Financière de l'Odet (EPA:ODET) Takes On Some Risk With Its Use Of Debt

Legendary fund manager Li Lu (who Charlie Munger backed) once said, 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital. So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. Importantly, Financière de l'Odet SA (EPA:ODET) does carry debt. But the real question is whether this debt is making the company risky.

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Financière de l'Odet

What Is Financière de l'Odet's Debt?

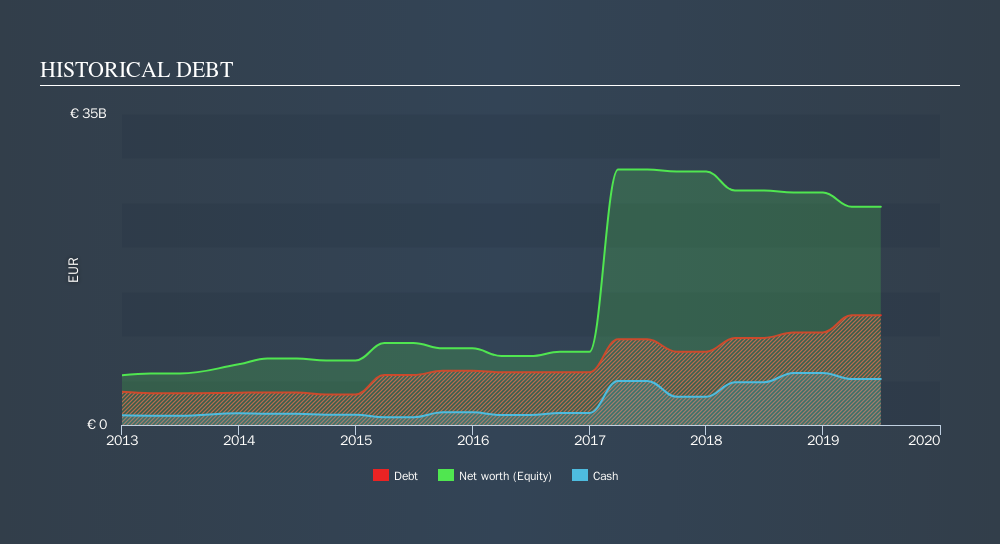

The image below, which you can click on for greater detail, shows that at June 2019 Financière de l'Odet had debt of €12.4b, up from €9.80b in one year. However, it does have €5.17b in cash offsetting this, leading to net debt of about €7.18b.

A Look At Financière de l'Odet's Liabilities

We can see from the most recent balance sheet that Financière de l'Odet had liabilities of €15.4b falling due within a year, and liabilities of €16.1b due beyond that. Offsetting this, it had €5.17b in cash and €7.96b in receivables that were due within 12 months. So its liabilities total €18.4b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the €3.48b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet." So we'd watch its balance sheet closely, without a doubt After all, Financière de l'Odet would likely require a major re-capitalisation if it had to pay its creditors today.

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Financière de l'Odet has a debt to EBITDA ratio of 2.6, which signals significant debt, but is still pretty reasonable for most types of business. But its EBIT was about 13.3 times its interest expense, implying the company isn't really paying full freight on that debt. Even if not sustainable, that is a good sign. Importantly, Financière de l'Odet grew its EBIT by 31% over the last twelve months, and that growth will make it easier to handle its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Financière de l'Odet's earnings that will influence how the balance sheet holds up in the future. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So the logical step is to look at the proportion of that EBIT that is matched by actual free cash flow. During the last three years, Financière de l'Odet produced sturdy free cash flow equating to 64% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

We feel some trepidation about Financière de l'Odet's difficulty level of total liabilities, but we've got positives to focus on, too. To wit both its interest cover and EBIT growth rate were encouraging signs. Looking at all the angles mentioned above, it does seem to us that Financière de l'Odet is a somewhat risky investment as a result of its debt. Not all risk is bad, as it can boost share price returns if it pays off, but this debt risk is worth keeping in mind. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Financière de l'Odet's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ENXTPA:ODET

Compagnie de l'Odet

Operates transportation and logistics, communication, and industry business in France, Africa, the Americas, the Asia-Pacific, and other European countries.

Flawless balance sheet and overvalued.

Market Insights

Community Narratives