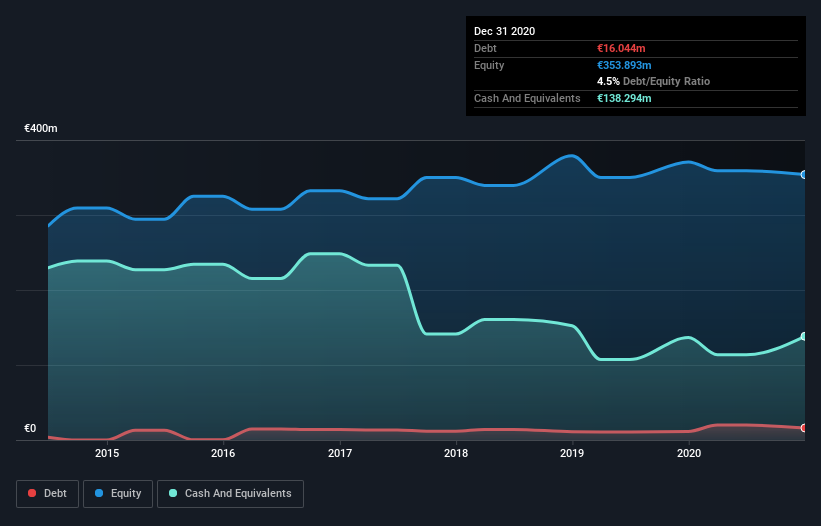

As you can see below, Électricite de Strasbourg Société Anonyme had €6.92m of debt at December 2020, down from €11.4m a year prior. But it also has €138.3m in cash to offset that, meaning it has €131.4m net cash.

A Look At Électricite de Strasbourg Société Anonyme's Liabilities

The latest balance sheet data shows that Électricite de Strasbourg Société Anonyme had liabilities of €329.0m due within a year, and liabilities of €1.02b falling due after that. On the other hand, it had cash of €138.3m and €258.7m worth of receivables due within a year. So it has liabilities totalling €947.1m more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of €824.5m, we think shareholders really should watch Électricite de Strasbourg Société Anonyme's debt levels, like a parent watching their child ride a bike for the first time. In the scenario where the company had to clean up its balance sheet quickly, it seems likely shareholders would suffer extensive dilution. Given that Électricite de Strasbourg Société Anonyme has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

The modesty of its debt load may become crucial for Électricite de Strasbourg Société Anonyme if management cannot prevent a repeat of the 21% cut to EBIT over the last year. When a company sees its earnings tank, it can sometimes find its relationships with its lenders turn sour. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since Électricite de Strasbourg Société Anonyme will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Électricite de Strasbourg Société Anonyme may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. In the last three years, Électricite de Strasbourg Société Anonyme's free cash flow amounted to 49% of its EBIT, less than we'd expect. That's not great, when it comes to paying down debt.

Summing up

While Électricite de Strasbourg Société Anonyme does have more liabilities than liquid assets, it also has net cash of €131.4m. So although we see some areas for improvement, we're not too worried about Électricite de Strasbourg Société Anonyme's balance sheet. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. We've identified 3 warning signs with Électricite de Strasbourg Société Anonyme (at least 1 which is a bit concerning) , and understanding them should be part of your investment process.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Électricite de Strasbourg Société Anonyme, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Électricite de Strasbourg Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme

Engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.