- France

- /

- Electric Utilities

- /

- ENXTPA:ELEC

3 European Dividend Stocks Yielding Up To 6.7%

Reviewed by Simply Wall St

Amid easing trade tensions and optimism over potential U.S. interest rate cuts, European markets have shown resilience, with the STOXX Europe 600 Index rising by 1.18%. This positive sentiment provides a favorable backdrop for investors seeking dividend stocks, which can offer stable income streams even in fluctuating market conditions.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.18% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.61% | ★★★★★☆ |

| Telekom Austria (WBAG:TKA) | 4.17% | ★★★★★☆ |

| Rubis (ENXTPA:RUI) | 6.94% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.62% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 4.95% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.03% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.62% | ★★★★★★ |

| CaixaBank (BME:CABK) | 6.56% | ★★★★★☆ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.70% | ★★★★★☆ |

Click here to see the full list of 216 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

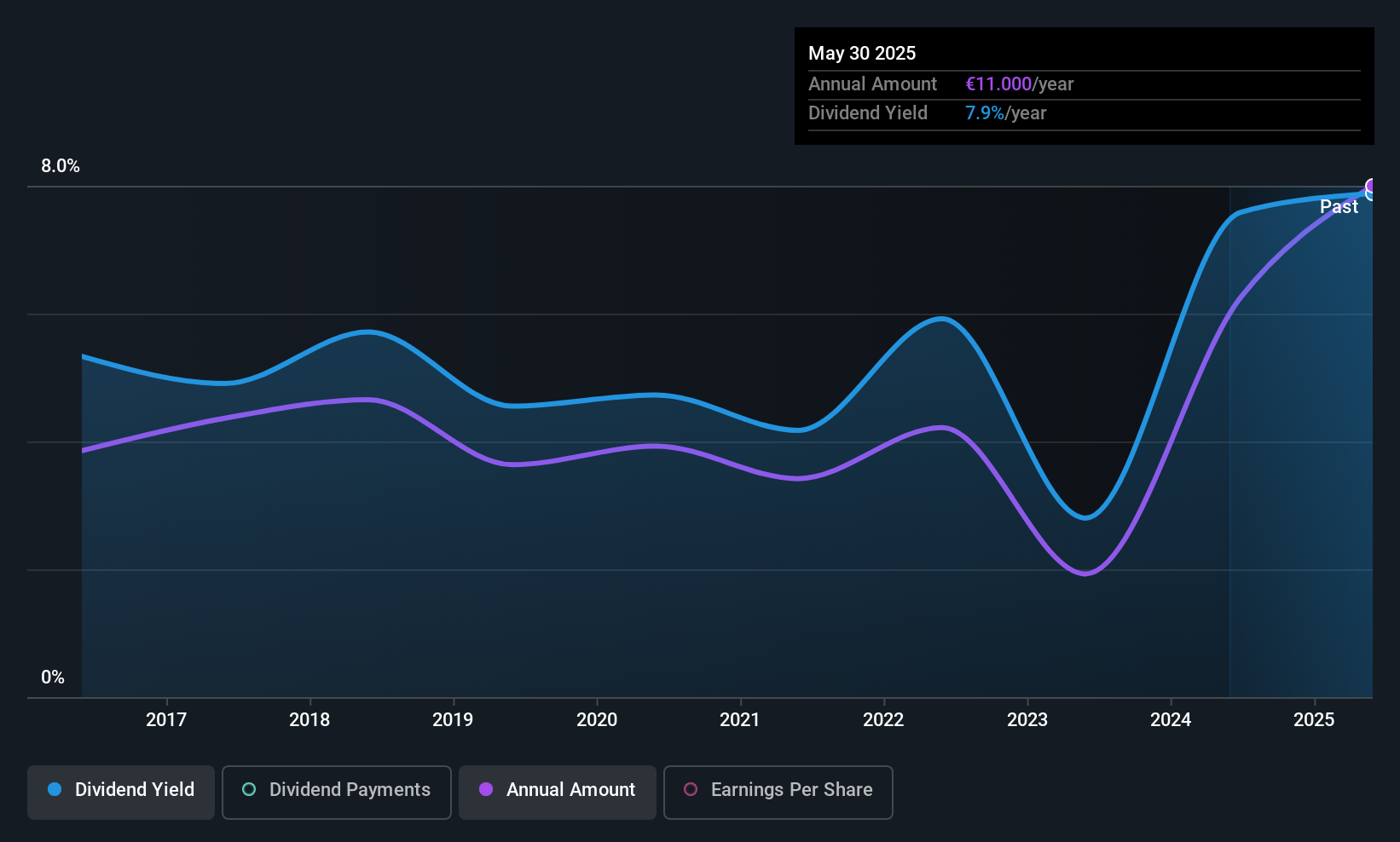

Électricite de Strasbourg Société Anonyme (ENXTPA:ELEC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Électricite de Strasbourg Société Anonyme supplies electricity and natural gas to individuals, businesses, and local authorities in France, with a market cap of €1.18 billion.

Operations: Électricite de Strasbourg Société Anonyme generates revenue primarily from the production and marketing of electricity and gas (€1.12 billion) and the consumption of electricity and gas (€311.39 million).

Dividend Yield: 6.7%

Électricité de Strasbourg Société Anonyme offers a compelling dividend yield of 6.71%, ranking in the top 25% of French dividend payers. Despite its attractive valuation, trading significantly below estimated fair value, its dividend history is marred by volatility, with significant annual drops over the past decade. However, dividends are well-covered by earnings and cash flows with payout ratios of 52.4% and 71%, respectively, indicating current sustainability despite past instability in payments.

- Delve into the full analysis dividend report here for a deeper understanding of Électricite de Strasbourg Société Anonyme.

- In light of our recent valuation report, it seems possible that Électricite de Strasbourg Société Anonyme is trading behind its estimated value.

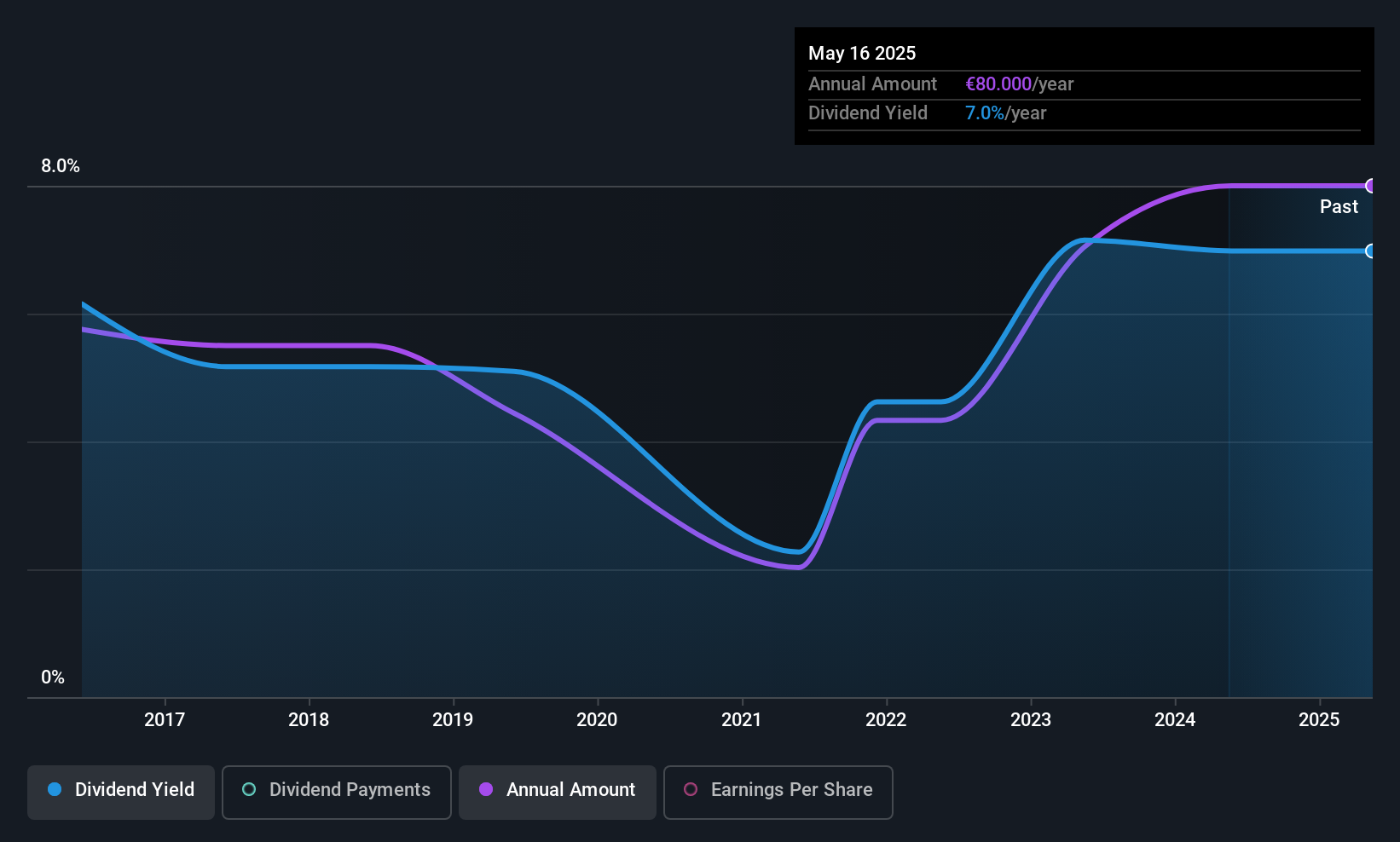

CFM Indosuez Wealth Management (ENXTPA:MLCFM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CFM Indosuez Wealth Management SA, along with its subsidiaries, offers banking and financial solutions in Monaco and internationally, with a market cap of €727.71 million.

Operations: CFM Indosuez Wealth Management SA generates revenue primarily from its Wealth Management segment, which accounted for €196.43 million.

Dividend Yield: 6.1%

CFM Indosuez Wealth Management provides a notable dividend yield of 6.14%, placing it among the top 25% of French dividend payers. It maintains a reasonable payout ratio of 73.6%, suggesting dividends are covered by earnings, yet its historical volatility raises concerns about reliability. The price-to-earnings ratio is favorable at 12.3x compared to the broader French market's 16.3x, indicating potential value, though its allowance for bad loans remains low at 48%.

- Unlock comprehensive insights into our analysis of CFM Indosuez Wealth Management stock in this dividend report.

- In light of our recent valuation report, it seems possible that CFM Indosuez Wealth Management is trading beyond its estimated value.

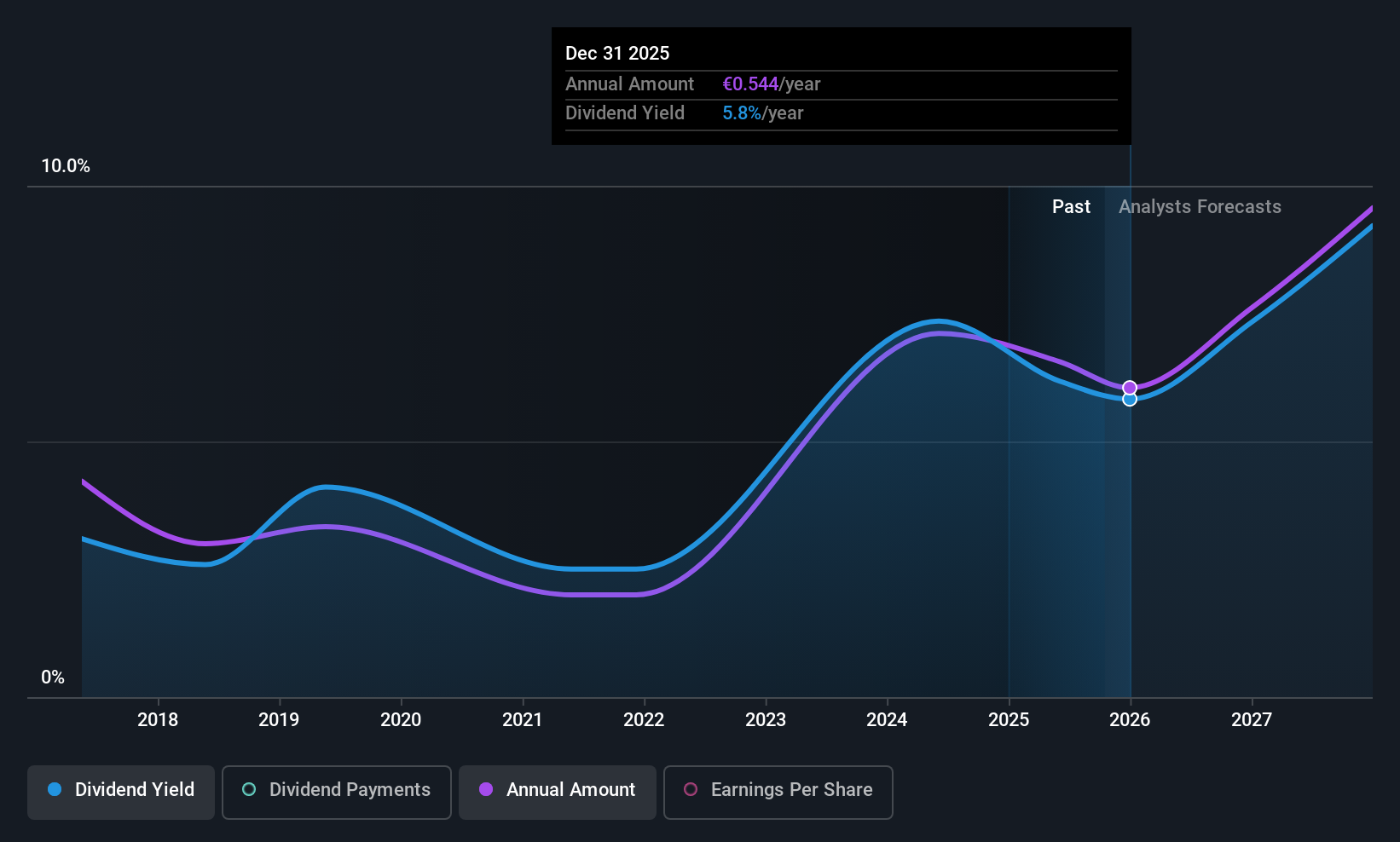

ProCredit Holding (XTRA:PCZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ProCredit Holding AG, with a market cap of €587.81 million, operates as a commercial bank offering products and services to small and medium enterprises and private customers across Europe, South America, and Germany.

Operations: ProCredit Holding AG generates its revenue primarily from its banking segment, totaling €449.56 million.

Dividend Yield: 5.9%

ProCredit Holding AG offers a competitive dividend yield of 5.91%, ranking it in the top 25% of German dividend payers. Despite a history of volatility and only eight years of payments, dividends are currently well covered by earnings with a payout ratio of 37.1%. The recent decrease to EUR 0.59 per share reflects strategic alignment with their policy, distributing one third of consolidated results amid positive business developments despite declining net income and interest income for H1 2025.

- Click here to discover the nuances of ProCredit Holding with our detailed analytical dividend report.

- Upon reviewing our latest valuation report, ProCredit Holding's share price might be too pessimistic.

Seize The Opportunity

- Reveal the 216 hidden gems among our Top European Dividend Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Électricite de Strasbourg Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ELEC

Électricite de Strasbourg Société Anonyme

Engages in the supply of electricity and natural gas to individuals, businesses, and local authorities in France.

Solid track record with excellent balance sheet and pays a dividend.

Market Insights

Community Narratives